With the rapid rise in the “Magnificent 7” stocks to start the year, there has been renewed discussion over whether U.S. stocks are becoming overvalued. What has been driving these returns?

Stock prices are driven by a variety of factors. In a perfectly efficient market, the price of a stock would primarily reflect its fundamentals. This is the underlying company data that impacts its perceived value, such as its revenues and earnings performance. However, stock prices are also affected by the supply and demand for the shares. As such, the collective investment behaviour of market participants can influence a stock’s price.

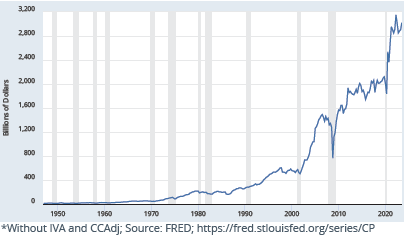

Over time, the underlying growth trend in equities has generally been similar to the growth of corporate profits and the economies in which they participate. The chart below shows the tremendous upward trajectory of U.S. corporate profits since the 1950s (with the shaded grey areas indicating recessionary periods).

Of course, there can be substantial swings around the trendline based on market behaviour — consider periods of investor euphoria and fear, when stock prices can get ahead of themselves

Tremendous Growth: U.S. Corporate Profits After Tax, 1950 – 2023

or fall to levels where they are at bargain prices. Yet, by and large, equities have generally continued their upward climb because earnings have continued to grow.

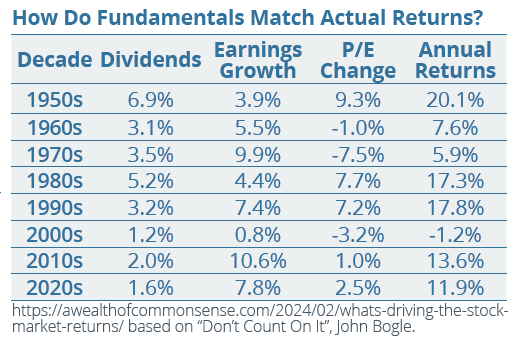

Has multiple expansion, or higher valuations, been responsible for driving stock market prices over time? One perspective suggests that while valuations have been slightly increasing over the long term (as measured by Robert Shiller’s CAPE ratio data*), this likely plays a smaller role than most market observers assume. This is supported by work done by the late renowned investor John Bogle, who used the following formula to estimate expected returns in the stock market:

Expected stock market returns = Dividend Yield + Earnings

Growth +/- Change in Price/Earnings (P/E) Ratio

Financial strategist Ben Carlson updated Bogle’s S&P 500 return data by decade (below) to observe what may be driving returns. The P/E change — or multiple expansion/contraction — may be viewed as a gauge of investor sentiment or emotions, or what people are willing to pay for earnings.  While there has been some multiple expansion in the 2010s and 2020s, it isn’t quite as significant as those of the 1980s and 1990s. Earnings growth has been the main

While there has been some multiple expansion in the 2010s and 2020s, it isn’t quite as significant as those of the 1980s and 1990s. Earnings growth has been the main

driver of stock market returns since the end of the Global Financial Crisis. One likely reason is due to the efficiency and productivity gains that have come with advances in technology.

While these observations may not apply to short-term stock market movements, they do show that fundamentals like corporate earnings have been a key driver of stock market returns over the longer run. This may be good food for thought for investors: The human condition to advance, progress and grow is an unwavering trend. This will drive corporate profits into the future, and investors can share meaningfully in the growth yet to come should they choose to participate.

*Carlson argues that increasing CAPE ratios may be due to falling interest rates and inflation, as well as the underlying structure of the market due to technology.

See:https://awealthofcommonsense.com/2020/04/my-new-theory-about-future-stock-market-returns/

| The information contained herein has been provided for information purposes only. The information does not provide financial, legal, tax or investment advice. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. All insurance products and services are offered by life licensed advisors of Wellington-Altus Insurance Inc. or other insurance companies separate from WAPW. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. © 2024, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca |