Overview

- Office Update

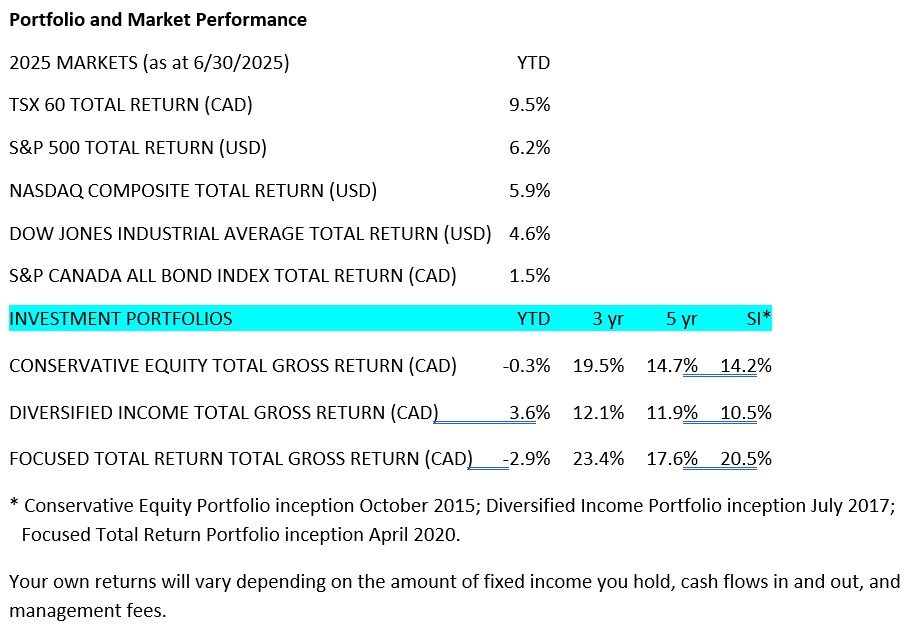

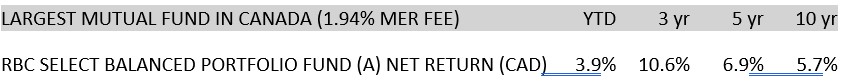

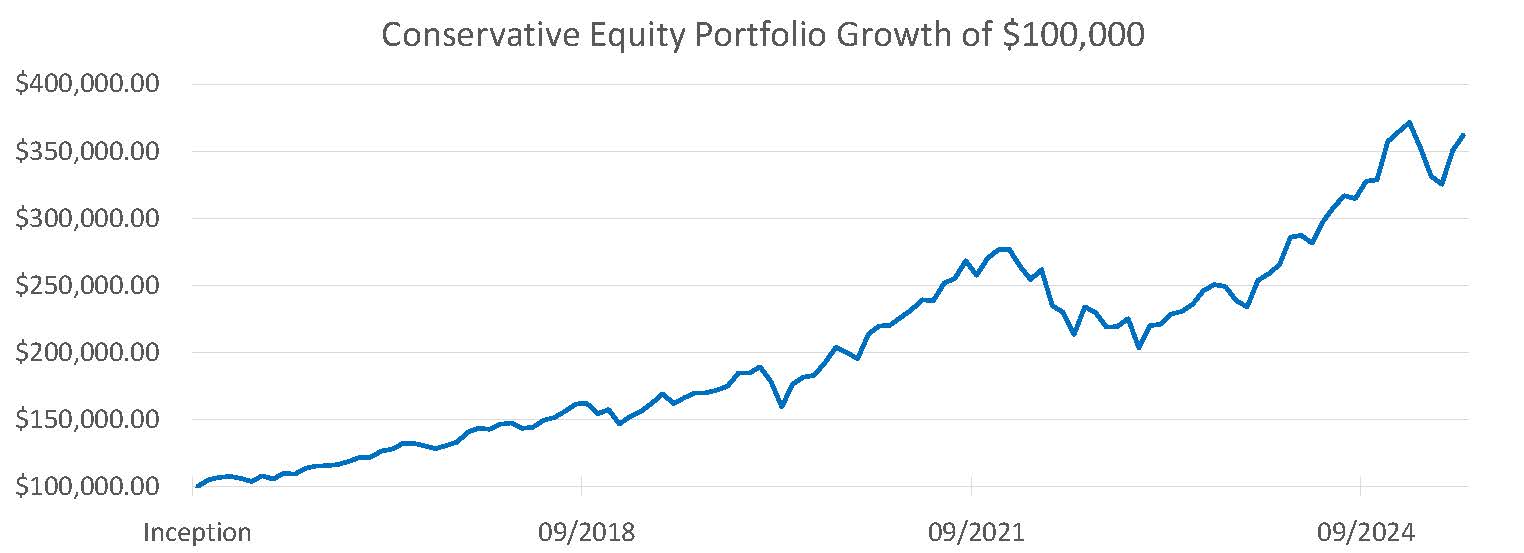

- Portfolio and Market Performance

- Portfolio Update

- Company Updates

- Global Macroeconomics

- Market Outlook

Office Update

We hope everyone had a wonderful Canada Day. We spent it fishing off the dock with our kids. Great memories were made.

Portfolio and Market Performance

Portfolio Update

We made no significant portfolio changes in June, although we will be looking to trim Nvidia soon as it has risen more than 40% over the last 3 months and is now at a 12% weighting in the portfolio.

Company Updates

Brookfield Renewable

First, Nuclear Power

We are in a massive global race to expand energy production, with China leading the pace. It’s been estimated that demand from new technologies will double or triple our energy needs over the next few decades. We have talked about this on previous calls.

In Quebec alone, Hydro-Québec has estimated CAD $150–$180 billion in investment in our grid infrastructure by 2035, which is an annual of 3 to 4 times as much as we had previously been spending.

This brings us to an area of electricity production that is very hot right now: nuclear power.

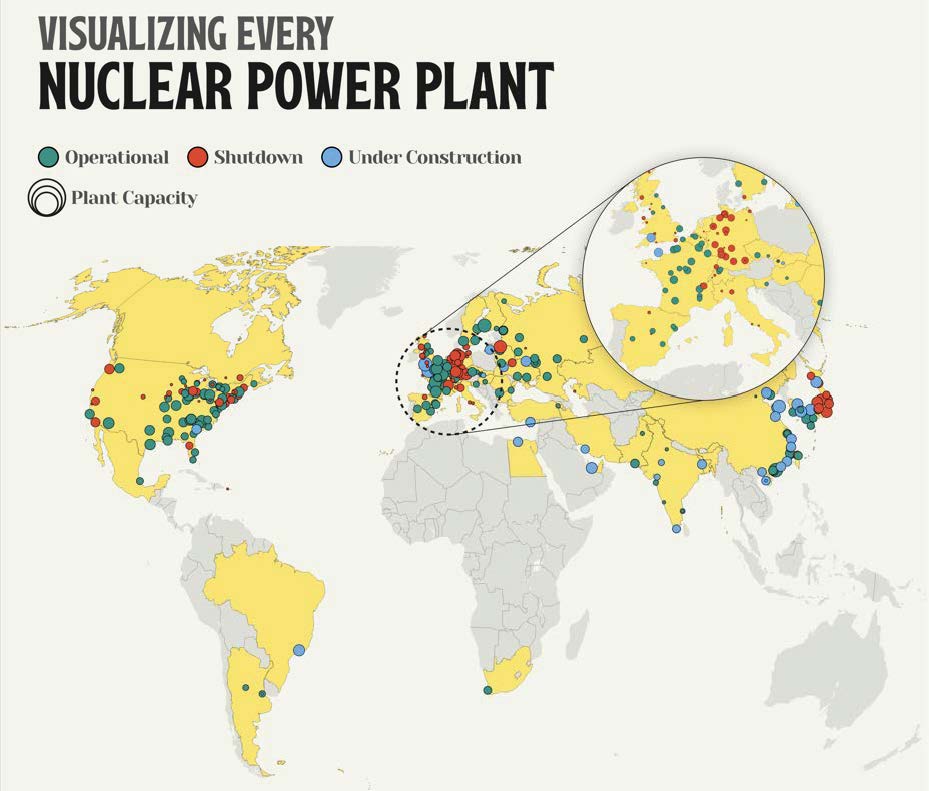

There are roughly 440 operable nuclear power reactors worldwide. These reactors supply about 10% of the world’s electricity.

Here is a map of global nuclear power plants. The red circles represent plants that have been shut down and are more common in Germany and Japan, and the U.S. Blue dots, representing projects under construction, are most prevalent around China and Korea.

What we are starting to see is the restarting of reactors that were shut down. An example is Constellation Energy’s USD $1.6 billion plan to refurbish and restart Unit 1 at Three Mile Island, which was shut down in 2019, with all the energy already contracted to Microsoft to power their AI servers. We expect to start to see this trend globally as countries that are building out AI infrastructure realize they have a bigger electricity deficit than they thought.

Another major trend is what are called Small Modular Reactors, or SMRs. These are smaller projects that have major benefits. They have much lower up-front capital costs (USD $1–$3 billion versus $6–$12 billion), have shorter construction timelines (3–5 years versus 7–10 years), have a much smaller footprint and are far less visible, and offer newer nuclear technologies that tend to have major safety benefits.

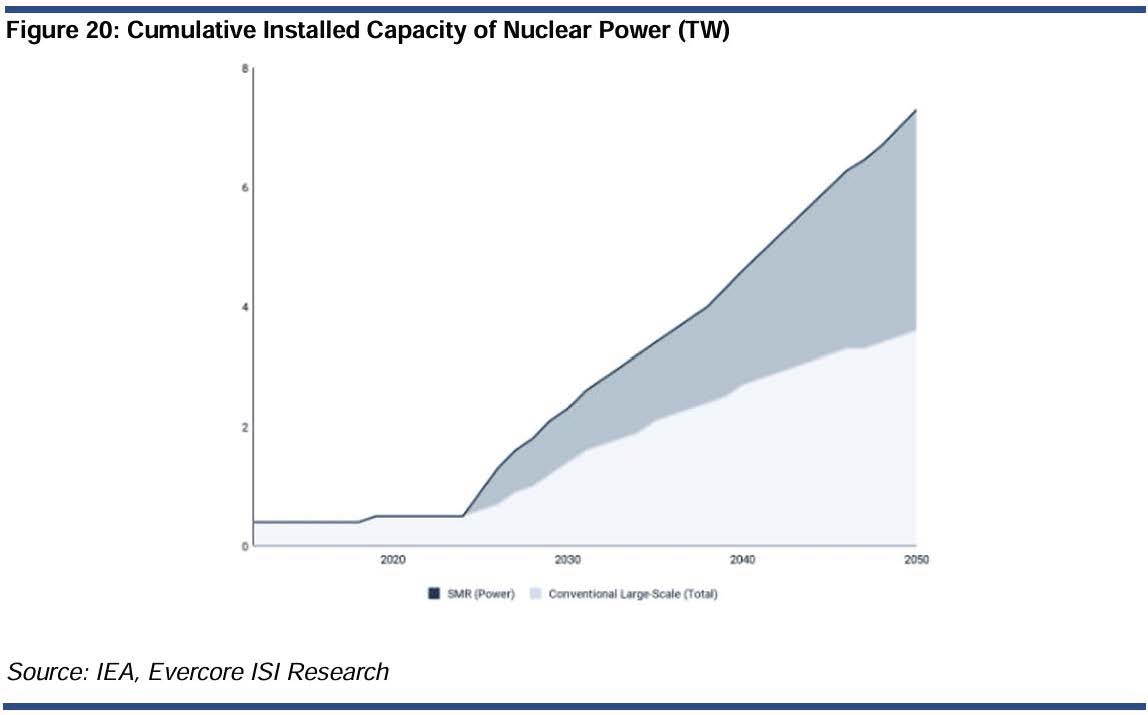

This chart shows the International Energy Agency’s projections for nuclear power generation. You can see that around half of projected future production is expected to come from SMRs.

Enter Brookfield Renewable

Largely because of the 2011 Fukushima nuclear disaster, Westinghouse Electric Company filed for bankruptcy protection in 2017. Brookfield purchased Westinghouse in 2018 for USD $4.6 billion with Cameco.

Brookfield Renewable controls 51% and directly owns 17% of Westinghouse Electric.

It is estimated that Westinghouse has long-term maintenance and fuel supply contracts to 35–50% of the world’s 440 nuclear reactors. Their revenue this year is around US$6 billion, with about 85% of this coming from fuel supply and service contracts. This is highly stable recurring revenue.

Westinghouse currently has three SMR approaches: first, the AP300, which is based on a smaller version of their existing Pressurized Water Reactor designs; second, a new Lead Cooled Fast Reactor, which is significantly cheaper and less dangerous, and requires far less maintenance (fuel lasts up to 15 years before it has to be changed versus the old design, where you need to take the reactor offline every 12–24 months to change the fuel); and third, a Micro SMR design through the eVinci® Microreactor (will fit in a standard shipping container, can be used to power off-grid locations, mines, or micro grids, and can go eight years without refueling).

Very cool side note: There is an eVinci space reactor being worked on to supply power for bases on the moon or Mars.

TESLA

Tesla launched Robotaxi in Texas without major incident. A small group of these autonomous taxis are operating with paying customers. The plan is to scale this very slowly and carefully.

With the recent political tensions, it’s important to remind ourselves why we are investing in Tesla. The Tesla factory, especially its next generation Cybercab production line, is the product. That, Autonomy, and Optimus (robotics) are what matter. All three are moving along despite the tensions.

Global Macroeconomics

Middle East Conflict

The 12-day war in the Middle East between Israel and Iran caused some understandable turbulence through July. Global oil prices went up about 15% once fighting broke out and returned back to where they started once the ceasefire was declared. Why was this important? Fuel prices are still a major input price in most goods through fuel for shipping and transportation. Historically elevated oil prices can assist in moving economies toward recession.

Trade Negotiations and Tariffs

The Digital Services Tax, which we’d spoken about last month, has been removed by the Canadian government. This will benefit the largest companies we own: Nvidia, Apple, Google, Amazon, Tesla, Microsoft, and AMD. At the same time, the increase to the withholding tax of U.S. companies, which we had spoken about as being used as a pressure point, was also removed.

Prime Minister Mark Carney has said he expects to finalize a trade deal with the U.S. by July 22. We welcome, and we suspect the markets will welcome, the return to more certainty, as companies will adapt.

Market Outlook

Here are the monthly notes from our Chief Market Strategist, Dr. Jim Thorne, along with our comments ().Bull market is upon us. Target of 7,000 for the S&P 500 for 2025. (This has been our call all year.)

- Yes, a V-shaped recovery. Wall Street missed it. They hate Trump. Check your biases at the door and let’s make money. (This is why we stay invested. Ignore the noise!)

- AI and Technology long and strong. (With this in mind, we are positioned well.)

- Fed will cut; target is 2.75%. (Our bond portfolio is positioned accordingly: 20% Vanguard Intermediate-Term Treasury ETF 5- to 10-year U.S. treasuries.)

- In a secular bull market when rates are dropping, Financials and Capital Markets are a must own … keep it simple. (This is the number one reason we’ve been building positions in JP Morgan and Goldman Sachs)

- Regionals Banks are playing catch-up. (We are not invested in Regional Banks; there’s too much risk in one name.)

- Trump tariffs are noise. (We agree.)

- Dash for Trash starting to take hold. (Small caps and value traps are not our thing.)

- USD hangs out and consolidates. (USD versus CAD should stabilize.)

- We climb the Wall of Worry. (Agreed.)

- The most hated market in a generation. That keeps me bullish. (True, when everyone is negative, we’re usually bullish.)

- And yes, by the end of this run, the S&P 500 will be at 14,000. (Agreed.)

~~~

We won’t have a call in August, as many of you will be off enjoying your summer. We’ll pick up again in September.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager,

Wellington-Altus Private Wealth

Michael Hale, CIM®

Portfolio Manager

Senior Wealth Advisor,

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045