As you can probably tell by my social, blog and video content, I’m a big supporter of starting your financial knowledge young. Since Nate and Avrie were little, my husband Kurtis and I have educated them on smart saving and building healthy financial habits, and in today’s age, there’s an amazing app for that––The Mydoh App.

What is the Mydoh App?

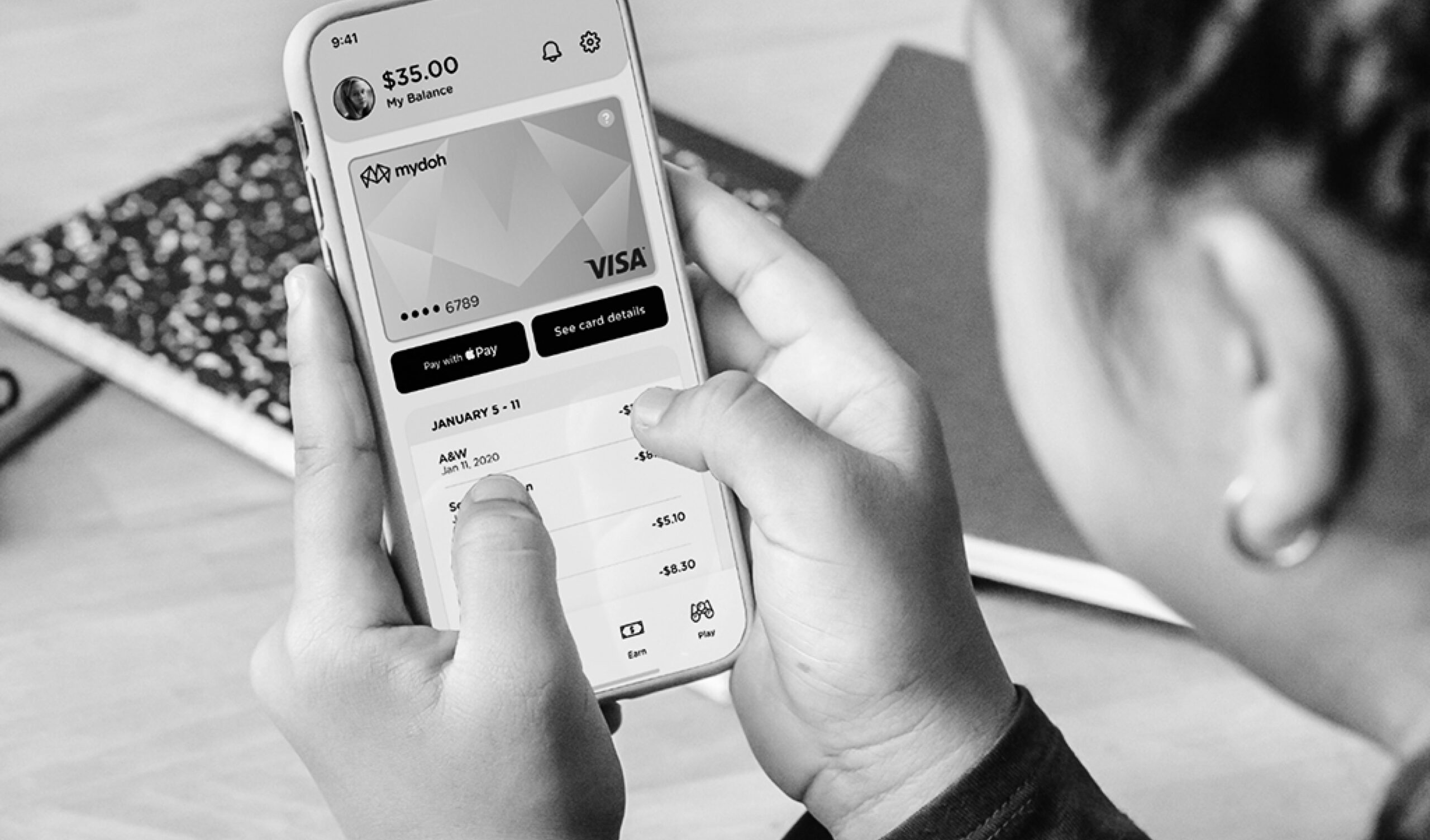

Mydoh is changing the way that families teach good saving habits and build their kids’ understanding of finances. Having these abilities available through an app versus a piggy bank gives children an engaging platform to work through their money management—it reminds me of online banking! The app is available on iOS and Android platforms, making it accessible to a wide range of users.

Easily manage chore money and allowances

In the app, you can set up certain tasks (for example, empty the dishwasher) with certain dollar allowances for each. When you link these to financial rewards, you can send the money once the task is complete, and the funds will show up directly in your kids’ accounts!

Kids can spend money in the app

One cool thing is that through each kid’s Mydoh Smart Card, they can make their own purchases, giving them a sense of independence. You, as the parent, have total control over the spending limits and can monitor transactions in real time. This way, you can have conversations with your kiddos if they are overspending on something or need additional guidance. Transparency is key during these stages.

Interactive activities

In addition to the real, tangible savings in Mydoh, the app offers fun activities, quizzes and games for every age group. It’s a nice challenge on top of the fun challenge of saving!

My kiddos seriously love it so much that they keep reminding me of when they complete their tasks. 🤭Are you going to get your kiddos on the Mydoh train? Are they already on it? Let me know!