At one time in the not-so-distant past, our society was tuned into saving. We wouldn’t think of buying something until we saved enough cash to pay for it, whether for a car or other consumer goods. Only for the rare, big-ticket item, such as a home, would we go into debt.

Today, this quaint notion has largely gone by the wayside. Younger generations appear more impulsive, often choosing to ignore the admonishments to “wait” before spending. Our increasingly on-demand and cashless society, with easy access to credit cards and lines of credit, can land many in difficulty with debt. Often missing has been the discipline of the past: “Can we afford this?” The lack of a saving strategy has implications for investing: Without saving, there is no accumulation of capital; Without capital, there can be no investment.

It’s Hard to Save!

Often, those who profess to want to save will protest that it is impossible to do today. Yes, the cost of living is high and inflation is creating further pressures, with many people having a tough time making ends meet. Yet, there may be certain ideas that can help improve our personal fiscal habits, and here are some tips:

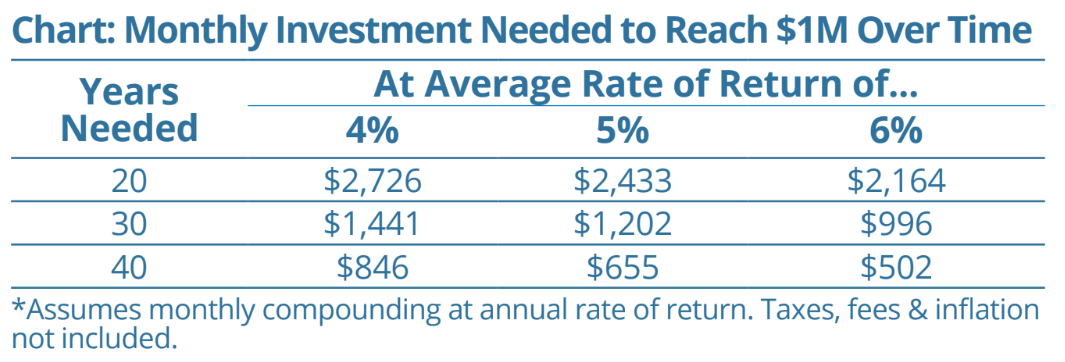

Pay ourselves first — It is interesting how the shift to spending from saving has occurred during a time in which the general wealth of Canadians continues to grow. Sometimes, the problem with saving is a lack of will. One easy way to make saving a regular habit is to “pay yourself first.” This involves having a portion of each paycheque automatically set aside in a separate account: via a payroll deduction at work, an automatic bank account debit, a dollar-cost-averaging investment plan or similar program. The theory: What you don’t see, you won’t miss — and otherwise spend. How much you allocate is up to you, but almost any amount sent to savings can create a sizeable amount over the years. And this can translate to even more if invested over time. It may surprise many young people, but the ability to become a millionaire is well within reach if you start early (see chart).

With some forethought, you can build your own list of possible savings that fits your lifestyle and circumstances. You may surprise yourself with what you can achieve. These tips may not seem significant at first glance, but consider that finding just $3,000 in savings each year can accumulate to over $100,000 in just 20 years if invested at a five percent rate of return. Not a bad basis for a real investment program!

Don’t overlook the “gift” of time — One of the greatest gifts that most young people have is time. A good rule of thumb that may encourage saving is the “Rule of 72,” a simplified formula that estimates how long it takes for an investment to double in value based on a rate of return by dividing 72 by the rate of return. Here’s a thought: An investment with an annual rate of return of five percent will double in approximately 14 years (72÷5=14.4), so a 25-year-old could potentially see their savings double four times within their lifetime (assuming average life expectancy). The bottom line? Success in building wealth is often within reach for many of us…and it can all start with saving!The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. ©️ 2023, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION