Balancing Churchill’s Caution, Truman’s Expectations, And Gandhi’s Wisdom In The Age Of Chaos

“I always avoid prophesying beforehand, because it is much better policy to prophesy after the event has already taken place.” – Winston Churchill

In the realm of economic forecasting, the concept of a trilemma emerges as a thought-provoking framework. This trilemma, which I refer to as the Truman-Gandhi-Churchill trilemma (or the TGC trilemma), encapsulates the perspectives of three influential figures: former British Prime Minister Winston Churchill, the 33rd President of the United States Harry S. Truman, and the revered Indian political leader Mahatma Gandhi. It finds relevance in our current situation as we endeavor to forecast the glide path and resting point for interest rates into 2025. By navigating the TGC trilemma with caution, practicality, and humility, we seek to uncover insights that challenge consensus and shed light on the likelihood of interest rates heading lower than currently believed.

The term “trilemma” is derived from the Greek words “tri,” meaning three, and “lemma,” meaning proposition or assumption. Trilemmas can occur in various fields and contexts, including philosophy, economics, politics, and decision-making processes.

In today’s investing world, a trilemma emerges. Do we adopt Churchill’s strategy and make predictions only after events have occurred—a perspective embraced by many forecasters on Fintwit and Wall Street? On the other hand, Truman would seek a one-handed economist willing to make forward-looking calls, believing that such an approach could lead to optimal returns. Or do we follow Gandhi as he reminds us that mistakes are inevitable? It is essential to recognize the uncertainty and unpredictability when making portfolio decisions. Investing is hard and investors must navigate this trilemma, acknowledging the potential for errors and the limitations of foresight in an ever-changing world.

In light of this, it is worth considering the words of Charlie Munger, one of his generation’s top investors, who recently passed away at the age of 99. Munger once famously said, “I’m constantly making mistakes where I can, in retrospect, realize that I should have decided differently. And I think that is inevitable because it’s difficult to be a good investor.” Munger’s candid admission underscores the challenges faced by even the most seasoned investors, further emphasizing the need for humility and continuous learning in the face of uncertainty.

It is within this gripping tapestry of perspectives, where the TGC trilemma takes shape, that we find ourselves confronted with a profound question: How can we navigate this complex labyrinth and avoid the pitfalls of ambivalence while embracing the humility of uncertainty? As we delve deeper into this enigmatic conundrum, a startling revelation emerges—the case for a federal funds rate below the natural rate of interest.

Churchill’s Skepticism and Caution

Churchill’s skepticism towards forecasting highlights the inherent uncertainties and unpredictability of the future. He recognized the potential pitfalls of making predictions and advocated for prudence when approaching the task.

While being correct in hindsight by commenting on what has already happened may give the illusion of intelligence, it is not necessarily the best strategy for portfolio returns. Investing is about the future, not the past, and relying solely on past data to position a portfolio can be detrimental. To make informed investment decisions, it is crucial to take a forward-looking view (sometimes of 12 to 16 months) and remain adaptable as new information emerges.

Truman’s Pragmatism and the Practical Necessity

Harry S. Truman recognized the practical necessity of making forecasts despite their fallibility. Truman sought economists who were willing to make predictions, understanding that informed decision-making often requires insights into potential outcomes. With respect to interest-rate forecasting, Truman’s pragmatic viewpoint encourages us to gather relevant data, analyze trends, and consult with experts to form educated projections that inform our strategies and decisions.

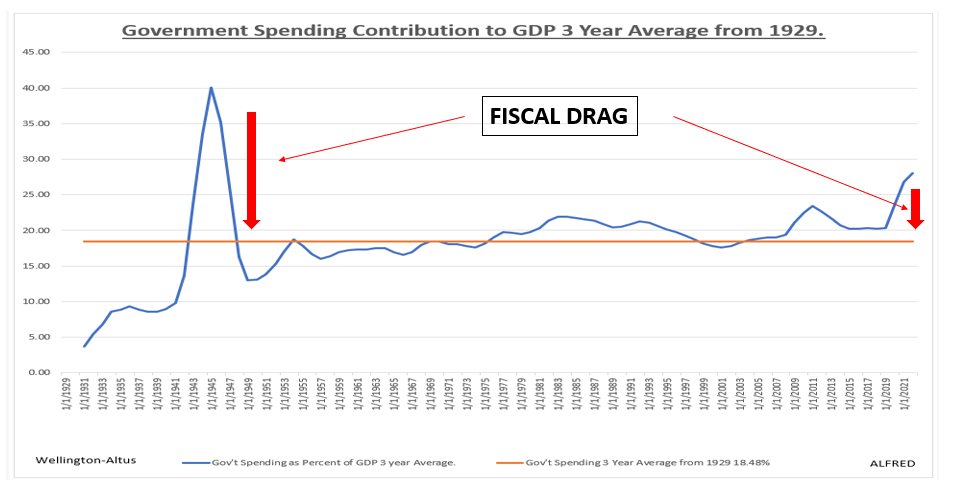

Truman’s occasional frustration with economists is evident in his famous statement where he expressed exasperation with their “On the one hand and on the other” approach to presenting contrasting perspectives. It’s important to remember that Truman served as president after the Second World War, a time similar to today, when fiscal policy accounted for more than 40% of gross domestic product (GDP) and inflation was averaging 10%. The subsequent reduction in government spending led to a recession and sparked concerns about deflation and a depression—the historical precedent of this era should not be ignored.

Gandhi’s Humility and the Unpredictable Future

Mahatma Gandhi approached forecasting from a philosophical standpoint. He acknowledged the limitations of human knowledge and emphasized humility, surrendering the desire to control the future. In the context of interest rate forecasting, Gandhi’s perspective reminds us to remain adaptable and open to revising our predictions as new information emerges. It encourages us to focus on the present and recognize that unexpected events can significantly influence interest rates, making long-term forecasts challenging.

Challenging Consensus and Lower Interest Rate Projections

Considering insights of the influential figures of the TGC trilemma and integrating the careful analysis of economic indicators and trends, a compelling conclusion emerges— that interest rates are likely heading lower into 2025 than currently believed, prompting us to reconsider prevailing expectations and adapt our strategies accordingly.

In a period which I believe will be characterized by secular stagnation and deflation, policymakers will grapple with the rapid decline in economic growth and prices, like the post-Second World War era. The unknown lies in the potential consequences of overtightening by central bankers, which could result in a credit crunch with medium-term implications. Given this, it is advisable for investors to plan for a transition period during which interest rates could fall below the neutral rate of 2.5%, potentially extending until the end of 2025.

My forecast, influenced by Truman’s desire for decisiveness and Gandhi’s wisdom, diverges from the prevailing view on Wall Street regarding the U.S. Federal Reserve’s funds rate. Concerns such as expansive fiscal policies, credit market warnings, and shifting global dynamics challenge the consensus. Objective data reveals a different narrative—that we are in a transitional phase with declining inflation rates. Fiscal policies that fuelled growth are losing momentum, potentially leading to deflationary pressures and prolonged secular stagnation based on historical precedents.

Moreover, a crucial factor in fostering economic growth amidst high debt levels is ensuring that interest rates remain below the natural rate rather than exceeding it. If the actual interest rate surpasses the natural rate, it can have the unintended consequence of triggering deflation. These fundamental principles align with the core tenets of Knut Wicksell’s theory of interest rates and economic growth (which we’ll get to later). Given the weight and validity of these arguments, this alternative theory must receive earnest and thoughtful consideration in the ongoing discourse.

Amidst the cacophony of conflicting market opinions, it becomes paramount for investors to discern the true signal amidst the noise. Disregarding the looming deflationary forces would be a grave oversight. An insightful analysis reveals a noteworthy aspect: a significant portion of Canada’s Consumer Price Index (CPI), 55%, is attributed to shelter, and an even more substantial 70% of Core CPI in the U.S. is also attributed to shelter. The delayed impact of the disinflation shelter variable may unleash considerable deflationary pressures between now and 2025.

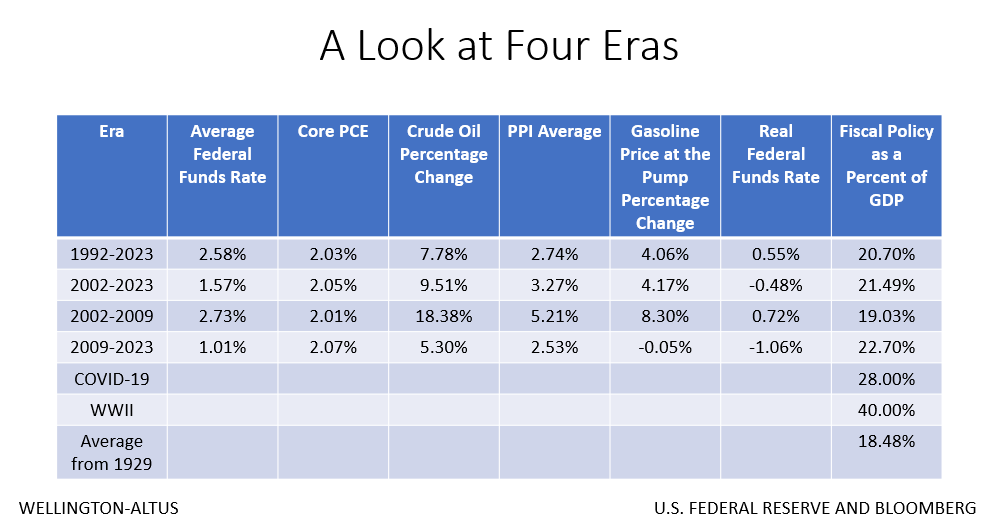

My forecast suggests 150 basis points (bps) of rate cuts in 2024 with the federal funds rate falling to 1.75% by the third quarter of 2025. The federal funds rate will have to go below the neutral rate to support economic growth and counter deflationary forces. To further guide our analysis, we examine the past 30 years in distinct eras: 2002 until the Global Financial Crisis (GFC), the period from the GFC to now, and a blend of both. From these eras, we anticipate the nominal federal funds rate to settle between 1.75% and 2.5% by late 2025, with a positive 50 bps for the real federal funds rate.

The next two years will serve as a transition phase, influenced by factors such as a transformative technology wave—which could have significant economic implications— China’s evolving economy, the dissipation of COVID-19 supply shocks, and the necessary correction of over-tightening by central banks to counteract extreme levels of fiscal policies. This new era is likely to encompass a combination of slow growth, secular stagnation, high productivity, an aging population, elevated debt levels, and rapid innovation.

In my base case, I take a middle ground between the “higher for longer” crowd and those who believe interest rates will return to the pre-GFC “zero-bound,” foreseeing a blend of the pre-GFC era and the pre COVID-19 era, considering various factors. Consequently, this suggests a terminal federal funds rate and natural rate of interest that diverge from the current consensus.

The Natural Rate and the Loss of Central Bank Credibility

Often represented as r-star (r), the natural rate of interest is a cornerstone of macroeconomic theory and was first proposed by Swedish economist Knut Wicksell. He postulated this rate as an equilibrium, achieving perfect price stability in an ideal state devoid of monetary disturbances. In this perspective, the natural rate balances savings supply and demand, thereby ensuring a stable price level. My view aligns with Wicksell, the r is fixed. Moreover, I assume that it is 2.5%, the long-term interest rate target for the federal funds rate as stated in the Summary of Economic Projections (SEP).

Wicksell suggested that deviations from this rate would disrupt the savings-investment equilibrium, leading to either inflation or deflation. In practice, when the federal funds rate is below the natural rate, it stimulates investment and aggregate demand, causing inflation. Conversely, when it exceeds the natural rate, it dampens investment and consumption, reducing aggregate demand and bringing down inflation levels.

New Keynesian economics (today’s central bankers) assume that the natural rate can fluctuate over time. According to this perspective, the natural rate can permanently change due to exogenous shocks such as the COVID-19 pandemic. These Keynesian economists also introduce elements like nominal rigidities, imperfect information, and market frictions into their analysis. They also consider the zero-lower-bound, and quantitative tightening as policy tools, which are explicitly recognized by Wicksell.

Alan Greenspan, former Chairman of the U.S. Federal Reserve, emphasized the crucial role of the central bank’s credibility in maintaining a stable economy. However, in recent years, the credibility of central banks has come under scrutiny, with critics arguing that unconventional policies such as quantitative easing and negative interest rates have eroded their effectiveness in managing the economy.

Moreover, a decline in credibility can undermine a central bank’s effectiveness in influencing aggregate demand and stabilizing the economy. If businesses and consumers lose trust in the central bank’s ability to manage inflation and maintain a stable price level, they may adjust their expectations and behaviour, which can exacerbate economic fluctuations. Hence, understanding and managing the natural interest rate becomes increasingly vital in today’s complex and interconnected global economy.

A Look at the Data

As we navigate the uncertain post-COVID-19 era, it is vital to challenge the prevailing economic narrative propagated by Wall Street and central bankers that we are in a “new higher for longer” phase of economic growth. Much evidence suggests a return to secular stagnation and deflation, reminiscent of the pre-GFC era.

Several factors contribute to this deflationary trend. A technology wave more extensive than the 1990s is driving down costs and prices. An aging population reduces demand and slows economic activity. Globalization, while opening new markets, has also contributed to wage stagnation and job losses in developed economies. Excessive debt levels limit growth potential, as more resources are channeled towards debt servicing rather than productive investments. Finally, China’s growth miracle, primarily fuelled by commodity-intensive urbanization, is tapering off, reducing global commodity demand.

Within the ongoing discourse surrounding the stability of the natural interest rate, an intriguing perspective emerges that aligns with the classical Wicksellian view. This alternative viewpoint challenges the prevailing New Keynesian perspective, which posits that the natural interest rate is inherently unstable and necessitates ongoing adjustments. According to this contrasting school of thought, stabilizing the federal funds rate around 2.5% signifies an alignment with the natural interest rate. Notably, this interest rate serves as the long-term target for the Federal Reserve and finds its reflection in the influential SEP. This implies that the impact of the COVID-19 shock on the global economy was temporary and did not structurally alter long-term fundamentals.

Further bolstering this perspective is an examination of historical data and precedent. An analysis of the past three decades reveals instances where the federal funds rate consistently fell below the natural rate, particularly during economic downturns. Given prevailing economic headwinds, it is reasonable to consider the possibility of a similar drop occurring in the coming two years.

However, as fiscal policy normalizes following the extreme response to the COVID-19 pandemic, we anticipate that government spending will not support economic growth. Instead, it could become a drag on the economy. This situation further strengthens the case for a return to secular stagnation, deflation, and interest rate cuts.

Solving the TGC Trilemma

In the pursuit of knowledge, let us not be swayed by dogma or the allure of popular theories. Instead, let us approach the determination of interest rates with a sense of skepticism and a willingness to challenge prevailing narratives. By doing so, we can navigate the complexities of the investment landscape more effectively, armed with a broader perspective that transcends the limitations of any single school of thought.

Truman encourages us not to underestimate the importance of sound judgment and careful analysis in shaping our investment strategies. By recognizing the fixed nature of the natural interest rate and acknowledging the shortcomings of central bankers’ faith in certain economic doctrines, we can strive for a more informed and nuanced approach to forecasting.

In conclusion, Truman’s desire for clarity leads me to believe that the natural interest rate is fixed at 2.5%. Moreover, the loss of reputation experienced by central bankers and their misguided faith in New Keynesian dogma necessitate a critical re-evaluation of our understanding. Let us heed Gandhi’s warning and approach the determination of interest rates with caution, embracing a diversified perspective that goes beyond any single school of thought. Through this approach, we can navigate the intricacies of the investment landscape with greater wisdom and prudence.

What Should Investors Do?

As we navigate the intricate web of economic factors and uncertainties it is crucial to consider the proactive steps investors can take in response to the evolving interest rate landscape.

Looking ahead, fiscal policy may face limitations in supporting short-term growth due to budgetary constraints and the goal of reducing government spending. This adds an additional layer of complexity to the economic landscape. Therefore, investors are advised to carefully evaluate both short-term and long term investment opportunities.

In the long term, we anticipate a secular bull market driven by technology, accompanied by a return to secular stagnation and a persistently low-interest rate environment. Resolving the current debt situation will likely require fostering growth, akin to the post-Second World War era. Consequently, investing in long-duration assets such as bonds and secular growth equity names during the peak of interest rates may be prudent.

In the short term, once central banks begin to lower rates, there may be opportunities for investors with shorter time horizons to profit from tradable oversold rallies. Sectors sensitive to interest rates, such as financials and utilities, warrant consideration.

By approaching the dynamic interest rate landscape with a proactive mindset, investors can position themselves to capitalize on both short-term opportunities and long-term trends, adapting their strategies to navigate the everchanging economic currents.