Access to Alternative Investments

In the current environment of higher valuations, slower growth and increased volatility, there’s been renewed attention to alternative investments. Alternatives are often given focus during more challenging times since their performance doesn’t typically correlate with the markets. Alternatives generally refer to investments not available in publicly traded markets. Most commonly, this includes private equity, infrastructure/real assets, commercial real estate, private credit and hedge funds. Many successfully managed pension funds allocate a portion of their investments to alternatives. A select few have a majority allocation, such as the Yale Endowment1 and the Canada Pension Plan Investment Board.2 These funds may be outliers, but they highlight the increased focus to alternatives by successful money managers.

Why Focus on Alternatives?

One of the main reasons to include alternatives within a diversified portfolio is to benefit from their general low correlation with traditional asset classes, such as public equities and fixed-income assets. Private assets can reduce portfolio volatility and soften the fluctuations typically associated with equity markets. They also offer additional diversification by providing exposure to income streams that differ from conventional sources like dividends and interest payments. Moreover, alternatives may enhance a portfolio’s risk-adjusted return through what is often termed the ‘liquidity premium’ (or sometimes the ‘illiquidity premium’). Many alternatives such as private equity, require longer investment time horizons, typically around 10 years. However, investors are compensated for committing capital over this extended period. For those with a longer-term time horizon who can forgo some liquidity, a position in alternatives may be a strategic choice.

Access to a Greater Pool of Investments: A Shrinking Public Equity Market

Consider also that alternatives offer diversification benefits in part due to the broader range of companies found within private markets .The alternative investment marketplace has continued to grow, largely at the expense of the public markets. In 1996, the number of companies listed on U.S. stock exchanges peaked at around 8,000. Since then, despite the U.S. economy expanding by nearly $20 trillion and the population growing by 70 million people, only around 4,000 companies are listed today.3 By one account, 87 percent of U.S. firms with revenues of more than $100 million are now private.4 With fewer public options,

alternatives may be a worthwhile consideration.

A Brief Primer: Alternative Investment Options

As the alternative investment landscape evolves, there are many options available to investors. Private equity investments, which generally invest in private companies not listed on stock exchanges, have been viewed for their potential value-add achieved through active management, where private managers have direct control over their portfolio companies. Their compensation is often tied to performance, which may drive value creation, enforce discipline and promote a focus on long-term results. Infrastructure investments (such as railways, highways, airports) and real assets (such as commodities, energy, farmland) are often seen as providing a hedge against inflation. Certain real estate investments, such as data centres, self-storage, student housing and medical centres, may offer opportunities where traditional real estate investments in areas like office spaces have been challenged by the changing work-from-home movement. Investments in infrastructure can provide regular cash flows (i.e., consider the cash flows generated from a toll road) and may be sought for their high barriers to entry and longer-term agreements with public authorities.

Alternatives: Risk & Reward

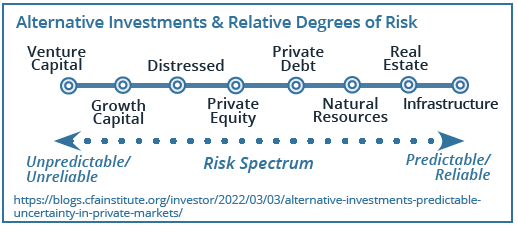

Like any investment, alternative investments have varying risk and return profiles. The chart below shows the general risk spectrum. Alternatives may also be highly illiquid or involve a lengthy investment time horizon. Certain alternatives may not be subject to regulatory requirements and correspondingly come with higher risks. As well, alternatives may involve higher fees or more complex tax structures.

Chart: The Investment Risk Spectrum of Private Capital

Alternatives can help to achieve enhanced portfolio diversification, but as with any investment, thoughtful evaluation and careful selection are important. However, with more modest expected returns for equity markets alongside the higher volatility that might come in a late cycle environment, these non-traditional assets may offer benefits if prudently selected and carefully managed.

My/Our Difference: Access to Alternatives

One of the ways we differentiate ourselves at Wellington-Altus is by providing access to alternatives. Depending on your risk profile, the integration of alternatives into a well-diversified portfolio may be a consideration. Please call if you would like to discuss.

1. https://investments.yale.edu/about-the-yio;

2. Private equity, private credit and real estate account for more than half of the allocation in 2023. https://www.cppinvestments.com/the-fund/f2024-annual-report/;

3. https://www.theatlantic.com/ideas/archive/2023/10/private-equity-publicly-traded-companies/675788/;

4. https://www.apolloacademy.com/many-more-private-firms-in-the-us/#

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances.

Insurance products are provided through Wellington-Altus Insurance Inc.

© 2024, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION.

www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca