In the summer of 2022, technology pioneer Bill Gates met with the team that developed the algorithm ChatGPT and left them with a challenge: “Train an artificial intelligence to pass an Advanced Placement biology exam…if you can do that, you’ll have made a true breakthrough.”

Expecting to keep them busy for two or three years, they returned to Gates in less than a few months. ChatGPT would correctly answer 59 of 60 multiple-choice questions in this college-level test and provided outstanding answers to six open-ended questions. Then, to further amplify its capabilities, it masterfully answered a non-scientific question: “What do you say to a father with a sick child?” The experience, according to Gates, was “stunning.”

Indeed, the age of AI has begun. The remarkable capacity of artificial intelligence is increasingly demonstrating its potential to be a significant disruptor. Quite understandably, it has also ignited a new debate about the threat of our technological advances. Yet, beyond this deeper existential debate, the evolution of AI should remind us of the continued pursuit of humans to constantly advance. Look at how far we’ve come in just two centuries:

• At the start of 1800, life expectancy was around 34 years old. There was no electricity and 90 percent of the population was illiterate.

• To start 1900, the average family had no indoor plumbing, phone or car, and less than 10 percent of homes had electricity.

• At the onset of 2000, smartphones didn’t exist. Today, we use these to watch live TV, buy clothes, get driving directions or even file our taxes!

Earlier revolutions, such as those sparked by the development of railroads, electricity and the automobile ignited upwaves of economic growth that lasted for many decades. Consider the impact of the global petroleum industry or the assembly line introduced by Henry Ford — the latter changed global manufacturing processes forever. Will this revolution be any different?

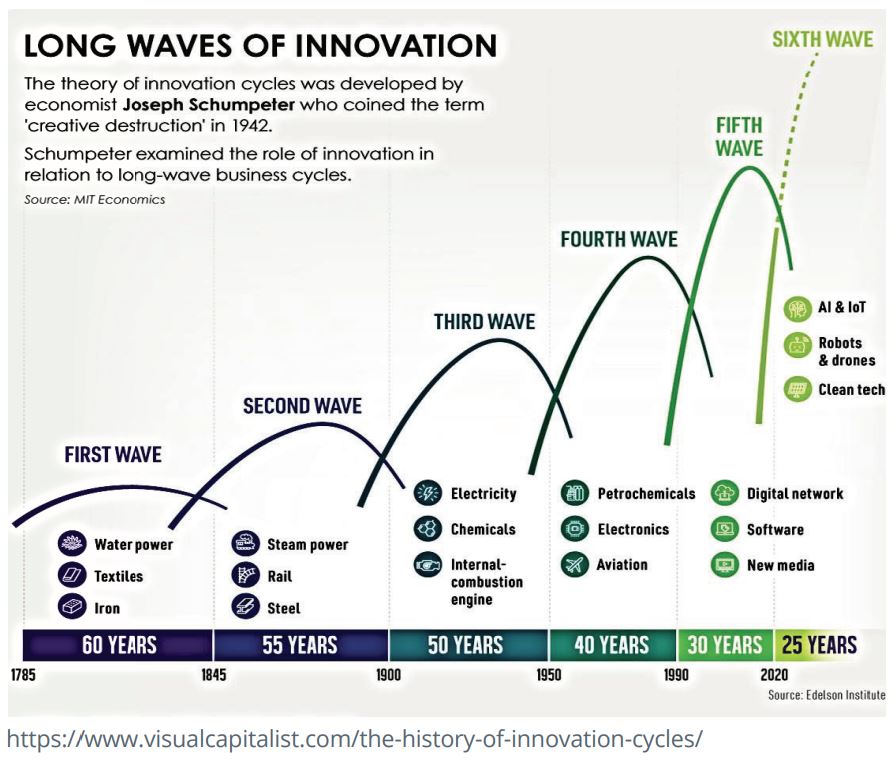

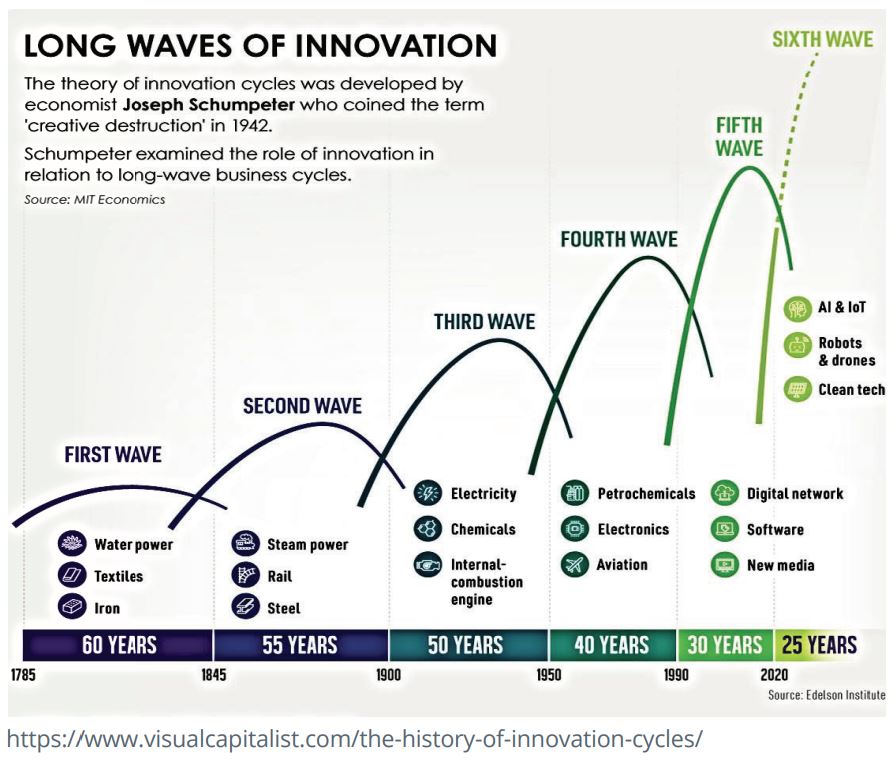

Economist Joseph Schumpeter developed the theory of innovation cycles suggesting that business cycles operate under long waves of innovation (see infographic). These new waves emerge as the markets are disrupted by “creative destruction.” One observation is that as time progresses, these waves are getting shorter — some suggest that this is because there are diminishing marginal returns for innovation.

What does this mean for investing? Innovation will continue to drive economic growth, just as it always has. Taking a step back, let’s not forget that when we invest in the equity markets, we are investing in the businesses that underlie the economy. Over time, economies have continued to progress and grow because of the motivations of individuals and businesses to innovate and advance, as we are witnessing today.

Of course, in the face of increasingly rapid change, our willingness to adapt also remains important. In the third wave of innovation, Ford and GM had hundreds of competitors that caught the imagination of investors. And do you remember Wang and Commodore? They were the high-tech leaders of the 1980s that have faded from view. Investing involves assessing the changing world, with careful analysis, selectivity and a nimble approach.

Though we may currently be enduring slower economic times, we should expect innovation to support the new growth yet to come — and investors can share meaningfully in the change that lies ahead. Continue looking forward!

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable.

The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

©️ 2023, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION