Finding Balance Amid Uncertainty

Keeping expectations on an even keel has been a challenge when it comes to the financial markets. In 2022, we have experienced a rapid reversal in both direction and sentiment. With persistently high inflation, and with headwinds from the Ukraine war and the spring Covid shutdowns

in China, the central banks have taken a more aggressive stance to try and temper inflation. This has prompted worries that, with slowing growth, economies may be pushed into a recession. The changing expectations and economic uncertainty have created significant volatility in the markets.

Indeed, humans often react unfavourably to uncertainty. Studies have shown that our emotions are a key driver of stock market volatility over shorter periods. One study suggested that roughly 75 percent of short-term market variation can be explained by risk aversion.1 This is because we often underestimate our ability to adapt.

Yet, history reminds us that markets and economies have continued to adjust and move forward from setbacks. As such, some balance may be warranted. We are emerging from a time in which record stimulus benefitted both the markets and economies, so a period of adjustment has been expected. Many company earnings thrived during this time and must now adjust as consumption patterns balance towards a post-pandemic world. Inflation has been a prevailing headwind and although it has been more than just transitory, consider that it also will not be permanent.

While certain market pundits are pointing to a recession, for now, labour markets continue to be robust and household balance sheets suggest consumer resilience. Recessions also come in different intensities and lengths; the past two recessions lasted only three and seven months in duration.2

Here at home, we are fortunate to be insulated from many of the challenges facing other nations. Our vast resource-based economy, including domestic energy production, serves us well. Consider that in the first quarter, Canada’s GDP grew at a rate of over three percent, whereas U.S. GDP contracted. As the growth sector has been punished more recently, the Canadian markets have been comparatively resilient, in part due to a larger composition in resources and commodity-related sectors. At the same time, we shouldn’t forget that one of the key drivers of growth over recent times has been the technology sector, which is expected to continue to support future innovation, advancement and growth.

This is not to suggest that there aren’t challenges ahead. For now, economic uncertainty is expected to continue, however eventually the pendulum will swing back again. Uncertainties will always be with us, and finding balance amid the uncertainty is important.

While setbacks can happen too quickly to ignore, progress often happens too slowly to notice. This is why investing has been compared to planting trees: progress measured over months often shows nothing, yet over the long term can yield significant results. And, as Einstein once said, progress is “like riding a bicycle. To keep your balance, you must keep moving.”

[1] https://www.nber.org/papers/w19818; [2] www.cdhowe.org

Navigating Uncertainty

Don’t Overlook the Value of Staying Invested

Equities continue to be one of the best asset classes in which to grow wealth, but that’s not without market fluctuations. With significant volatility over recent times, it is worthwhile to remember the importance of staying invested. Here are some reasons why:

Trying to time the markets can be costly. During market pullbacks, some investors may feel inclined to sell investments for fear of a greater loss. However, this can create two issues — selling at low prices and the inevitable need to re-enter the markets. Market timing is difficult; perhaps one of the most convincing reasons being that the biggest up and down days have historically clustered together. The chart shows the impact of missing the best performing months of the S&P/TSX Composite Total Return Index over a 30-year period. By staying invested, a notional investment of $1,000 would have grown to $12,693. By missing the five best months, this would fall to $7,503. And, it’s not just about timing: Selling and rebuying can potentially create a costly tax situation in certain accounts or forego dividend income.

S&P/TSX Composite Total Return Index from 12/31/91 to 12/31/21 based on being: fully invested, missed three best months, missed five best months, missed ten best months.

Time reduces the volatility of returns. As history has shown, negative market performance smooths out as an investor’s time horizon increases. Since 1992, the likelihood of the S&P/TSX Composite Total Return Index experiencing a negative monthly return is 38 percent. This drops to 13 percent over a three-year rolling holding period, and 0 percent over seven-year rolling holding periods and beyond.

S&P/TSX Composite Total Return Index from 12/31/91 to 12/31/21 based on investing: monthly, 1-year holding period, 5-year holding period, 7-year holding period.

Staying invested can take advantage of compounding over time. Often, one of the most important variables for how you’ll do as an investor is how long you are able to stay invested. This is because of the impact that compounding can have over time. Perhaps you’ve heard of the trick question: “Would you rather have $10,000 per day for 30 days or a penny that doubled in value every day for 30 days?” Choosing the doubling penny, due to the power of compounding,* would yield about $5 million, compared to only $300,000 by choosing $10,000 per day. Compounding growth is often called the eighth wonder of the world because it possesses significant powers, like turning a penny into $5 million. In the words of renowned investor Charlie Munger, business partner to Warren Buffett, “the first rule of compounding is to never interrupt it unnecessarily.”

*Of course, it is acknowledged that a compounded rate of return of 100% is unrealistic.

Estate Planning

Worried About Heirs Managing Money?

After a lifetime of building wealth, many of us have a desire to pass along a lasting legacy to our children. As such, there has been an increasing focus on intergenerational wealth planning to support this longevity. An intergenerational plan considers future generations, possibly those you may never meet, with the objective of supporting your wealth’s longevity in complement to traditional estate planning documents. While these legal documents help to distribute, dispose of or deal with assets, the intergenerational plan helps to keep assets working into the future.

Start with a Plan and Document It — An intergenerational plan should set out goals and provisions for how money will be used by future generations, as well as how it will be accessed and replenished. For instance, you may wish for family members to invest in themselves, stipulating that funds should be used for higher education, or a business start-up or expansion. By offering heirs the means to obtain an education or run a business for themselves, they can gain the experience needed to create wealth and grow it. Once you determine your desired goals and provisions, it is important to formally document the plan so that it can be passed along to future generations.

Communicate Your Plan; Be the Family Resource — Once a plan has been developed, it is important to communicate it to family members. Often, parents keep their finances and related values secretive, missing the opportunity to pass along their ideals to children. An intergenerational plan can allow heirs to understand your vision for your wealth after you are gone. While specific financial details need not be disclosed, sharing your vision can be a catalyst for meaningful discussions. Some families use this plan to form a family constitution that can help future generations carry forward the intentions of the plan.

Even if an intergenerational wealth plan isn’t your desired path forward, there may be ways to help protect and preserve assets for the future:

Consider Protection Tools, Such as a Trust — Certain tools may help to protect future wealth in situations in which beneficiaries may not be financially responsible or where you wish certain goals to be attained. A trust can provide protection by putting assets under the control of a responsible trustee. The terms of the trust can specify the timing and the quantum of distributions to be made to heirs. Other tools may be considered, such as life insurance, to help protect and grow assets while also providing access to cash.

Create a Professional Support System — Having a support system of trusted professionals may be a valuable part of ensuring a successful generational wealth transfer, especially when heirs may not have the skillset to independently manage funds.

Creating a generational legacy can be one of the greatest gifts you leave behind. If you are in need of resources to help you get started, please call.

Federal Budget Recap

Arriving Soon: The FHSA and More…

The keys to your dream home

This year’s federal budget proposed a new tool intended to help support new home buyers. Expected to begin in 2023, the First Home Savings Account (FHSA) is a registered plan that combines the tax benefits of the RRSP and TFSA.

The FHSA will allow Canadian residents over age 18 to contribute up to $8,000 per year, to a maximum contribution of $40,000, towards their first home.1 Contributions will be tax deductible, similar to the RRSP, and qualified withdrawals will be tax free, similar to the TFSA. The FHSA can remain open for 15 years.

One constraint is that the proposed rules do not permit use of the existing Home Buyers’ Plan (HBP) alongside the FHSA. The HBP allows first-time buyers to withdraw up to $35,000 from the RRSP, subject to repayment in 15 years and other conditions. This has prompted the question: will the FHSA or RRSP/HBP be a better savings vehicle?

All things equal, the FHSA’s structure appears to be more beneficial given the tax-free benefit for a qualified withdrawal when funds are used to purchase a first home. However, whether the FHSA or RRSP/HBP offers greater benefits is likely to depend on various factors, including available income/cash flow, timing of a home purchase, marginal tax rate, current/potential tax bracket, other income-tested benefits (such as child benefit payments), etc.

Under the proposed rules, there will be an option to move funds from one’s RRSP to the FHSA, subject to FHSA annual and lifetime contribution limits; however, these transfers would not restore an individual’s RRSP contribution room. If not used for a first-home purchase, the FHSA may be transferred to the RRSP after 15 years without affecting RRSP contribution room.

In thinking ahead, there may be ways to help maximize the value of the FHSA. Consider starting early to take advantage of compounding over time, as the FHSA can stay open for 15 years. If the FHSA isn’t used, funds can be transferred to the RRSP (or taxes paid on withdrawals). As well, try to maximize the annual limit. The more you save from the onset, the greater potential benefit you may achieve from compounded growth. Annual contributions are limited to $8,000 and unused contribution room does not carry forward.

Not Just for Young Canadians? The recent budget proposals suggest that there is no age limit to invest in the FHSA. If this stands, there may be opportunities available to older Canadians.2 As details are finalized and legislation is passed, this will become clearer. More to come…

Select Budget Changes That May Impact You

Multigenerational Home Renovation Tax Credit. This proposed refundable tax credit offers up to $7,500 to claim up to 15 percent of $50,000 in eligible costs incurred to construct a secondary suite for a senior or adult with a disability.

Residential Property Flipping Rule. Under proposed rules, any profits on property sold that is held for less than 12 months would be subject to taxation as business income. As well, the Principal Residence Exemption would not be available. Certain exemptions will apply, so stay tuned for more details.

Small Business Deduction. The budget proposes to change the formula such that access to the small business deduction will not be reduced to nil until the corporation has taxable capital of $50 million.

Minimum Tax for High Earners. The current Alternative Minimum Tax regime will be revisited with a view to ensuring high-income earning Canadians pay a minimum level of tax. Further details are expected in the 2022 fall economic update.

At the time of writing, these proposals have not been enacted into law. For greater detail, please see the Government of Canada website: https://budget.gc.ca/2022/home-accueil-en.html

A New Tax Expected By The Fall

Coming This September: A Luxury Tax on Vehicles

Are you planning on purchasing a luxury vehicle in the coming months? Be aware that as of this fall, you are likely to experience an increase in the cost of certain luxury vehicles. While final legislation has yet to be enacted at the time of writing, the federal government quietly released revised draft proposals in March for a luxury tax to be introduced as of September 2022. The tax will apply to cars and aircraft with a retail sales price of over $100,000 and boats valued over $250,000.

The tax will be payable by a registered vendor based on the sale of the luxury good delivered in Canada, similar to the way in which vendors are responsible for collecting and paying the GST or provincial sales tax.

It is proposed to be calculated as the lesser of:

(a) 20 percent of the retail sales price that exceeds the thresholds listed above: $100,000 for cars/aircraft and $250,000 for boats; or

(b) 10 percent of the full value of the luxury car, boat or aircraft.

For instance, if you were to purchase a car priced at $150,000:

(a) 20 percent of the retail sales price over $100,000, or $50,000 = $10,000

(b) 10 percent of the full value of $150,000 = $15,000

Luxury Tax = Lesser of (a) and (b) = $10,000

Sub-Total Price (before provincial sales tax and GST) = $160,000 GST = $8,000 (based on federal government backgrounder

Total Sales Price with Luxury Tax and GST = $168,000

For more information, please see the Government of Canada website at: www.canada.ca/en/department-finance/news/2022/03/government-releases-draft-legislative-proposals-to-implement-luxury-tax.html

Macroeconomic Perspectives: Is a Recession Imminent?

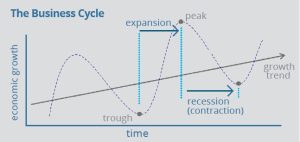

Economic x Growth Business Cycle – Expansion periods and recession periods. Upwards growth trend.

With slowing global growth, persistently high inflation rates and as the central banks have taken a more aggressive position to combat inflation by raising interest rates faster than anticipated, the media has been preoccupied with evoking fear that a recession is imminent. While this is a legitimate worry, we suggest that maintaining perspective may be worthwhile.

Economies, like financial markets, are cyclical in nature and are naturally prone to expanding and contracting over time. A recession can occur when economic activity declines — commonly defined as two successive quarters of declining gross domestic product (GDP), the measure used to gauge economic health.

It’s not normal for any economy to be in a perpetual expansion, and contractions do occur from time to time. Yet, recessions can be quite different in their length and intensity. While the Great Depression of the 1930s is the longest contraction historically, consider that our most recent recession was the shortest on record. This precipitated during the depths of the pandemic due to the economic shutdowns in February 2020, but lasted only until April of that year — just three months in length.

Some are comparing our current inflationary situation to the 1970s, suggesting that we are headed for a similar period of economic slowdown that followed. Yet, let’s not forget that today’s central bankers are taking more rapid action to try and curb inflation. In the early 1970s, the U.S. Federal Reserve was easing monetary policy. It wasn’t until Paul Volcker headed the Fed in 1979 that he raised the Fed funds rate to a whopping 20 percent to try and end high inflation, but this wasn’t until after almost a full decade of persistently high inflation. This shock led to more severe economic consequences.

Today, there are a variety of reasons to keep perspective. Labour markets and household balance sheets are at healthy levels to support consumer resilience, and consumer spending has been robust in the services industry. While some corporate earnings have missed expectations recently, it was anticipated that there would be a period of adjustment as we returned to normal from the pandemic. In some cases, record stimulus skewed consumer demand; in others, the economic shutdowns created ongoing supply chain issues. High inflation has also driven up many companies’ costs, but this inflation is not expected to

be permanent. Recessions are also usually characterized by excesses of inventory, capacity or credit, which aren’t largely apparent at the moment.

This is not to suggest we don’t face many challenges. The pandemic has caused a variety of problems, including significant stimulus debt, higher inflation, supply chain disruptions, slower growth and more. We are now confronted with new issues created by the conflict overseas. Continued patience is needed as we resolve these issues and move forward.

However, some balance may be warranted to address the current discussion of recession. Investors should also remember that portfolios positioned for the longer term have been structured with the expectation that economic and financial markets will experience both ups and downs. Most importantly, when a recession eventually does arrive, remember that it will be temporary.

The 6 Canadian Recessions in the last 50 years.