After a difficult year, and as we look to the year ahead, here are three reminders to help keep perspective.

Volatility: Likely to persist

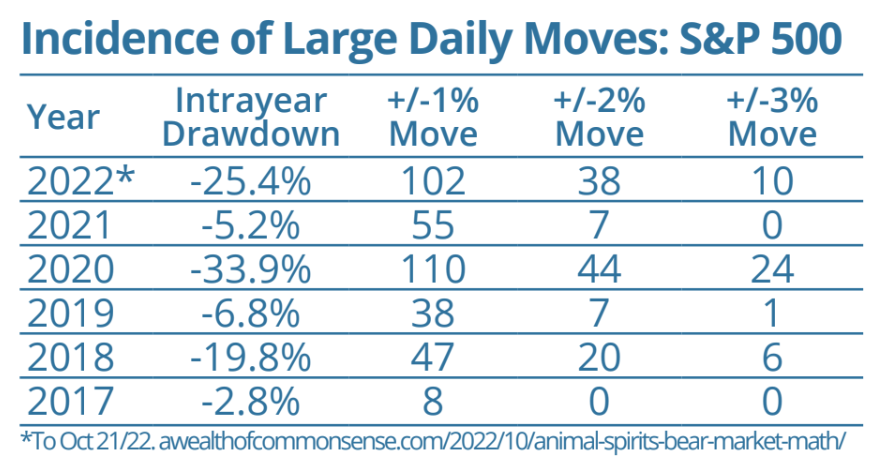

Periods of greater volatility tend to coincide with market drawdowns and 2022 was no exception (chart).*

In 2023, we expect ongoing volatility as the central banks continue their tightening practices to rein in inflation. Rate hikes are intended to slow the economy, which may put downward pressure on earnings and lead to volatility. Downward volatility can be difficult, even for the best of us. Modern behavioural scientists suggest that we feel the pain of loss about twice as much as the pleasure of a similar-sized gain. It can cause undue stress or prompt poor investing decision making. During these times, consider focusing less on the financial news or checking in on portfolios. Leave the day-to-day focus on your investments to those who are here to manage them.

Markets will go down; This is normal

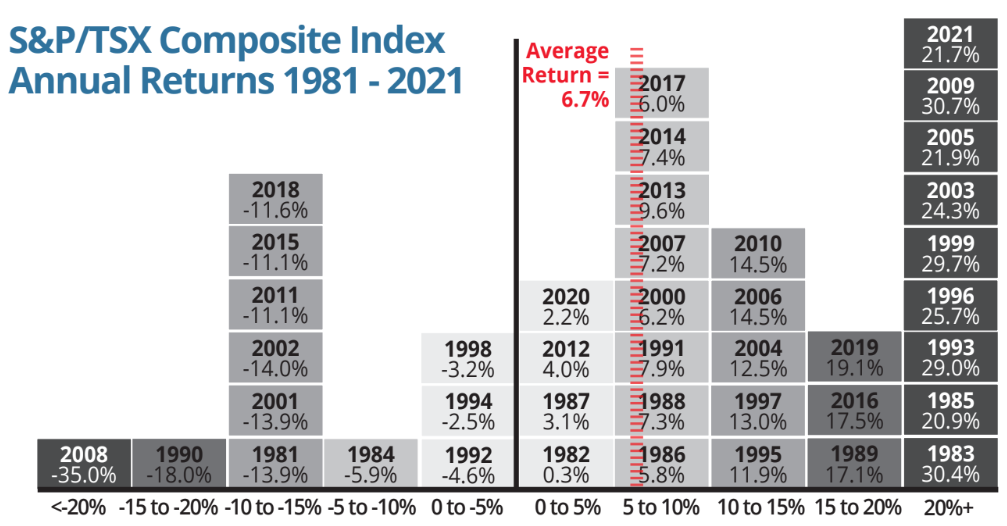

Part of investing involves accepting that the markets will go down from time to time. The good news is that, over longer periods, compounding average returns can lead to significant wealth. We often talk about average returns and it’s worth repeating that annual returns often do not fall close to this average. Consider the visual (below) that shows the wide dispersion of annual returns of the S&P/TSX Composite Index since 1981.

Annual returns are less than the long-term average of 6.7 percent (red line) in 19 out of 41 years. That’s almost one-half of the time. And, 29 percent of the time, annual returns were negative. In the short term, we can expect a wide range of outcomes, including negative performance

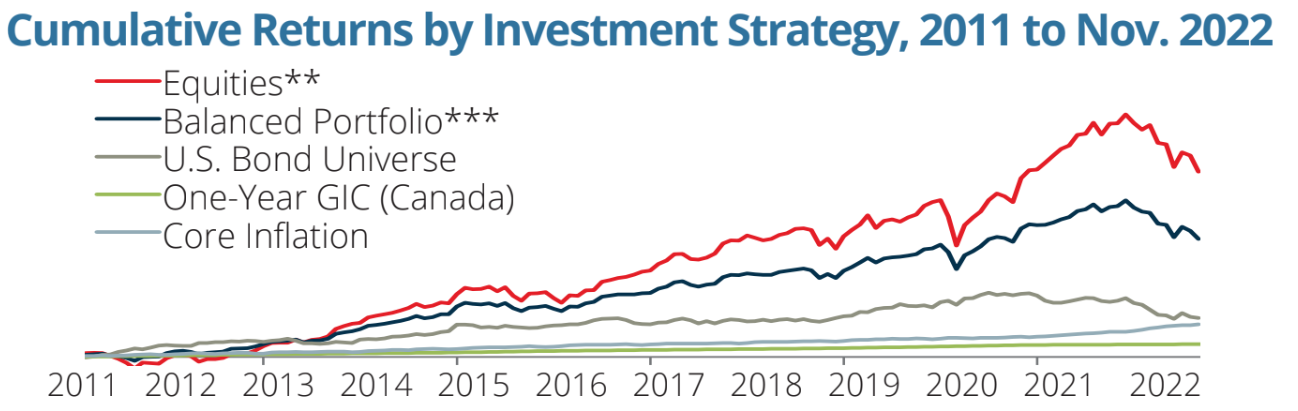

Equities continue to be one of the best asset classes to generate wealth

With increased market volatility and interest rates at levels not seen in decades, products like low-risk, guaranteed investment certificates may look appealing. While this may be a good opportunity for cash on the sidelines, if you’re investing for the long term, consider that equities continue to be one of the best asset classes in which to generate wealth and beat inflation over time, even in spite of the down years.

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. ©️ 2023, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION