Politics and money are never far apart. Election years frequently bring about questions surrounding changes to public policies, potential regulatory shifts and the ensuing effects on the markets and economy. This year’s U.S. election has been no exception, with investors keeping a close eye on possible changes that could influence industries, sectors and the overall economic landscape. However, while public policy undoubtedly plays a role in shaping

specific industries, sectors and even the broader economic and social climate, its actual impact on investment outcomes may not be as pronounced as some might believe. Here are four perspectives:

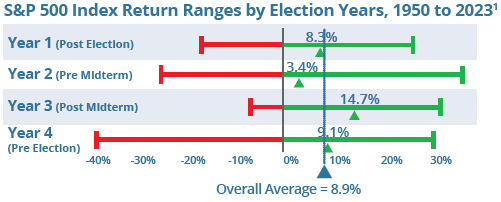

1. The U.S. presidential election is not a notably “market-changing event.” While the markets tend to perform positively in election years, some investors have suggested that this upward trend is due to the party in power encouraging the markets to improve the chances of getting re-elected. However, historical data shows that election-year market performance doesn’t differ significantly from the overall average market performance. Since 1950, the S&P 500 Index has averaged a return of 9.1 percent in an election year (indicated by “Year 4” in the chart below), compared to the overall market average of 8.9 percent during this time. One interesting observation is that the 12 months preceding an election have exhibited the widest range of market outcomes compared to other times in the election cycle.

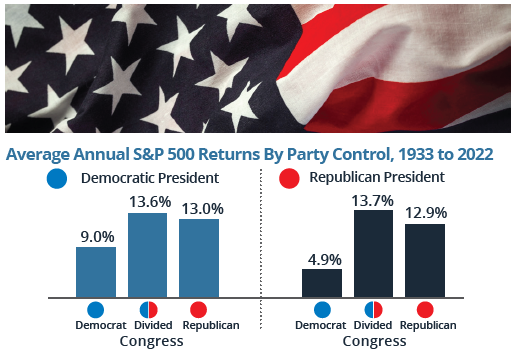

2. There isn’t a strong relationship between election-day outcomes and how markets perform thereafter. While some investors assert that one political party may be better for market returns, historical data does not support this theory. Since 1933, the S&P 500 has historically averaged positive returns under every partisan combination and there is no clear trend that relates to political party power: markets appear to be non-partisan. In fact, a divided government has been correlated with the strongest market returns — some have suggested that this is because government gridlock may create less policy uncertainty (see graph, top right).

https://www.fidelity.com/learning-center/wealth-management-insights/election-2024-market-impact

3. Predicting potential policy impacts, at this stage, carries risks. While it is possible to anticipate potential policy impacts from a high level, making changes to investment programs based on campaign promises is not advised. This is supported by historical data on sector performance which suggests very few consistent patterns of relative sector returns in election years.1 Of course, many investors are watching carefully to see how potential policy changes could impact the markets, sectors or even a company’s performance. However, consider that campaign promises do not always result in policy changes. The success of these policies may also depend on a variety of factors, including the composition of Congress or the Senate, economic and social conditions and many others.

4. Consider sticking to your plan and making adjustments based on thoughtful analysis. During presidential election years, election-year uncertainty and media headlines can often spark market volatility, prompting some investors to consider making adjustments to their investing strategies. While the buzz surrounding elections is often hard to ignore, consider the merits of staying focused on long-term goals rather than getting caught up in the short-term noise. Once the elected party takes power, adjustments can be made based on formal policy changes and thoughtful analyses. Reacting to the immediate outcomes of an election is rarely beneficial from an investing perspective. Instead, a disciplined approach and a well-crafted investment plan should remain the cornerstones of your strategy, no matter where the political winds may blow this November.

1. https://www.fidelity.com/learning-center/wealth-management-insights/election-2024-market-impact

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances.

Insurance products are provided through Wellington-Altus Insurance Inc.

© 2024, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION.

www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca