As we look forward to another year, after the financial market volatility we experienced in 2023, it may take discipline to stay focused on our objectives, but here are three perspectives:

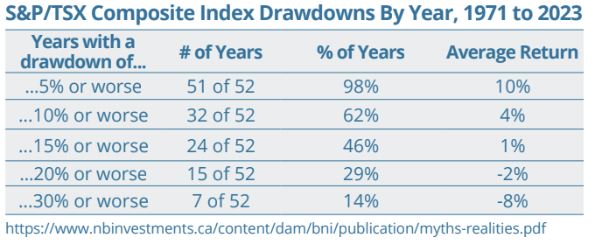

1. Volatility plays a normal role in the markets. Stock market declines are a regular occurrence and should be expected. A look at the S&P/TSX Composite Index since 1971 shows just how common it is for large declines to occur within the year (chart below). Yet despite the fluctuations, over this period the market advanced by 1,960 percent!

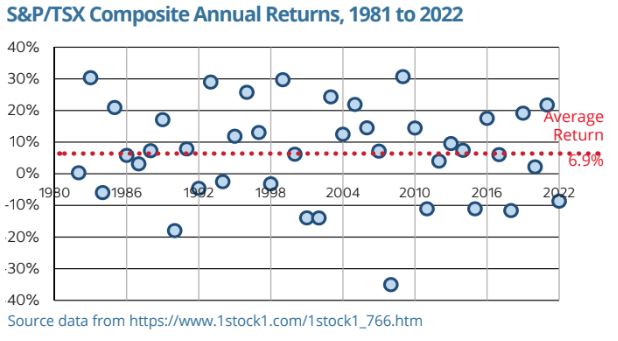

2. Annual returns are almost never “average.” While we often talk of average returns for indices like the S&P/TSX Composite, annual returns often vary from the average. The chart below shows the wide dispersion of annual returns of the S&P/TSX Composite Index since 1981: 83 percent of the time, annual returns did not fall within +/-2 percentage points of the long-term average return of 6.9 percent (red line). Almost 30 percent of the time, annual returns were negative. Investors should expect a wide range of outcomes over shorter time periods, including negative returns. This is a normal part of the investing cycle.

2. Annual returns are almost never “average.” While we often talk of average returns for indices like the S&P/TSX Composite, annual returns often vary from the average. The chart below shows the wide dispersion of annual returns of the S&P/TSX Composite Index since 1981: 83 percent of the time, annual returns did not fall within +/-2 percentage points of the long-term average return of 6.9 percent (red line). Almost 30 percent of the time, annual returns were negative. Investors should expect a wide range of outcomes over shorter time periods, including negative returns. This is a normal part of the investing cycle.

3. Investing often requires patience. After the 2020 bear market — the shortest in history at a mere 33 days during the pandemic — we may have been conditioned to believe that the markets should quickly rebound. However, history shows that recovering from a bear market can take time. Over the past 50 years, the average time it took for the S&P 500 Index Total Return (with dividends reinvested) to exceed its previous peak after a bear market was about 40 months, or almost 3.5 years.

3. Investing often requires patience. After the 2020 bear market — the shortest in history at a mere 33 days during the pandemic — we may have been conditioned to believe that the markets should quickly rebound. However, history shows that recovering from a bear market can take time. Over the past 50 years, the average time it took for the S&P 500 Index Total Return (with dividends reinvested) to exceed its previous peak after a bear market was about 40 months, or almost 3.5 years.

Yet, bear markets are a normal part of the investing process and, for many investors, they may be opportune times to build portfolios for the future. After all, the pendulum eventually swings back. History reminds us that the markets have always recovered from their bear market corrections to reach new highs.

Yet, bear markets are a normal part of the investing process and, for many investors, they may be opportune times to build portfolios for the future. After all, the pendulum eventually swings back. History reminds us that the markets have always recovered from their bear market corrections to reach new highs.

Keep Perspective. During uncertain times, it may be unsettling to see portfolio values fluctuate; however, it’s important to keep perspective. The investing road is a long one, and these periods smooth out over time. Longer-term investing requires the understanding that financial markets will fluctuate over the short term and the patience to see them through. Continue looking forward.