“All models are wrong. Some models are useful.”

— George E. P. Box, statistician

“Patience is a form of wisdom,” notes Jon Kabat-Zinn, creator of the Stress Reduction Clinic and the Center for Mindfulness in Medicine at the University of Massachusetts Medical School. It demonstrates that we understand and accept that sometimes things must unfold in their own time. In 2022, Wall St. and policymakers lost their patience. Their response resulted in the most aggressive tightening cycle in modern history. Raising rates does not accelerate an economy’s adjustment process to digest supply shocks. We likened it to a python digesting a pig, which takes considerable time. Unfortunately, in this instant gratification groupthink world, many lost their patience.

Throughout 2022, I differed from the consensus on what caused the inflation spike. The conventional view was that wages and aggregate demand of the private sector were the main culprits. I disagreed. My thesis was that the twin supply shocks of COVID-19 and the war, along with the extreme fiscal policy response, caused inflation. I adamantly disagree with the false premise that the inflation we experienced was akin to the 1970’s inflation spike.

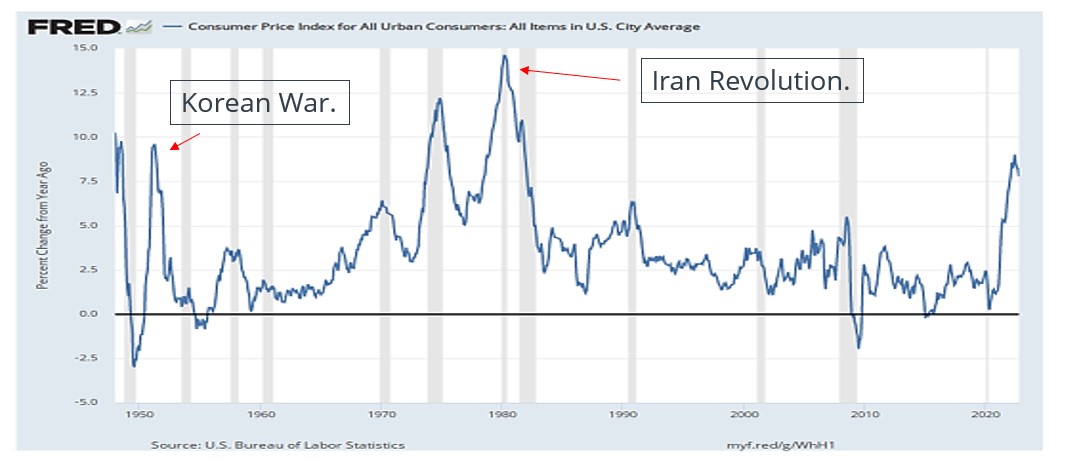

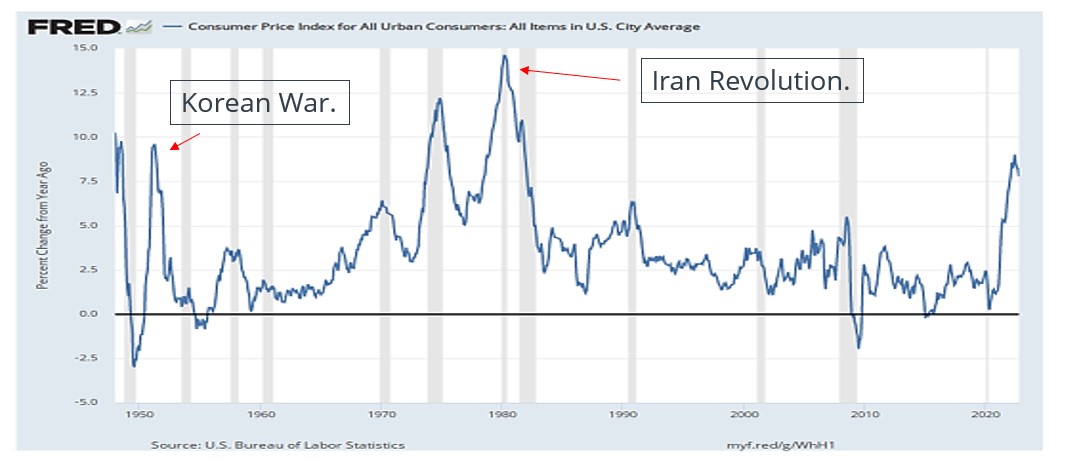

To be clear, raising interest rates does not solve supply-side shocks. Nor does it, in the short term, stop governments from implementing inflationary fiscal policy. As long as another supply shock does not occur, the fear of another inflation spike driven by private demand-side forces is misplaced. Since 1945, the twin-peak inflation spikes that so many are fearful of have been caused by the Korean War in 1951 and the second energy supply shock in 1979. Barring a significant supply shock, investors need to prepare for an environment in 2024 of below-trend growth and core Personal Consumption Expenditure (PCE) at levels below the Fed’s target range. Implicit in the 2023 forecast is the belief that the Fed will not keep tightening and cause a global financial crisis. 2023 will be the year data dependency comes back into vogue, and the secular bull market for equities will continue, just as the 1994-95 road map suggests.

We entered 2022 assuming a challenging first half of the year. What surprised us was the dramatic pivot by the Fed from the policy shift it implemented in 2020 at Jackson Hole. To this day, central bank officials still proclaim the false premise that wages cause inflation. If this was the cause, then why have real wages declined? In this groupthink world, the willingness of so many to accept this flawed arguement should give investors cause for concern. We heard throughout 2022 that the Fed had lost its inflation-fighting credentials, that wages and the housing market caused inflation and that solution was pain for Main Street. With excessive levels of global debt, central bankers closed their eyes and abandoned fundamental economic theory. Inflation is now dramatically falling because supply chains are opening up. Rate hikes do not speed up the digestion of supply shocks by the economy. Aggressive rate hikes do not cure inflation caused by supply shocks. Still, they can significantly hurt long-term growth prospects. One is the crowding out of the private sector by the public sector. Capital formation in the private sector has been negatively affected. The proclamations that there was no other alternative are specious at best.

Secular Themes To Watch In 2023

Secular themes will continue to evolve and shape how investors construct portfolios in 2023. As the effects of exogenous shocks dissipate, secular themes will take center stage.

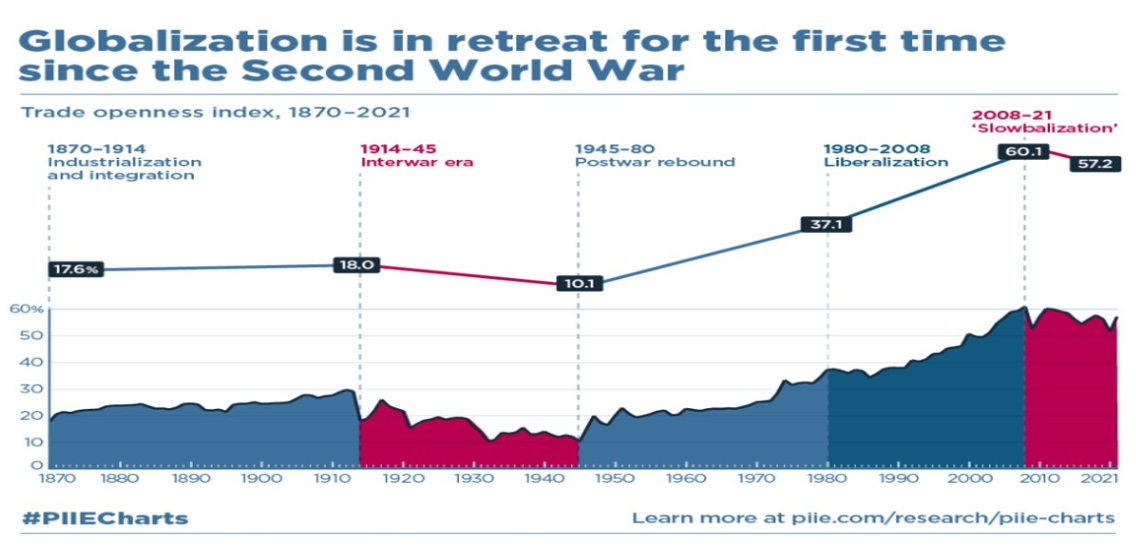

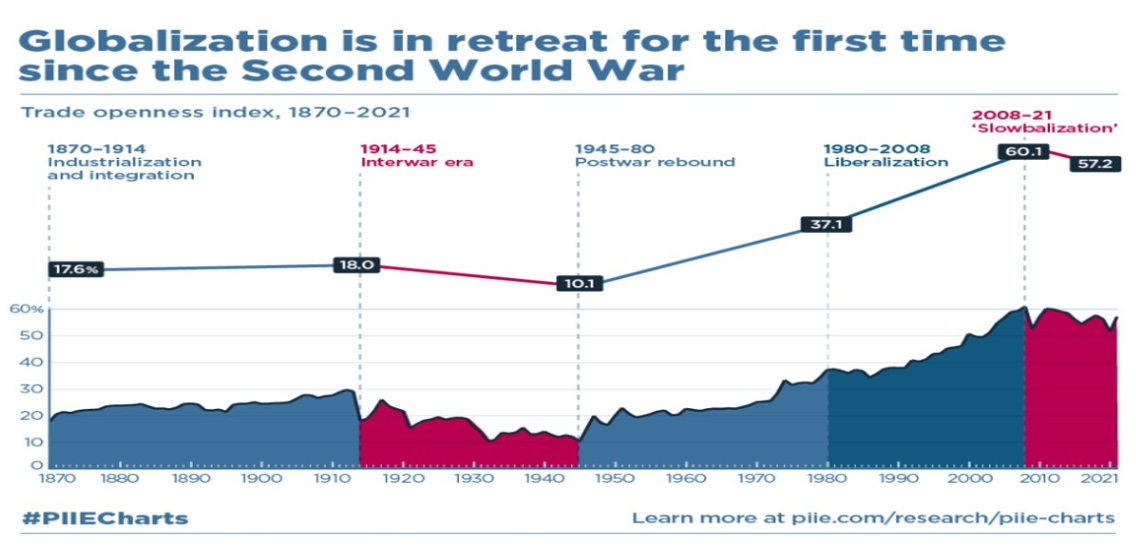

1. Deglobalization

Globalization is evolving, it’s not over. Regionalization will slowly take hold. The adjustment of global supply chains has been ongoing for decades and will continue.

2. Demographics

Millennials control the narrative. A new generation is setting social norms.

3. Population growth and immigration

Similar to the 1870s, the labour market will remain tight, resulting in central bankers staying vigilant on keeping inflationary expectations well anchored.

4. NetZero

Development of a noninflationary transition strategy to net zero. Canada and the USA benefit from exporting liquefied natural gas.

5. Digital revolution not over

Web 3.0, AI, blockchain, space, health care.

In a slow growth environment, companies that can grow sales and market share will again garner attention from market participants. One under the radar theme will be that Wall St. finally embraces technology and innovates.

Earnings And Interest Rates In 2023

As investors, we must accept that we live in a world of groupthink, where emotions get amplified on both the upside and downside. Our base case is that the economy achieves a soft landing and grows below trend. The tight labour market will support consumption and services, which should temporarily offset the weakness in interest-sensitive sectors and fiscal drag. We suggest modest growth in earnings of only three per cent. What will drive the appreciation of equities will be the multiple expansion caused by rate cuts and the discounting of solid gains and continued lower interest rates in 2024. With the negative positing of the consensus, evidence will show that the fears going into 2023 will be replaced by fear of missing out in the late summer.

For 2023, Bloomberg Data suggests that the bottom-up EPS estimate for the S&P 500 is $232.53. Wall St. strategists’ forecasts are wrong. Wall St. estimates at the beginning of the year for earnings will be wrong. History suggests that the average difference between the bottom-up EPS estimate at the start of the year and the final EPS number for that year would be two per cent. With inflation rapidly falling, a target of 2.5 per cent on the US 10-year bond should support multiple expansions. If the economy achieves a soft landing, then an S&P 500 target of 4800 would not surprise. Our preferred road map for 2023 follows the evolution of the capital markets following the rate-hike cycle of 1994-95. Those that anchored their pessimistic forecast off the inverted yield curve for their negative 2023 are overlooking one important point: In 2022, the stock market corrected over 20 per cent before the inversion took place. A very rare event. Investors are too pessimistic. In 2023, the data will show that deflation is a real threat. Economic growth will slow, and policymakers will cut interest rates. A tight labour market is not inflationary, but rather, is supportive of the economy holding the recession at bay.

Our Three Scenarios Are As Follows:

1. Hard landing

3600, $227 in earnings at an S&P 500 multiple of 15. Rates rise into early summer, no rate cuts in 2023.

2. Mild recession

4400, $232.53 in earnings at an S&P 500 multiple of 19. Rates rise into late spring. Rate cuts in late fall.

3. Soft landing

4800, $236 in earnings at an S&P 500 multiple of 20. Rates pause late winter or early spring. Rate cuts in summer.

As supply chains normalize, what we refer to as The Walmart Effect will be re-introduced. Companies are starting to cut prices to protect market share. The global economy has excess capacity. With consumers reverting to their regular consumption patterns, companies have over-earned by increasing retail prices by more than input costs. True, we may be entering into a new era, but preferences, supply chains, business processes, and economies take time to adjust. True, inflation did not decline as quickly as desired, but the effects of war and COVID-19 have been with us much longer than anyone anticipated. Simply put, COVID-19 was not a temporary phenomenon.

Interest rates are the determining factor when building a portfolio. In 2023, we assume that data dependency will be back in vogue. Chairman Powell’s presentation at the Brookings Institution ushered in a subtle pivot from frontloading rate hikes to becoming data-dependent. Forward-looking data points to a significant deceleration in economic growth and prices. The base case in 2023 is based on the simple fact that the forward-looking information is not a mirage. Monetary policy has long and variable lags. Our base case is that inflation and economic data will allow the Fed to stop hiking rates by the March Federal Open Market Committee (FOMC) meeting. As rapid disinflation becomes a concern, the Fed will start cutting rates by late summer. The tight labour market will support economic growth and consumption such that growth dramatically slows but does not contract in 2023. No, we don’t buy into the end-of the-world narrative. Truth be told, if all goes to plan, and 1994-95 or even 2002-2003 road maps come to fruition, my target of 4800 may turn out to be too low. The equity market internals of late 2022 lead us to believe that lows of the stock market are in and the next leg of the secular bull market has begun.

The Fear Of Another Inflation

What about the fear of a reacceleration of inflation? History reveals that since WWII, reacceleration of inflation results from additional supply shocks. In 1951, the fear that the Korean War would spread into a global conflict led to an inflation spike. In the late 1970s, the second oil shock caused the acceleration of inflation. The dual oil shock of the 1970s was associated with events surrounding the Iranian Revolution, which began in early 1978. Historical facts do not support the fears that many policymakers and pundits communicate. Deflationary forces have strengthened. They are more robust than before the twin exogenous shocks hit. Rate hikes or even interest rate levels do not cure the economic consequences or deter exogenous events from occurring. Interest rates at 10 per cent would not have stopped the COVID-19 pandemic or the war in Ukraine. In the absence of another exogenous supply shock, inflation should rapidly decline, with core PCE falling below the Fed’s target rate of two per cent by early 2024. At this time, the secular stagnation deflation narrative’s reintroduction will again be front and center.

Top 10 Predictions For 2023

1. Soft landing or mild recession. The labour market remains tight. 1994-95 playbook is our guide.

2. Inflation will continue to slow. The surprise will be how rapidly it declines.

3. Core PCE under three per cent by the end of 2023.

4. The yield on US 10-year bond finishes the year at close to 2.5 per cent. The Fed will cut interest rates in the second half of 2023.

5. Emerging markets will recover. China opens up. Stimulus growth tailwinds for global growth. Europe is slow to emerge from the economic slowdown.

6. Long-duration assets do well, starting with fixed income and then shifting to equities.

7. Favourite sectors: financial, technology, health care, and energy.

8. US dollars’ episode of extreme outperformance pauses.

9. Oil and natural gas prices will stabilize.

10. S&P 500 target of 4800.

We see the 2022-23 episode as the pause that refreshes the secular bull market − just as the 1994-95 tightening cycle set the capital markets up for a very strong secular bull market. As Warren Buffet suggests, be fearful when others are greedy and greedy when others are fearful. The Fed will finally pivot in 2023, much sooner then many predict. It’s true, all models are wrong, but if investors can ignore the noise, they may see the opportunity that lies in front of them.