When the U.S. launched a trade war in January, many were quick to warn of a possible recession. With Canada’s economy already growing at a sluggish pace—GDP growth is projected at just 1.8 percent for 2025—the Bank of Canada estimated that a blanket 25 percent tariff would reduce annual GDP growth by 3 to 4 percentage points. While the tariffs implemented in March have been subject to change, concerns about their economic impact have continued to grow.

Is a Recession Imminent?

A recession is typically defined as two consecutive quarters of declining GDP. While tariffs will undoubtedly put downward pressure on the economy, Canada has a few economic buffers in its favour:

- Low interest rates and inflation — Both help to support consumer spending. For example, recently released Q4 2024 GDP data showed annualized growth of 2.6 percent, surpassing expectations and driven by stronger consumer spending;1

- A weaker Canadian dollar — This makes Canadian exports more competitive as they cost less, potentially offsetting some of the tariff impact on U.S. buyers; and Government intervention — As we witnessed during the pandemic, the government has been willing to provide fiscal and monetary support when conditions deteriorate, thus preventing a prolonged downturn. The federal government has already announced potential aid in light of the evolving situation2.

It is also worth noting that the U.S. economy is facing its own uncertainties, including persistent inflation, higher interest rates and weakening economic data. One inflation-related development garnering significant recent attention is the soaring price of U.S. eggs, which have more than doubled since August 2023 due to the avian flu. Less than a year ago, a dozen eggs cost an average of $2.04; today they are around $4.95.3 The effects of higher tariffs continue to be actively debated in U.S. circles, with many concerned that tariffs will lead to higher prices for U.S. consumers.

Perspectives for Investors

Without a doubt, broad-based tariffs would put downward pressure on the economy. However, it is important for investors to keep things in perspective. Here are some reasons why:

Markets and economies don’t always move in sync. Seasoned investors know that markets don’t always mirror the state of the economy. At times, economic and stock market performance can diverge.  The composition of the market also differs from the economy. For example, the S&P/TSX is heavily weighted in sectors like financials (33%), energy (17%), and metals and mining (12%).4 While these sectors are key to the economy, they can have a disproportionate influence on the index. Not all sectors will react similarly to tariffs. Consider the financial services sector, for example. It’s unlikely to see a major direct impact from tariffs, though an economic slowdown could still affect things like loan loss provisions. As advisors, we are continuously evaluating the potential effects of the evolving tariff situation on investments.

The composition of the market also differs from the economy. For example, the S&P/TSX is heavily weighted in sectors like financials (33%), energy (17%), and metals and mining (12%).4 While these sectors are key to the economy, they can have a disproportionate influence on the index. Not all sectors will react similarly to tariffs. Consider the financial services sector, for example. It’s unlikely to see a major direct impact from tariffs, though an economic slowdown could still affect things like loan loss provisions. As advisors, we are continuously evaluating the potential effects of the evolving tariff situation on investments.

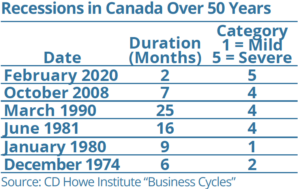

Economic cycles are normal. While recessions have become less frequent in recent years (chart, above) due to government intervention, economies—just like financial markets—naturally expand and contract over time. It’s unrealistic to expect perpetual economic expansion. Contractions are a natural part of the cycle and often serve as a much needed reset to correct inefficiencies and ignite growth.

Equity markets trend upward over the longer term. Despite financial crises, pandemics, supply chain issues, war—and even recessions—the longer-term trend of the markets has been upward. From 1945 to 2022, we’ve seen all these challenges; yet the S&P 500 delivered positive returns in 78 percent of one-year periods and 97 percent of 10-year periods. Similarly, the S&P/TSX posted positive returns in 74 percent of one-year periods and 100 percent of 10-year periods.5

Consider also that the economy and the markets don’t always react as expected—especially in extreme scenarios. Take the pandemic, for example, which many expected would lead to a prolonged recession. Moreover, if the start of 2025 is any indication, the nature and degree of tariffs can shift at any time—the policies of the new U.S. administration appear to change rapidly. During uncertain times, careful analysis and thoughtful investment selection become even more critical. This is where the support of advisors provides value.

1. https://financialpost.com/news/economy/canadas-economy-gained-momentum-2024-beatingexpectations;

2. https://www.ctvnews.ca/business/article/ottawa-announces-6-billion-aid-package-forbusinesses-

hit-by-trade-war/; 3. https://fred.stlouisfed.org/series/APU0000708111; 4. At 01/31/25: https://

www.spglobal.com/spdji/en/indices/equity/sp-tsx-composite-index/; 5. https://ca.rbcwealthmanagement.

com/documents/691191/0/market_perspectives_play_long_game_apr2023.pdf/eddab819-e602-4064-

8b19-8e1283950129