Ways to Live a Longer Life — The Importance of Connection

In the longest-running study on happiness, the Harvard Study of Adult Development found that social connections are the strongest predictor of happiness and health, which in turn may contribute to greater longevity.1

Retirement planning is more than a “number.” Of course, my/our role is to support your wealth management so you have the means to live the life you envision in retirement and beyond. Yet often overlooked is how we’ll maintain life satisfaction as we age.

We live in an era of unprecedented global wealth, yet levels of unhappiness are at record highs. Social disconnection has become such a recognized issue that the UK and Japan have appointed government “Ministers of Loneliness,” and in 2023, the U.S. surgeon general declared loneliness an “epidemic.”2 A recent media headline even suggested that Gen Z may avoid the proverbial ‘midlife crisis’ not because they are happier, but because unhappiness has become so common much earlier in life.3 In the past, happiness tended to follow a “U-shaped” curve across the lifespan. Today ,this may have shifted to an upward-sloping line, with young adults now the least happy and older adults reporting the greatest happiness.

Why this change is happening may be linked to various factors—the effects of job and housing prospects, the lasting impact oft he pandemic, growing wealth inequality and, of course, the rise in social media and smartphones that have created a broader connectivity ecosystem inundating us with negative news and comparative envy.

This kind of connectivity, however, does not sustain us. A thriving human experience is fuelled by face-to-face interactions, which foster self-expression, creativity, optimism—and ultimately happiness.4 In fact, these interactions can help rewire our brains and change how we perceive the world in a more positive way. Neuroscience shows that in-person interactions engage the brain in beneficial ways that text messages or video calls cannot replicate.5

Is there any evidence to support this connectivity as a predictor of longevity? One study following nearly 1,500 older adults over a decade found that those with large networks of friends outlived those with fewer friends by more than 20 percent.2 Conversely, social disconnection is linked to higher risks of cardiovascular disease, stroke, depression, dementia and premature death. One

study showed that loneliness increased the risk of early mortality by 26 percent and social isolation by 29 percent.6

The Longevity Benefits of Giving to Others

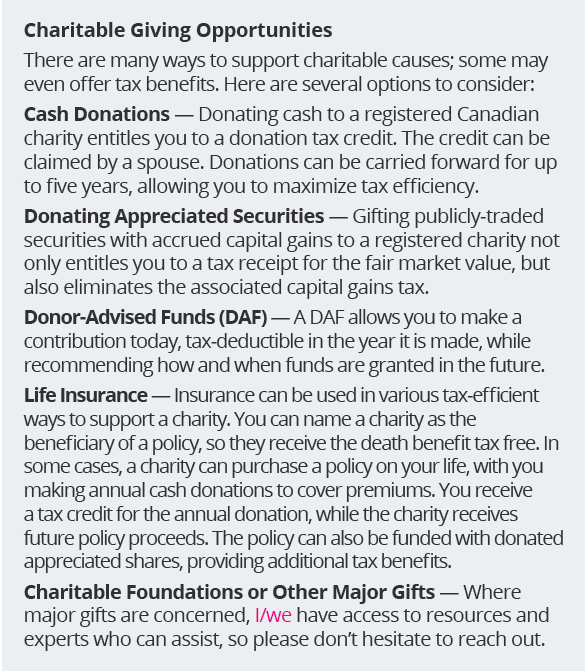

Importantly, connectivity is not only about how many physical friends we have, but also about how we engage with others. Those who participate in “prosocial” behaviours—acts intended to help or benefit others—tend to enjoy better health themselves. This can include volunteering or even making a charitable donation. For instance, seniors who spent about 15 hours per week tutoring and mentoring young children experienced measurable improvements in both cognitive and physical health.

Volunteering has been linked to longer lifespans.7 Acts of giving can lower blood pressure, reduce stress and even decrease cortisol levels (the stress hormone), while boosting feel-good brain chemicals like dopamine and serotonin.8

This may be worth reflection as we enter the season of giving: In supporting causes that matter to us, we not only make an impact ton others, but may also enrich our own health and happiness. Most importantly, staying connected helps us lead fuller, more satisfying lives as we plan for retirement and beyond.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Financial Inc. (Wellington-Altus) is the parent company to Wellington-Altus Private Wealth Inc. (WAPW), Wellington-Altus Private Counsel Inc. (WAPC), Wellington-Altus Insurance Inc. (WAII), Wellington-Altus Group Solutions Inc. (WAGS), and Wellington-Altus USA Inc. Wellington-Altus (WA) does not guarantee the accuracy or completeness of the information contained herein, nor does WA assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor..

©2024, Wellington-Altus Private Wealth Inc., Wellington-Altus Private Counsel Inc., Wellington-Altus Insurance Inc., Wellington-Altus Group Solutions Inc., and Wellington-Altus USA Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca