For 2023: Look Forward, Not Back

Most people, investors or not, tend to base their current views on what is most recent in memory. In good times, we may expect them to continue for the foreseeable future; in bad times, we often underestimate our ability to move forward. We all tend to “drive by the rear-view mirror” to some extent, basing our decision making on what has just happened.

In investing, this may be amplified. We can see significant market movements based on the prevailing sentiment. It has been said that “In the short run, the market is a voting machine. But in the long run, it is a weighing machine.” Prices can overshoot underlying “fair values” in both directions during the course of a cycle. While it is never easy to see asset prices under pressure, 2022 saw a return to more reasonable fair values and perhaps more thoughtful ways of deploying capital, which can be viewed as healthy.

One of the challenges of investing is that building wealth doesn’t always follow a steady course. We may forget that the investing road can be a long one — depending on our objectives, sometimes as long as our lifetimes — and what happens from year to year often has less significance down the road.

Though not to overlook the challenges of today, it is important to keep perspective. Many of the same issues we faced in 2022 persist: geopolitical conflict, sustained inflation and high interest rates — and now, the expectation of slower economic growth with the central banks’ continued attempts to reel in inflation. Yet, we may be well positioned to endure these times. Our financial system continues to be strong; most companies and individuals are not heavily indebted, a previous driver of serious downturns. While stronger labour markets continue to complicate central bank efforts, they may lessen the impact of any slowdown. And while there will always be short-term setbacks, corporate profits and economies have grown over time. This isn’t likely to change.

It is instructive that throughout the turbulence of 2022, renowned investor Warren Buffett added to his portfolio; in fact, a record amount of purchases.1 Buffett uses the inevitable down periods to continue building wealth for the future, strong in his conviction that brighter days lie ahead. While Buffett has outperformed the markets over time, consider also that he has underperformed the S&P 500 more than 40 percent of the time on an annual basis.2 It is a reminder that even for the most respected investors, investing is never a smooth road.

The road ahead can be a long one — be guided accordingly. As Buffett’s actions remind us, it is important not to let the short-term outlook obstruct our view as we continue planning for the future. The rear-view mirror is great for perspective on where we’ve just been, but don’t necessarily let what you’ve seen dominate your drive to the future.

After a challenging year, we remain grateful for your continued confidence in our services. May the year ahead be filled with brighter days and stronger markets.

[1] https://markets.businessinsider.com/news/stocks/warren-buffett-berkshire-hathaway-60-billion-record-stock-purchases-portfolio-2022-8;

[2] BRK-A vs. S&P 500 Index annual returns, 1965 to 2021.

RRSP Season Is Here Again

The RRSP & RRIF: Be Aware of Taxable Withdrawals

The market volatility in 2022 put many asset values under pressure. Yet, markets are cyclical and we expect prices to eventually resume their climb in the same way as the cycle swings back to more optimism. As such, consider the implications of making taxable withdrawals from either the Registered Retirement Savings Plan (RRSP) or Registered Retirement Income Fund (RRIF). In both cases, allowing funds to remain within the plan can be beneficial to allow asset prices to recover. Here are some other considerations:

The RRSP: Implications of Taxable Withdrawals

For those still saving for retirement, when looking to pay down short-term debt, some may consider withdrawing funds from the RRSP. However, consider the implications of making taxable withdrawals. They will be subject to a withholding tax and must be reported as income on a tax return. You may end up paying more tax on the withdrawal than you’ll save in interest costs on debt. If your current income is higher than it will be in future years, you may be paying higher taxes today than in the future. You will also forego the opportunity for continued tax-deferred compounding, perhaps the most beneficial aspect of the RRSP. In addition, once you make a withdrawal, you won’t be able to get back the valuable contribution room.

RRIF Withdrawals: Are There Ways to Minimize the Impact?

For those who have entered retirement, allowing funds to remain in the RRIF may be challenging given the minimum withdrawal requirement, which is considered taxable income. However, there may be ways to potentially minimize the impact and here are some ideas:

Make withdrawals at the end of the year — By taking your withdrawal at the end of the year, it may allow greater time for asset values to potentially recover. Consider also that making withdrawals at the end of each year, instead of the beginning, allows for a longer time period for potential growth within the plan.

Make an “in-kind” withdrawal — If you aren’t in need of funds from the RRIF minimum withdrawal, consider making an “in-kind” withdrawal. While the fair market value at the time of withdrawal will be considered income on a tax return, you will continue to own the security. If you transfer this to a TFSA, subject to available contribution room, future gains will not be subject to tax.

Split RRIF income with a spouse — Don’t overlook the opportunity to split income and save taxes on mandatory withdrawals. RRIF income qualifies as eligible pension income for pension income splitting. If you have a lower-income spouse and you’re 65 or older, you can split up to 50 percent of your RRIF income to reduce your combined tax bill.

If you are turning age 71 in 2023, here are additional options…

Make the first withdrawal next year — You aren’t required to make a withdrawal in the year that the RRIF is opened. You can wait until the end of the year in which you turn 72 to make the first withdrawal.

Base withdrawals on a younger spouse’s age — If you have a younger spouse, you can use their age to result in a lower minimum withdrawal rate, helping to keep more assets to grow within the plan. This can only be done when first setting up the RRIF, so plan ahead.

RRSP & RRIF Reminders

- RRSP Deadline: March 1, 2023 (for the 2022 tax year). Don’t overlook the opportunity for tax-deferred growth.

- Turning 71 in 2023? You must collapse your RRSP. Please call the office to discuss options.

Macroeconomic Perspectives

Rising Interest Rates: What to Expect in 2023

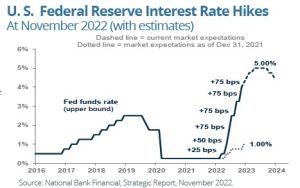

2022 will go down in the record books as an abnormal year for the financial markets. As inflation reached 40-year highs, it caught the central banks by surprise and led to a rapid tightening of monetary policy through interest rate increases. What has made this tightening cycle unique is the speed and magnitude at which rates increased (chart).1 Many argue that these actions have been necessary because the central banks acted too late to control inflation. However, this created significant volatility in 2022, with declines to both fixed income and equity markets. The declines may have felt particularly significant because for much of 2020/2021, asset values increased with little interruption, supported by the availability of low-cost capital and use of leverage, an increased money supply due to pandemic stimulus and excessive exuberance.

What Can We Expect in 2023?

The central banks have been focused on achieving “price stability” to prevent inflation from becoming entrenched. The good news is that we are seeing the effects of the rate hikes take place (they often lag), such as with the cooling of rate-sensitive areas of the economy like the housing market. Yet, it will take time for inflation to substantially ease. As such, if inflation persists, the central banks are likely to continue raising rates, with the intent of slowing economies, and this may lead to market volatility.

More recently, there has been a growing belief that the tightening policies may be slowing. In December, the Bank of Canada said it would be “considering whether the policy interest rate needs to rise further.”2 This may be positive news because rising rates have put downward pressure on the financial markets. For fixed income, investors will recall that bonds have an inverse relationship to interest rates: when rates rise, bond prices generally fall. For equities, higher rates mean valuations generally go down because the future value of cashflows is lower when a higher discount rate is used — this is especially true for the way in which growth stocks are valued. If a significant slowdown in inflation does become apparent in

2023, it will then allow for a return to less restrictive monetary policy.

[1] www.forbes.com/advisor/investing/fed-funds-rate-history/; [2] www.bankofcanada.ca/2022/12/fad-press-release-2022-12-07/

Estate Planning, In Brief

When Was the Last Time You Reviewed Your Will?

Over the years, the statistics haven’t changed much: the majority of people still do not have a Will and, for those who do, it may be outdated. When was the last time you read through your Will? Why not make your Will a priority in 2023. If you haven’t yet drafted a Will or need to make updates, in brief, here are some considerations:

Think carefully about how the Will is structured for your children. Estate lawyers suggest that many people often fail to properly plan for children. Sometimes, assets are passed in the Will to children at the age of majority without any conditions. Yet, transferring a significant amount of money at this age can lead to problems. Setting up a trust may be one way to help younger beneficiaries better manage funds. Others may neglect to appoint guardians or trustees over assets for minors. The terms and conditions for how funds are distributed to, and by, guardians can also be specified in the Will to help protect beneficiaries.

Remember which assets your Will distributes (and how). Don’t forget that a Will may not include all of the assets that you hold at death. Assets held in registered accounts (TFSAs, RRSPs, RRIFs)*, as well as certain pension plans or insurance policies, may have named beneficiaries which means these assets will pass outside of the estate. In most cases, joint assets will also pass outside of the estate. This is often overlooked when equalizing an estate between multiple beneficiaries. As well, don’t forget the potential effect of taxes on these accounts in reducing the final distribution of assets passing through a Will.

Pre-plan for cash flow issues. Will there be enough cash or liquidity to pay estate taxes, funeral costs or probate (in provinces where applicable)? There may be a significant tax liability for a family property or business, especially if the value has increased over time. Planning, using tools such as life insurance, can avoid future surprises.

Update as things change. Regular updates to Wills are often overlooked, such as due to changes in marital/family status, when a new beneficiary is identified, a change in jurisdiction occurs or when the status of assets changes. Administrative updates may also be needed, such as when a person named in the Will has a name change due to marriage or divorce. These updates can help to make future estate settlement easier.

Tell someone! Make sure to tell a trusted friend or loved one, as well as the estate’s executor/liquidator, of the location of your Will. While this may sound obvious, there have been instances in which estates were settled through the provincial courts because the Will could not be located.

*Not applicable in Quebec

Investing Perspectives

Three Reminders to Start Another Year

After a difficult year, and as we look to the year ahead, here are three reminders to help keep perspective.

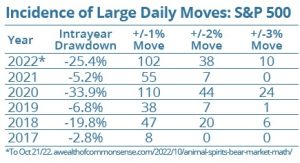

Volatility: Likely to persist — Periods of greater volatility tend to coincide with market drawdowns and 2022 was no exception (chart).* In 2023, we expect ongoing volatility as the central banks continue their tightening practices to rein in inflation. Rate hikes are intended to slow the economy, which may put downward pressure on earnings and lead to volatility. Downward volatility can be difficult, even for the best of us. Modern behavioral scientists suggest that we feel the pain of loss about twice as much as the pleasure of as similar-sized gain. It can cause undue stress or prompt poor investing decision making. During these times, consider focusing less on the financial news or checking in on portfolios. Leave the day-to-day focus on your investments to those who are here to manage them.

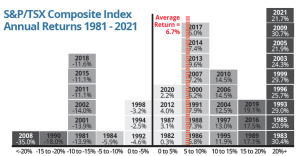

Markets will go down; This is normal — Part of investing involves accepting that the markets will go down from time to time. The good news is that, over longer periods, compounding average returns can lead to significant wealth. We often talk about average returns and it’s worth repeating that annual returns often do not fall close to this average. Consider the visual (top right) that shows the wide dispersion

of annual returns of the S&P/TSX Composite Index since 1981. Annual returns are less than the long-term average of 6.7 percent (red line) in 19 out of 41 years. That’s almost one-half of the time. And, 29 percent of the time, annual returns were negative. In the short term, we can expect a wide range of outcomes, including negative performance.

Equities continue to be one of the best asset classes to generate wealth — With increased market volatility and interest rates at levels not seen in decades, products like low-risk, guaranteed investment certificates may look appealing. While this may be a good opportunity for cash on the sidelines, if you’re investing for the long term, consider that equities continue to be one of the best asset classes in which to generate wealth and beat inflation over time, even in spite of the down years.

To Start a New Year: In Need of a Bit More Happiness

A recent article in the Wall Street Journal suggests that we may all be in need of a bit more happiness.1 It pointed to the “Misery Index,” which has climbed to double digits in recent times. This may not come as a surprise. We’ve been through a lot lately: a pandemic, ongoing war, high inflation, rising interest rates and market volatility.

For many years, economists have been fascinated by the relationship between economic factors and happiness — so much so that the “economics of happiness” has become a recognized field of study, complete with doctoral dissertations and professorships. In fact, the Misery Index is an economic indicator invented by late economist Arthur Okun, who believed that a nation’s collective happiness

is influenced by inflation and employment. The index adds the unemployment and inflation rates together — suggesting that as more people become unemployed and inflation rises, the greater our unhappiness. Various academic studies support this finding; one study didn’t explicitly ask people about the economy, yet could still tie their happiness to these factors. Other studies find that inflation and unemployment contribute differently to happiness (or lack thereof): higher unemployment depresses our well-being more than inflation; almost twice as much in one study and up to five times in another.1

So perhaps we have an understanding of what drives our “unhappiness,” but what drives happiness? There is, indeed, a relationship between happiness and income. Happiness and GDP are highly correlated; happiness often rises steadily with income.

There is also a link between happiness and economic outcomes. Research shows that happiness can make us more productive, wealthier and nicer.2 The share price of Fortune’s 100 Best Companies to Work For posted annual increases of 14 percent, compared to just six percent for the overall market between 1998 to 2005. One study primed people to feel happy and found that they were 12 percent more productive than their peers.3 Another looked at hundreds of studies on the causal effect of success on happiness and found the reverse: the stronger effect was how happiness engenders success.4 A recent study in China may provide some insight: when web broadcasters who rely on voluntary viewer tips for income showed more positive emotions, their tips increased.5

Yet, when it comes to the happiness of society as a whole, we may not be doing a good job. Even before the challenges we’ve recently faced, the World Happiness Report reported that worry and sadness have been rising over the past 10 years. It may be particularly telling that Canada has fallen in its global happiness rank: from 5th in 2012 to 15th in 2022. Wealth has increased substantially, but we haven’t increased our happiness. This may not be surprising — studies show that greater wealth leads to rising happiness, but once it reaches a certain level the effects plateau: Money can buy happiness, but only to a certain extent. As such, many economists now argue that we need a greater focus on increasing

societal happiness.6 Back in the 1970s, Bhutan began to track happiness through its Gross National Happiness Index. Other countries, like New Zealand and the U.K., have now begun to follow suit by building well-being metrics into their policymaking.

Is happiness the key? Reflecting on the many challenges of today, Harvard professor and happiness guru Arthur Brooks believes so. His goals are far from modest: to build “a grassroots movement of happiness hobbyists. That’s actually how you change the country.”7

[1] www.wsj.com/articles/inflation-and-unemployment-both-make-you-miserable-but-maybe-

not-equally-11668744274; [2] www.theguardian.com/lifeandstyle/2014/nov/03/why-does-happiness-matter; [3] www.warwick.ac.uk/newsandevents/pressreleases/new_study_shows;

[4] https://escholarship.org/content/qt1k08m32k/qt1k08m32k.pdf; [5] www.theatlantic.com/

family/archive/2022/10/prioritizing-happiness-before-success/671714/; [6] www.weforum.org/agenda/2019/02/what-will-succeed-gdp/; [7] www.gq.com/story/arthur-brooks-secrets-happiness

The Secret to Finding Happiness?

It is a question that researchers continue to explore: What drives our happiness? Researchers suggest that 50 percent of our happiness is genetic, 40 percent is under our control and 10 percent depends on circumstances. Here are some ideas for finding happiness, based on an over-80-year Harvard study:

- Buy more time. Spending money on time-saving purchases can promote greater life satisfaction.

- Stay connected to family and friends.

- Volunteer to gain a sense of purpose.

- Practice gratitude. Perform regular acts of kindness.

- Find your “inner child.” Revisit activities that provided joy when you were younger.

- Invest in experiences rather than material objects.

- Surround yourself with happiness: it can be contagious.

- Reduce decision-making opportunities for regret or worry.

- Continue to look forward: Don’t second-guess decisions!

Source: Health & Happiness Go Hand in Hand, M. Solan, Harvard Men’s Health, 11/1/21.