Succession Planning — What Is Your Business Worth?

Warren Buffett is leaving the building. After almost six decades at the helm of Berkshire Hathaway, Buffett announced earlier this year that he will step down as CEO at the end of the year. Buffett’s departure doesn’t come as a surprise. He named his successor Greg Abel back in 2021, wisely aware that succession planning, like investing, is often most successful when treated as a long game.

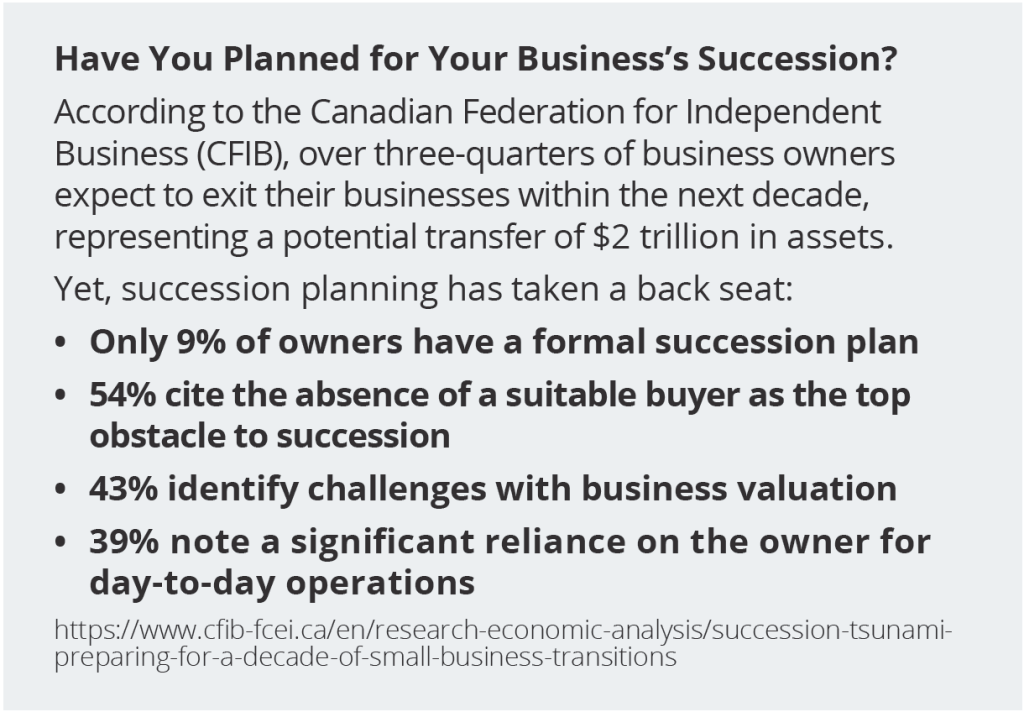

Succession planning takes time. Timelines vary based on complexity, but many experts suggest that it typically takes 3 to 5 years to fully implement a plan, and it may even take up to 10 years for family businesses. Yet, time alone isn’t enough. For many small businesses, one of the more overlooked aspects of preparing for a transition is understanding what the business is actually worth. (Of course, as Buffett prepared for his transition, he had the luxury of knowing Berkshire’s value as a publicly-traded company, which reached a trillion-dollar status last year, 44 years after its IPO in 1980!)

The Importance of Valuation

Why does valuation matter? Even if you are years away from transitioning your business, knowing your company’s value today can set realistic expectations. It’s not uncommon for business owners to overestimate what their company is worth. A valuation exercise can uncover gaps, for reasons including.

- Market value vs. book value — Owners may include goodwill or revenue potential, while buyers may only focus on cash flow (what the business earns today and can repay).

- Industry multiples — Valuation depends on comparable sales. Market conditions, growth prospects and sector trends can lower multiples.

- Dependence on key persons — If the business relies heavily on key individuals who may leave the business once sold, such as the owner, buyers may apply a discount.

Understanding valuation not only prevents future surprises, but it can also support strategic decisions around growth, succession and family planning:

- Enhancing Future Value — Identifying value drivers may point to strategic opportunities or operational improvements to boost valuation before a transition.

- Planning a Tax-Efficient Sale — Accessing tax-planning strategies such as the Lifetime Capital Gains Exemption (LCGE) or the new Canada Entrepreneur’s Incentive (CEI) may require years of preparation. Techniques such as an estate freeze or the use of a family trust can also help manage tax implications when passing the business within a family.

- Ensuring Family Fairness — If not all children are involved in the business, valuation supports estate equalization, helping to avoid family disputes. Clear communication can also reinforce that ownership is an earned responsibility, potentially minimizing entitlement and promoting stewardship.

- Optimizing Timing & Financing — Value can guide when to sell or transition the business, as well as how to structure buy-sell agreements, financing or staged transfers within a family.

- Supporting Retirement & Estate Planning — After many years of building a business, for many business owners the company often represents most of their wealth. Knowing its value can help project and plan for retirement income after transition, as well as for the estate distribution, ensuring financial longevity and security for you and your family

Knowing your business’s value today can give you better control of tomorrow. It helps you make informed decisions, safeguard your family’s interests and preserve the legacy you’ve worked hard to build. For guidance that goes beyond wealth management, including broader business planning support, our team of specialists can assist. Please call the office for a deeper discussion.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Financial Inc. (Wellington-Altus) is the parent company to Wellington-Altus Private Wealth Inc. (WAPW), Wellington-Altus Private Counsel Inc. (WAPC), Wellington-Altus Insurance Inc. (WAII), Wellington-Altus Group Solutions Inc. (WAGS), and Wellington-Altus USA Inc. Wellington-Altus (WA) does not guarantee the accuracy or completeness of the information contained herein, nor does WA assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor..

©2024, Wellington-Altus Private Wealth Inc., Wellington-Altus Private Counsel Inc., Wellington-Altus Insurance Inc., Wellington-Altus Group Solutions Inc., and Wellington-Altus USA Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca