Supporting a Home Purchase? Five Questions to Ask

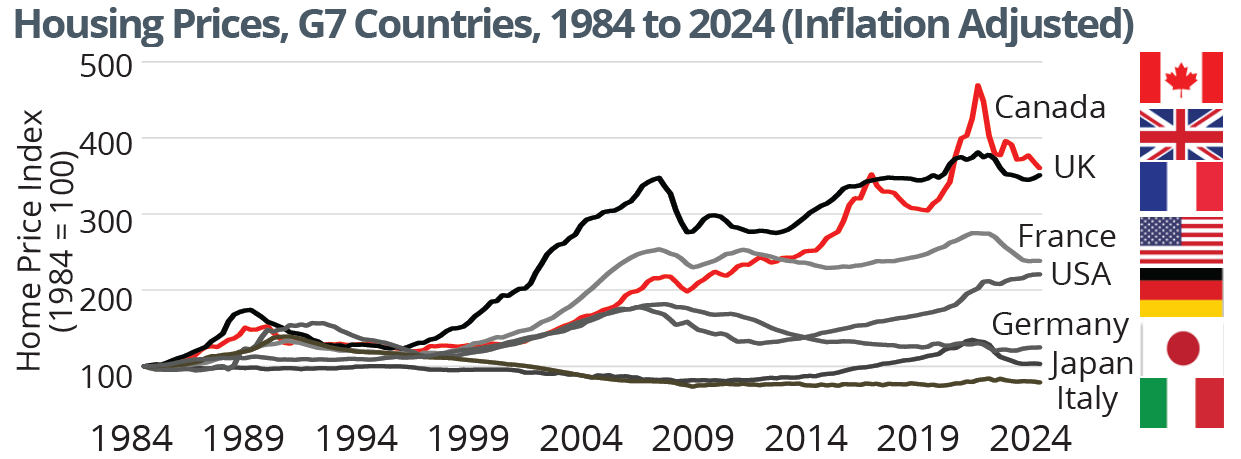

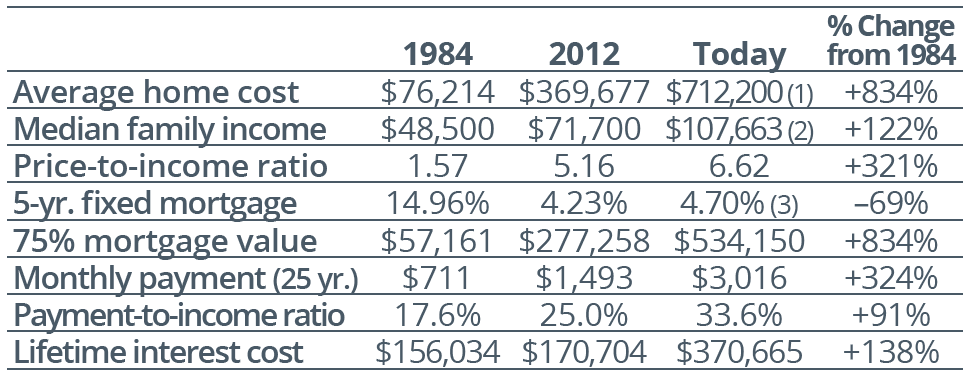

Without a doubt, home ownership has become increasingly out of reach for younger generations (chart, bottom right). Canadian home prices have risen faster than in any other G7 country—nearly quadrupling over 40 years (graph, top). As such, many families are stepping in to help. Beyond easing financial stress, this support can have added benefits. Many high-net-worth individuals value the opportunity to see their wealth in action during their lifetime. Lifetime gifting can also simplify estate administration and, depending on province, may reduce probate fees. Still, meaningful support requires thoughtful planning to avoid unintended consequences. Here are five key questions to consider:

1. How will this impact my own finances? Many people draw from lifetime savings to provide support. It’s essential to assess how this could affect your long-term financial security—especially given increased life expectancy and the rising cost of long-term care.

2. How do I structure my support? Support can take many forms, including gifting cash, loaning funds, co-signing a mortgage or purchasing a property in your own name—each with different tax and family law implications.* Remember, gifting means giving up control. Smaller, ongoing support may allow the recipient to leverage tax-advantaged tools like the Tax-Free Savings Account (TFSA) or First Home Savings Account.

3. What are the family law implications? If the recipient is in a relationship that ends, gifts or property could be subject to division, depending on provincial family law. There may be ways to protect the intent of your support, such as through the use of formal ownership agreements or cohabitation agreements.*

4. Are there tax implications? While Canada has no gift tax, some arrangements can trigger taxable events. For example, co-owning a property with the recipient may protect your share, but if it’s not your principal residence, you could face capital gains tax upon its sale or disposition. Large gifts from taxable investment accounts could also trigger capital gains or income tax.

https://www.dallasfed.org/research/international/houseprice

5. Will this affect my estate plan? If you have multiple children who are intended beneficiaries, a gift to one child can affect how you equalize your estate. A strategic approach might include integrating gifting into an estate equalization plan—through lifetime gifts or testamentary planning using trusts or insurance. *Consult legal and tax professionals to understand the implications of any strategy.

Housing Costs Over 40 Years: Kids Today May Have It Harder

(1) National benchmark, April 2025: https://wowa.ca/reports/canada-housing-market; (2) StatCan

Table 11-10-0190-01, 2022 figure (after tax) with 2.56% annual wage growth in 2023-25; (3) Avg. major

banks’ five-year fixed rate, April 28, 2025. Historical data soucre: “2012 vs 1984: Yes, Young Adults Do

Have It Harder Today,” R. Carrick. Globe & Mail, 8 May 2012, B21

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Financial Inc. (Wellington-Altus) is the parent company to Wellington-Altus Private Wealth Inc. (WAPW), Wellington-Altus Private Counsel Inc. (WAPC), Wellington-Altus Insurance Inc. (WAII), Wellington-Altus Group Solutions Inc. (WAGS), and Wellington-Altus USA Inc. Wellington-Altus (WA) does not guarantee the accuracy or completeness of the information contained herein, nor does WA assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor..

©2024, Wellington-Altus Private Wealth Inc., Wellington-Altus Private Counsel Inc., Wellington-Altus Insurance Inc., Wellington-Altus Group Solutions Inc., and Wellington-Altus USA Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca