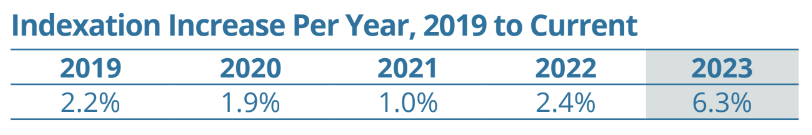

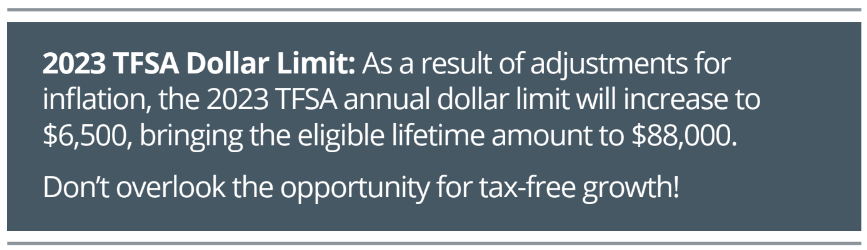

If there is any good news that can come with high inflation rates, it may be the resulting cost-of-living adjustment. Each year, certain personal income tax and benefit amounts are indexed to inflation using consumer price index (CPI) data. With inflation reaching 40-year highs in recent times, the adjustment is one of the largest in many years.

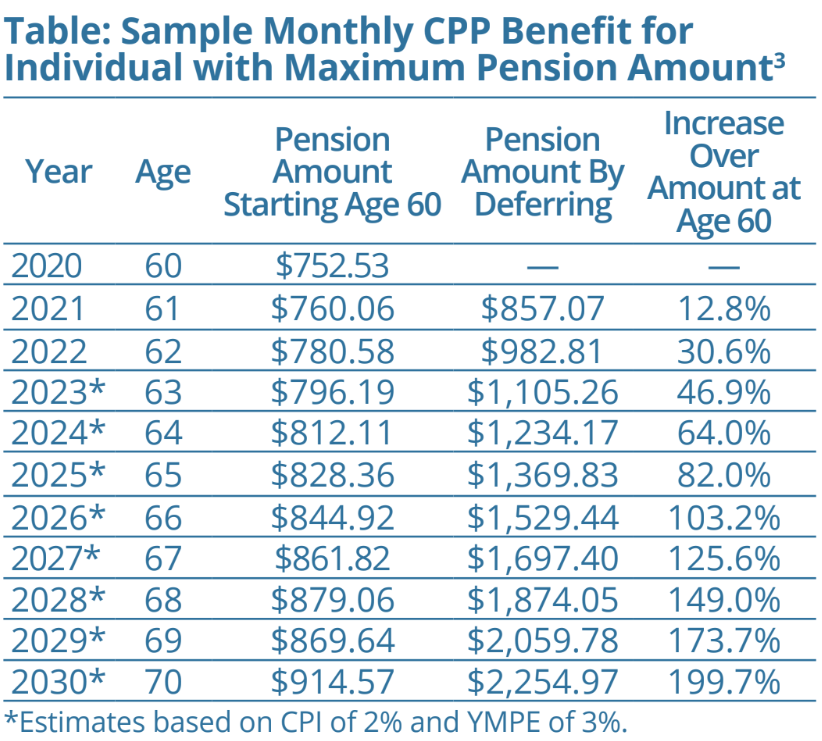

The Impact of Inflation on CPP Benefits

The Timing Decision Can Further Enhance CPP Benefits…

…And the Difference Can Be Significant

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. ©️ 2023, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION