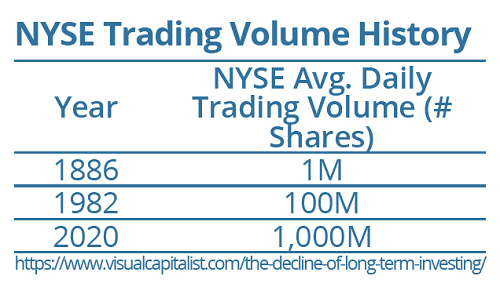

What has caused this decline? Technology has been one of the biggest drivers. Up until the 1970s, trading systems were not automated, which limited the number of trades that could be processed each day. The chart below shows how trading volume has grown over time. Technology has also significantly lowered the cost of transactions. And, with the connectivity of the internet, it has enabled investors of all kinds to trade, with information widely distributed and easy to access.

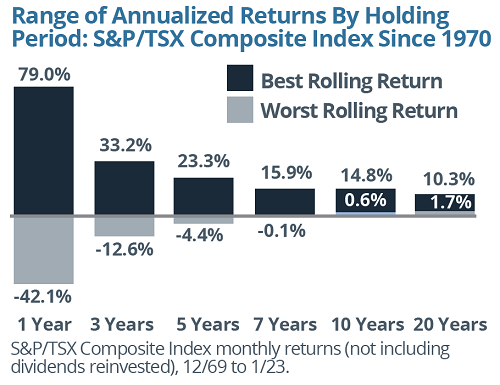

Yet, history shows that when it comes to investing, the longer your ability to focus, the better. Why? The variability of equity market performance smooths out substantially as the investing period grows. The graph shows the range of outcomes for the best and worst annualized returns of the S&P/TSX Composite Index (not including dividends reinvested) from 1970 to the start of 2023. These figures were calculated using rolling monthly returns. Over one-year periods, the variability is substantial: historically, you could have experienced a variation in annual returns of between -42.1 percent and +79.0 percent! However, as the time horizon extends to decades, the range of outcomes narrows significantly and the likelihood of negative returns also diminishes.

What has caused this decline? Technology has been one of the biggest drivers. Up until the 1970s, trading systems were not automated, which limited the number of trades that could be processed each day. The chart below shows how trading volume has grown over time. Technology has also significantly lowered the cost of transactions. And, with the connectivity of the internet, it has enabled investors of all kinds to trade, with information widely distributed and easy to access.

Yet, history shows that when it comes to investing, the longer your ability to focus, the better. Why? The variability of equity market performance smooths out substantially as the investing period grows. The graph shows the range of outcomes for the best and worst annualized returns of the S&P/TSX Composite Index (not including dividends reinvested) from 1970 to the start of 2023. These figures were calculated using rolling monthly returns. Over one-year periods, the variability is substantial: historically, you could have experienced a variation in annual returns of between -42.1 percent and +79.0 percent! However, as the time horizon extends to decades, the range of outcomes narrows significantly and the likelihood of negative returns also diminishes.

During volatile times, for some investors it may be difficult to maintain a longer-term view. But, the long and the short of it is that by extending a time horizon, historical probabilities continue to favour the long-term investor.

During volatile times, for some investors it may be difficult to maintain a longer-term view. But, the long and the short of it is that by extending a time horizon, historical probabilities continue to favour the long-term investor.

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. ©️ 2023, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION