In many aspects, the economies of Canada and the U.S. share similarities as developed countries ranked among the top 10 economic powers globally. Over the past two years, we’ve both grappled to curb inflation, with central banks’ actions mirroring each other. Moreover, both economies have shown substantial economic resilience due to low unemployment rates.

However, more recently, there’s been a divergence in economic growth, with the U.S. showing progress while Canada has been stagnant. This divergence stems from various factors. Higher interest rates are affecting Canadians more than Americans, largely because of the way our mortgages are structured. The average Canadian mortgage has a five-year term, whereas the average U.S. mortgage has a 30-year term. Many Americans secured fixed rates during their lows, so there has been less concern over rising debt payments and this has sustained U.S. consumer spending to support economic growth. New U.S. government initiatives, including the Inflation Reduction Act (focused on green initiatives), the CHIPS and Science Act (backing the semiconductor industry) and the Bipartisan Infrastructure Deal have earmarked trillions in spending to further fuel economic growth.

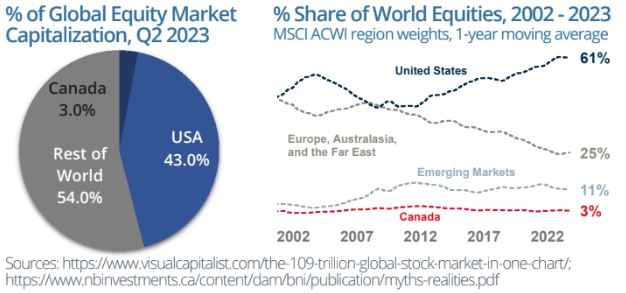

As we consider the economic differences we see today, we should also remember that there are distinct differences from an investing context. Canada, with its considerably smaller population and total output, represents only a fraction of the global equity market, at around 3 percent by market capitalization, in contrast to the U.S. at 43 percent (chart). The Canadian equity market is overweight in financials and energy sectors, but underweight in technology, health care, consumer discretionary and consumer staples relative to the global market.

These distinctions should highlight the significance of diversification. Different sectors, industries and regions can exhibit varied performances at different times. Diversification serves to shield against inevitable downturns while offering exposure to top-performing sectors. One interesting perspective comes from the MSCI All-Country World Index (ACWI). Over the past decade, U.S. equities have expanded from around 45 to over 60 percent of global market share within the index (graph).

Yet, in contemplating Canada’s economic path forward, let’s not forget that change is constant. Just three years before the pandemic, some sources proclaimed: “The American Dream Has Moved to Canada.”2 This should serve as a reminder that economic direction and perspectives can evolve, emphasizing the enduring value of diversification over time.