A recent article in the Wall Street Journal suggests that we may all be in need of a bit more happiness.1 It pointed to the “Misery Index,” which has climbed to double digits in recent times. This may not come as a surprise. We’ve been through a lot lately: a pandemic, ongoing war, high inflation, rising interest rates and market volatility.

For many years, economists have been fascinated by the relationship between economic factors and happiness — so much so that the “economics of happiness” has become a recognized field of study, complete with doctoral dissertations and professorships. In fact, the Misery Index is an economic indicator invented by late economist Arthur Okun, who believed that a nation’s collective happiness is influenced by inflation and employment. The index adds the unemployment and inflation rates together — suggesting that as more people become unemployed and inflation rises, the greater our unhappiness. Various academic studies support this finding; one study didn’t explicitly ask people about the economy, yet could still tie their happiness to these factors. Other studies find that inflation and unemployment contribute differently to happiness (or lack thereof): higher unemployment depresses our well-being more than inflation; almost twice as much in one study and up to five times in another.¹So perhaps we have an understanding of what drives our “unhappiness,” but what drives happiness? There is, indeed, a relationship between happiness and income. Happiness and GDP are highly correlated; happiness often rises steadily with income.

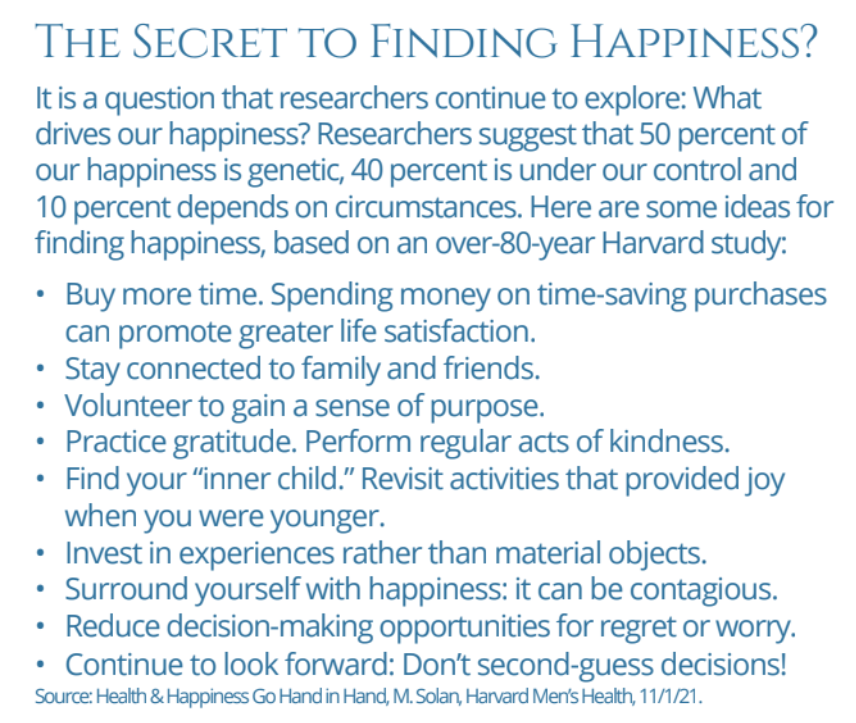

Yet, when it comes to the happiness of society as a whole, we may not be doing a good job. Even before the challenges we’ve recently faced, the World Happiness Report reported that worry and sadness have been rising over the past 10 years. It may be particularly telling that Canada has fallen in its global happiness rank: from 5th in 2012 to 15th in 2022. Wealth has increased substantially, but we haven’t increased our happiness. This may not be surprising — studies show that greater wealth leads to rising happiness, but once it reaches a certain level the effects plateau: Money can buy happiness, but only to a certain extent. As such, many economists now argue that we need a greater focus on increasing societal happiness.⁶ Back in the 1970s, Bhutan began to track happiness through its Gross National Happiness Index. Other countries, like New Zealand and the U.K., have now begun to follow suit by building well-being metrics into their policymaking.

Is happiness the key? Reflecting on the many challenges of today, Harvard professor and happiness guru Arthur Brooks believes so. His goals are far from modest: to build “a grassroots movement of happiness hobbyists. That’s actually how you change the country.”⁷

1. www.wsj.com/articles/inflation-and-unemployment-both-make-you-miserable-but-maybe-not-equally-11668744274 ; 2. www.theguardian.com/lifeandstyle/2014/nov/03/why-does-happiness-matter ; 3. www.warwick.ac.uk/newsandevents/pressreleases/new_study_shows ;

4. https://escholarship.org/content/qt1k08m32k/qt2k08m32k.pdf ;

5. www.theatlantic.com/family/archive/2022/10/prioritizing-happiness-before-success/671714/ ; 6. www.weforum.org/agenda/2019/02/what-will-succeed-gdp ;

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. ©️ 2023, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION