The Canadian dollar’s (CAD) weakness has raised questions about its broader impact and the path forward:

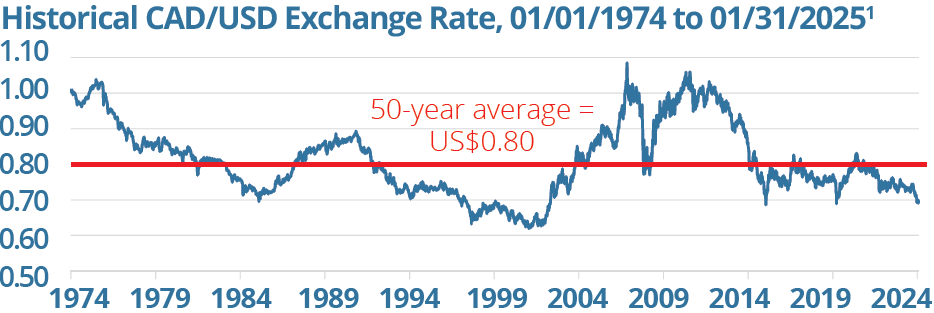

The CAD is trading below its historical average. To start 2025, it fell below 68 U.S. cents—a level not seen in two decades. The decline has been driven by factors such as diverging U.S. and Canadian monetary policies (lower interest rates make the CAD less attractive to foreign investors), ongoing tariff threats and a strong U.S. dollar. Historically, the CAD has moved in cycles. From 2005 to 2014, it benefitted from strong resource demand, surpassing parity with the U.S. dollar (USD)n i 2007 and peaking at US$1.09. Over 50 years, it has averaged around US$0.80.1

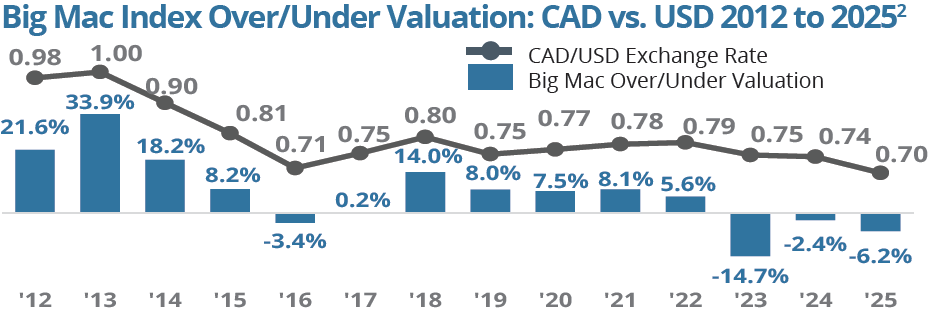

Will the loonie continue its fall? The “Big Mac Index” may offer some fun “food for thought.” Published by The Economist, it was developed as a lighthearted way to make exchange-rate theory digestible by comparing the purchasing power parity (PPP) of currencies. PPP suggests that, over time, exchange rates should adjust so that an identical basket of goods and services costs the same in each country. The index estimates an exchange rate by comparing the price of a Big Mac in different nations to its cost in the U.S. By comparing this to the prevailing exchange rate, it gauges whether a currency is under- or overvalued. According to the index, the CAD is undervalued (chart, top).

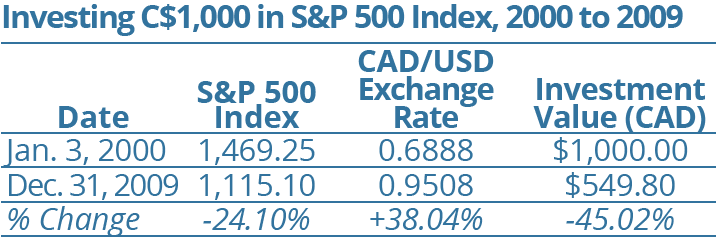

What does this mean for investors? Currency swings can impact returns on foreign-denominated investments when converted to Canadian dollars. A notable example occurred between 2000 and 2009—a period with parallels to today. At the start of 2000, US.. equity markets were at record highs amid the dot-com boom, while the CAD traded below 70 cents USD. If an investor put CAD into the S&P5 00 Index in early 2000, they would have experienced a loss—not just due to the market downturn, but also due to currency appreciation. By December 2009, the S&P 500 declined by 24.1 percent, but over the same period, the CAD appreciated by 38 percent. When converting investments back to CAD, the loss would have been 45 percent.

Over the long run, currency fluctuations tend to even out in well-diversified global portfolios, as gains in one currency can offset losses in another. There are also ways to mitigate currency risk directly, depending on an investor’s objectives, such as by using currency-hedged investment funds or Canadian Depository Receipts, which allow investors to buy foreign stocks on Canadian exchanges in CAD.

1. https://ca.investing.com/currencies/usd-cad-historical-data; 2. January data; https://github.com/

TheEconomist/big-mac-data/tree/master/output-data

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Financial Inc. (Wellington-Altus) is the parent company to Wellington-Altus Private Wealth Inc. (WAPW), Wellington-Altus Private Counsel Inc. (WAPC), Wellington-Altus Insurance Inc. (WAII), Wellington-Altus Group Solutions Inc. (WAGS), and Wellington-Altus USA Inc. Wellington-Altus (WA) does not guarantee the accuracy or completeness of the information contained herein, nor does WA assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor..

©2024, Wellington-Altus Private Wealth Inc., Wellington-Altus Private Counsel Inc., Wellington-Altus Insurance Inc., Wellington-Altus Group Solutions Inc., and Wellington-Altus USA Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca