Coping With Volatility

The summer did not see much respite from the volatility that has gripped the financial markets. The bearish commentators continue to evoke fears that the aggressive moves by the central banks in raising interest rates will inevitably push economies into recession. It is therefore not surprising that many of us feel we are already in recession1 — the current narrative, alongside an increasing cost of living, the higher cost of borrowing and financial market declines, certainly hasn’t helped to support optimism.

While it may be difficult to put a positive spin on today’s situation given the challenges, consider that Canada continues to be in a comparatively favourable position globally. There have been positive disinflationary signals as commodities prices, notably energy, have been moderating, supply chains are being fixed and consumer spending is slowing in certain areas. Canada holds an enviable position as a net exporter of both food and energy due to our vast domestic resources. Will inflation continue to slow? Recent U.S. data has been disappointing, suggesting inflation has been more persistent than expected, and in many other parts of the world it continues to accelerate. Europe has been particularly affected, with inflation surpassing the double-digit mark in many nations and an energy crisis only expected to worsen as the winter months arrive.

As such, the near-term outlook collides with the broader forces of the central banks who have yet to give up their fight against inflation. The lagging effects from the ongoing rate hikes are expected to continue slowing economic growth, which suggests continued volatility for the financial markets over the near term.

We know, however, that the financial markets, like economies, are cyclical and periodic declines will occur on a regular basis. It may also be worth pointing out that the markets and economies don’t always move the same way at the same time. A recent study looked back at recessions in the U.S. since 1945, suggesting that the S&P 500 Index actually rose an average of one percent across all recessionary periods. And, in almost every recession, the markets began their climb well before its end.2

As we navigate through these periods, two elements deserve emphasis: diversification and quality. Spreading assets across different sectors, asset classes, market caps or regions, among others, continues to be a proven way to increase stability and lower risk. Those who consider high quality investments will also worry less about enduring values in uncertain times, secure in the knowledge that any price setbacks should be temporary. Managing risks in these and other ways can help cope with the unavoidable volatility.

As we navigate through these periods, two elements deserve emphasis: diversification and quality. Spreading assets across different sectors, asset classes, market caps or regions, among others, continues to be a proven way to increase stability and lower risk. Those who consider high quality investments will also worry less about enduring values in uncertain times, secure in the knowledge that any price setbacks should be temporary. Managing risks in these and other ways can help cope with the unavoidable volatility.

Downturns and economic challenges of one sort or another are a common occurrence in modern capital markets. Periods of retrenchment have always been followed by new growth, economic expansion and improved equity values. There is little reason to expect otherwise in this cycle. And, markets can change their course even when sentiment may appear at its lowest. Keeping this in mind, having the perseverance to stick to your wealth plan is important. Patience may be one of our greatest allies to see us through this period.

[1] theglobeandmail.com/canada/article-majority-of-canadians-think-country-is-in-a-recession-fear-prices-will/; [2] forbes.com/sites/sergeiklebnikov/2022/06/02/heres-how-the-stock-market-performs-during-economic-recessions/

Back-To-School Time

Your RESP Withdrawal Questions Answered

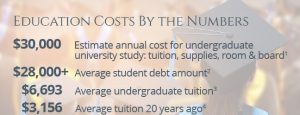

[1] Based on B.A., Canadian single dorm: www.queensu.ca/registrar/tuition-fees/expenses-budgets;

[2] www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3710003601; [3] Statistics Canada Table 37-10-0003-01; [4] www150.statcan.gc.ca/n1/daily-quotidien/020821/dq020821b-eng.htm

With the kids back in school, we have been receiving a good number of Registered Education Savings Plan (RESP) questions. Given the volatile markets, for those with young children still years away from attending post-secondary school, it may be an opportune time to contribute. For those looking to access RESP funds, some have asked about deferring withdrawals until certain investments can regain their values. Here are some answers to your RESP withdrawal questions.

- What portion of my RESP withdrawal is taxable? It’s important to distinguish between the two types of RESP withdrawals for educational purposes. The educational assistance payment (EAP) consists of any income earned or grants accumulated in the plan and is taxable in the hands of the beneficiary/child attending a qualifying educational program. The post-secondary education (PSE) payment represents funds the subscriber contributed to the RESP and is not subject to tax. When you withdraw from the RESP, you need to specify the type of withdrawal you wish to make. We can assist with identifying each component of the RESP.

- What is the best RESP withdrawal strategy? Students typically do not have significant income, so it generally makes sense to exhaust EAPs first, while the child attends school and has a lower marginal tax rate. If the RESP is large, it may be prudent to spread EAPs over several years to reduce the potential tax that may be incurred in any one year. This is because the student can potentially take advantage of several tax credits to offset EAP income. Consider that the basic personal amount for the 2022 tax year is $14,398. Assuming a federal tuition tax credit of $6,700 combined with this amount, the federal tax credits would total $21,098, meaning that a student with no other income in the year could potentially receive $21,098 of EAPs in 2022 and pay no tax.

- With market volatility, should I defer RESP withdrawals? While it may be prudent to wait for investment values to rebound, other considerations may impact your decision. Keep in mind that the basic personal amount is a non-refundable tax credit, so it must be used in the current tax year. The tuition credit can be carried forward. If the student has other income, such as from scholarships or a part-time/summer job, this, alongside a larger EAP, may put the student into a higher marginal tax bracket. Even worse, if you delay withdrawals and the student ends up dropping out of school, any remaining income/grant money may be taxable to you, the subscriber, and subject to an additional penalty tax.

- What if my child doesn’t attend post-secondary school? While original contributions/PSEs can be withdrawn without tax consequences, grants and income earned inside the plan may be subject to repayment and tax penalties, respectively. There may be an opportunity to transfer eligible funds to a sibling’s RESP, or income (as an “accumulated income payment” (AIP)) to the subscriber’s Registered Retirement Savings Plan (RRSP), subject to available contribution room to a maximum of $50,000. Remember also that the RESP can stay open for up to 36 years if a beneficiary has a change of heart and decides to pursue post-secondary education.

As you plan your RESP withdrawals, please call with any questions. We continue to advocate the RESP for a child’s post-secondary education.

Rising Interest Rates

Looking Back, Looking Forward: Housing in Canada

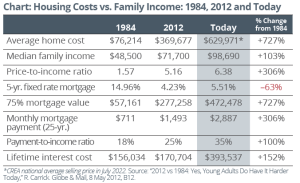

A decade ago, an article published in the Globe & Mail looked at the housing market around 30 years before to answer the question: Do young adults have it harder today? The conclusion: “Back in my day, economically speaking, life was easier.”

Given the significant increase in housing prices over the past few decades, and now with interest rates rising as well, one could argue that the same can be said in 2022. It is hard not to feel sympathy for those looking to buy a first home. The chart (right) shows just how difficult it is for first-time home buyers today, compared to back then. While mortgage rates are much cheaper — they aren’t close to the double-digit levels seen in 1984! — the rising cost of the average Canadian home has more than offset this effect.

As interest rates continue to rise, will they work to cool the Canadian housing market? Though there has been some softening over recent months, consider that the average home price is still above pre-pandemic levels. New rules and measures introduced by the federal government in this year’s budget have been targeted to achieving housing affordability, but it remains to be seen whether these will have a marked effect on the housing market going forward. Stay tuned…

Tax-Planning Opportunities

Tax Strategies During Uncertain Times

The markets may not have been too kind thus far in 2022, but there may be ways to engage in tax strategies during these uncertain times:

Donations to Charity — During more challenging economic times, a gift to a charity may be even more appreciated. If you donate shares “in kind” to an eligible charity, you will receive a donation receipt for the fair market value of the shares. If the shares are in a non-registered account and have appreciated in value, the donation will also eliminate the tax liability on the capital gains triggered. However, the shares must be donated in kind — do not sell them first and donate the proceeds, as part of the tax benefit will be lost. For securities that have declined in value, consider selling them and donating cash. You’ll be entitled to the capital loss, as well as a donation tax credit.

Tax-Loss Selling — With the challenging markets, you may find that some investments have declined in value. If investments held in non-registered accounts are sold for less than their original cost, this will result in a capital loss. For tax purposes, 50 percent of the loss can be used to offset taxable capital gains realized during the year. If you don’t have sufficient taxable capital gains to offset the losses, the net capital loss can be carried back three taxation years, or carried forward indefinitely to use against net capital gains. Be aware of the superficial loss rules, which may defer, suspend or deny the capital loss if you or an affiliated entity acquires the same security 30 days before/after the date of the loss transaction.

Gifts to Adult Children — Gifting investments that have declined in value to an adult child will not only trigger a capital loss in your hands but can put subsequent capital gains/income in the hands of someone in a lower tax bracket, resulting in less taxes payable for a family unit. For estate planning, transferring assets to children while alive can simplify an estate and reduce its value, subjecting it to less probate fees or estate administration tax (if applicable) at death.

Shifting Assets to a TFSA or RRSP — During uncertain times, many quality investments may have price setbacks that are temporary. Some investors may wish to repurchase an investment that has lost value and continue holding it for the longer term. Keeping in mind the superficial loss rules, once 30 days have passed, contributing funds to a registered account like a TFSA or RRSP (subject to available contribution room) may be a way to potentially benefit from a tax opportunity if the investment regains its value. With the TFSA, any future capital gains will not be taxed. With the RRSP, future growth will be tax sheltered and investors will receive a tax deduction for the contribution on their taxable income; however, original contributions and any gains will be subject to tax when withdrawn.

Estate Planning

The Benefits of Naming the Estate as Beneficiary

As you think about your estate plan, one important undertaking is naming and updating your beneficiaries. Note: In Quebec, beneficiary designations on registered accounts are generally not allowed to be made directly in the plan documentation and must be made within the will.

Often, individuals may be focused on certain tax implications associated with naming a beneficiary, such as bypassing probate fees/estate administrative tax in provinces where applicable. If no beneficiary is named, assets that would otherwise pass outside of an estate may be included in the estate and subject to probate. Although tax implications are important, there may be other considerations. For some,

naming the estate as the beneficiary may be beneficial under certain circumstances, including the following:

Equalizing the Estate — Naming the estate as a beneficiary may simplify the task of equalizing an estate amongst beneficiaries. For example, if the estate is not named as the beneficiary of the RRSP or Registered Retirement Income Fund (RRIF) (and passes outside of the estate in provinces other than Quebec) and taxes are due on the RRSP/RRIF value, the estate (and the estate’s beneficiaries) will be responsible for the taxes, while the full value of the RRSP/RRIF will pass along to the RRSP/RRIF beneficiary. This may complicate a situation in which the intent is to equalize the after-tax amounts received by all beneficiaries.

Covering Costs of the Estate — Naming the estate as a beneficiary for certain assets, such as life insurance policies, can provide funds to help cover tax liabilities, such as the capital gains tax liability of an appreciated family vacation home or other costs of the estate.

Maintaining Control — If a beneficiary is not currently financially responsible, you may consider establishing a trust, with the terms specified in the will. This may help to protect assets until certain requirements are met. Naming the estate as beneficiary can ensure that there are funds available for the trust.

As you review your beneficiary designations, remember to consider the broader implications of your selections. As always, please seek legal advice as it relates to your particular situation

Your Beneficiaries: Five Questions to Ask

- When was the last time I reviewed/updated my beneficiaries? Have there been recent births, deaths or marriages that may impact my choices?

- If beneficiaries are minors or disabled, do I have a trust in my will or other provisions in place to help manage their assets?

- Have I included secondary or alternate beneficiaries in the event that the named beneficiary(ies) predeceases me?

- Have I considered how I will equalize my estate for multiple beneficiaries to manage potential conflict?

- If I have named a spouse/partner as a beneficiary for the TFSA or RRSP/RRIF (where applicable), do I understand the “successor” designation?

Estate Planning & Your Loved Ones: Are There Ways to Help Preserve Family Harmony?

We can often have very unique visions for our legacy. For some, it may be to support the next generation to gain skills or to carry on a family business; others may have more philanthropic goals, such as supporting a cause they believe in. However, in many cases, a shared objective is to maintain family harmony after you are gone.

Even the most harmonious of families can undergo conflict and bitter disputes when dealing with the distribution of assets within an estate. As you plan ahead for your own estate, are there ways to help protect family harmony? Here are some thoughts:

1. Keep documents updated — Consider the importance of reviewing your estate plan periodically to ensure it reflects your current thinking and to avoid future conflict. If you have a will

in place, how old is it? Perhaps this may be a good time for a thorough review of your estate planning documents, especially if circumstances have changed. Equally important: reviewing your named beneficiaries. Many investors fail to revisit these designations after opening accounts, despite major life changes.

2. Rely on professional support — Improper documentation or vague instruction can lead to misunderstanding, conflict and even court battles. While you are able to create estate planning documents on your own, such as by using an online will service, even if the document is valid, do you fully understand the family and succession laws of your province or income tax and investment rules? These can change over time and should be evaluated against your estate plan. With the rise in blended families, balancing competing interests from children, stepchildren and a new spouse is challenging. The support of estate planning professionals can help ensure assets are distributed as intended.

3. Communicate — Sharing your intentions with beneficiaries can help manage expectations and prevent future conflict. While the topic of death is not easily approached, consider communicating with loved ones while you are alive about your estate. In-depth details do not have to be provided, but high-level conversations can be beneficial to avoid future surprises. These conversations can also help you understand the wishes of loved ones for when you are gone, such as for items of sentimental value, which can commonly become the centre of conflict.

4. Be aware of the potential consequences of joint ownership with children — Joint ownership* is often used to simplify the transfer of assets on death. Sometimes it is used to minimize probate fees in provinces where applicable. Yet, it has the potential to lead to complications — often revolving around estate equalization. It is a common cause for stressful and expensive lawsuits that will easily surpass the cost of probate — perhaps the exact situation you were trying to avoid in the first place! There may also be unintended consequences, such as tax implications or exposing assets to potential creditors.

5. Consider the support of a corporate executor — It may be money well spent to consider a corporate executor. This can help to preserve impartiality if you have children you were considering to be executor(s) of your estate. More importantly, it can help to take the burden off of loved ones during what is often a very emotionally difficult time.

Leaving a legacy that minimizes the potential for conflict can

be one of the most thoughtful things you can do for your loved ones and can help to ensure that the rewards of your lifetime of hard work are directed as intended. We recommend seeking the support of estate planning specialists as it relates to your situation.

*Joint ownership occurs when an asset is owned by more than one person. There are two forms: “Joint tenancy with the right to survivorship” refers to an arrangement in which the ownership of the asset passes directly to the surviving owner(s) upon the death of one of the owners. This does not apply in Quebec, where the laws differ and an automatic right of survivorship does not exist. Under a “tenants in common” arrangement, owners each hold separate ownership interests in the asset that can generally be sold, transferred or bequeathed without the consent of the other owners.