Join the mailing list here

In January, stocks maintained their upward momentum, with many of our holdings again reaching new all-time highs. We remain optimistic about the prevailing positive economic conditions, particularly in the United States, which are bolstering corporate earnings. This optimism fuels our expectation for continued gains in 2024.

This month we wanted to revisit the investment strategy underlying the Growth, American Growth and Small Cap Portfolios, where we hold individual stocks. Next month we’ll detail the Income Portfolio, where we hold exchange-traded funds (ETFs).

In our stock portfolios, our goal is to own shares of growing businesses whose stock prices are trending higher.

Our preferred measure of business performance is Free Cash Flow (FCF). FCF is a financial metric that represents the cash generated by a company’s operations that is available for distribution to its investors and for potential investments in future growth. It is a measure of a company’s ability to generate cash after accounting for necessary capital expenditures required to maintain or expand its operations.

FCF is typically calculated by subtracting Capital Expenditures from Operating Cash Flow, two items found in the Cash Flows section of a company’s Financial Statements. Operating Cash Flow is the cash generated by a company’s normal operating activities. Capital Expenditures is the cash a company spends on its fixed assets, such as property, plant, and equipment.

FCF provides insight into a company’s financial health and its ability to pursue growth opportunities, repay debt, pay dividends, acquire other businesses, or engage in share buybacks. Positive FCF indicates that the company is generating more cash than it is spending on maintaining or expanding its operations, while negative FCF suggests the opposite.

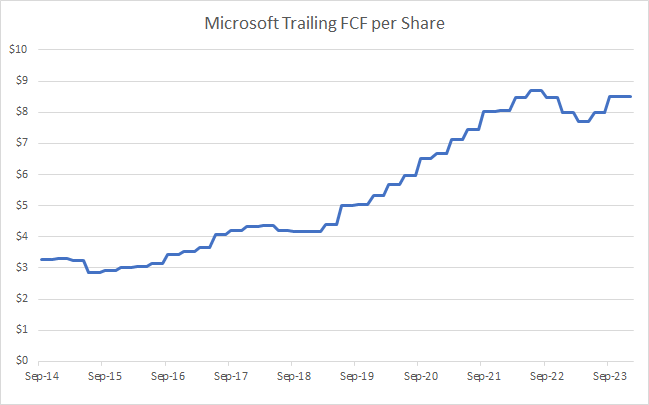

For example, consider Microsoft, a holding in both the Growth and American Growth portfolios. Over the past decade, Microsoft has exhibited significant growth in FCF per share, as illustrated in the chart below. While there is certainly room for deviations over the short-term, the long-term trend consistently points upwards.

In our approach to North American public companies, we narrow down our investment choices to those demonstrating the highest and most consistent rates of FCF growth. This selective process effectively filters out the majority of publicly traded companies, leaving us with only the top ranked prospects based on FCF.

Within this subset of companies, our focus then shifts to identifying attractive entry points for stock purchases. We search for specific patterns in the stock price that have demonstrated a statistical advantage as entry points for high-quality companies in the past. For instance, one pattern involves detecting a shift from negative to positive momentum after a stock has experienced a 20% drop from a previous high.

Upon identifying a stock that meets our criteria, we assess its volatility in comparison to the current portfolio’s volatility. The new stock is added to the portfolio only if it has the potential to reduce the overall portfolio volatility. To maintain the effectiveness of this process, we aim to limit our portfolio to about 15 companies at any given time.

Finally, each position in the portfolio is assigned a price alert level based on the stock’s historic volatility and trading price. If this level is breached, we sell the stock to protect capital and reinvest the proceeds in the next available opportunity that meets our criteria. This disciplined approach ensures that we stay vigilant and responsive to market conditions while aiming for a well-managed, focused, and high-quality portfolio.

Model Portfolio Highlights

Growth Portfolio

In January we took a profit on Element Fleet and a loss on CI Financial. With the proceeds we purchased shares of Google, using the same Canadian-listed CDR structure we used for our Netflix, Apple, Mastercard, and Microsoft positions.

American Growth Portfolio

In January we took profits on Bright Horizons Family Solutions, Broadridge, Intuitive Surgical, Roper and Block. We reinvested the proceeds into Google, Autodesk, Accenture, and Intercontinental Exchange, further upgrading the quality of the portfolio.

Income Portfolio

We made no changes to the holdings in January.

Small Cap Portfolio

We made no changes to the holdings in January.

Across all portfolios we look for mispriced opportunities, considering only those with a significant margin of safety and minimal risk of permanent capital loss. After identifying such opportunities, patience is the most important factor in realizing our expected long term return.

If you have any questions about your portfolio, financial planning or investments please be in touch. If you’d like to add a friend or family to this email list, please let me know. Click to book a meeting: https://calendly.com/bwk-wapw

Thank you.

Yours,

Ben

Ben W. Kizemchuk

Portfolio Manager & Investment Advisor

Wellington-Altus Private Wealth

Office: 416.369.3024

Email: bwk@wellington-altus.ca

Book a meeting

Ben Kizemchuk offers full-service wealth management for high-net-worth Canadians including families, business owners, and successful professionals. Ben and his team provide investment advice, financial planning, tax minimization strategies, and retirement planning.

Performance reporting disclaimer: Performance results reflect the returns of each representative model portfolio. Returns are calculated using each model portfolio’s monthly performance, including changes in securities values, and accrued income (i.e., dividend and interest), against its market value at the closing of the last business day of the previous month. Performance results are expressed in the stated strategy’s base currency and are calculated on a net of fees basis. Individual account performance may materially differ from the representative performance history set out in this document, due to factors such as an account’s size, the length of time the strategy has been held, the timing and amount of deposits and withdrawals, the timing and amount of dividends and other income, and fees and other costs. Investors should seek professional financial advice regarding the appropriateness of investing in any investment strategy or security and no financial decisions should be made solely on the basis of the information provided in this document. This is not an official statement from WAPW. Please refer to your official WAPW statement for your specific performance numbers.

Market Commentary

February 2024 Update

Join the mailing list here

In January, stocks maintained their upward momentum, with many of our holdings again reaching new all-time highs. We remain optimistic about the prevailing positive economic conditions, particularly in the United States, which are bolstering corporate earnings. This optimism fuels our expectation for continued gains in 2024.

This month we wanted to revisit the investment strategy underlying the Growth, American Growth and Small Cap Portfolios, where we hold individual stocks. Next month we’ll detail the Income Portfolio, where we hold exchange-traded funds (ETFs).

In our stock portfolios, our goal is to own shares of growing businesses whose stock prices are trending higher.

Our preferred measure of business performance is Free Cash Flow (FCF). FCF is a financial metric that represents the cash generated by a company’s operations that is available for distribution to its investors and for potential investments in future growth. It is a measure of a company’s ability to generate cash after accounting for necessary capital expenditures required to maintain or expand its operations.

FCF is typically calculated by subtracting Capital Expenditures from Operating Cash Flow, two items found in the Cash Flows section of a company’s Financial Statements. Operating Cash Flow is the cash generated by a company’s normal operating activities. Capital Expenditures is the cash a company spends on its fixed assets, such as property, plant, and equipment.

FCF provides insight into a company’s financial health and its ability to pursue growth opportunities, repay debt, pay dividends, acquire other businesses, or engage in share buybacks. Positive FCF indicates that the company is generating more cash than it is spending on maintaining or expanding its operations, while negative FCF suggests the opposite.

For example, consider Microsoft, a holding in both the Growth and American Growth portfolios. Over the past decade, Microsoft has exhibited significant growth in FCF per share, as illustrated in the chart below. While there is certainly room for deviations over the short-term, the long-term trend consistently points upwards.

In our approach to North American public companies, we narrow down our investment choices to those demonstrating the highest and most consistent rates of FCF growth. This selective process effectively filters out the majority of publicly traded companies, leaving us with only the top ranked prospects based on FCF.

Within this subset of companies, our focus then shifts to identifying attractive entry points for stock purchases. We search for specific patterns in the stock price that have demonstrated a statistical advantage as entry points for high-quality companies in the past. For instance, one pattern involves detecting a shift from negative to positive momentum after a stock has experienced a 20% drop from a previous high.

Upon identifying a stock that meets our criteria, we assess its volatility in comparison to the current portfolio’s volatility. The new stock is added to the portfolio only if it has the potential to reduce the overall portfolio volatility. To maintain the effectiveness of this process, we aim to limit our portfolio to about 15 companies at any given time.

Finally, each position in the portfolio is assigned a price alert level based on the stock’s historic volatility and trading price. If this level is breached, we sell the stock to protect capital and reinvest the proceeds in the next available opportunity that meets our criteria. This disciplined approach ensures that we stay vigilant and responsive to market conditions while aiming for a well-managed, focused, and high-quality portfolio.

Model Portfolio Highlights

Growth Portfolio

In January we took a profit on Element Fleet and a loss on CI Financial. With the proceeds we purchased shares of Google, using the same Canadian-listed CDR structure we used for our Netflix, Apple, Mastercard, and Microsoft positions.

American Growth Portfolio

In January we took profits on Bright Horizons Family Solutions, Broadridge, Intuitive Surgical, Roper and Block. We reinvested the proceeds into Google, Autodesk, Accenture, and Intercontinental Exchange, further upgrading the quality of the portfolio.

Income Portfolio

We made no changes to the holdings in January.

Small Cap Portfolio

We made no changes to the holdings in January.

Across all portfolios we look for mispriced opportunities, considering only those with a significant margin of safety and minimal risk of permanent capital loss. After identifying such opportunities, patience is the most important factor in realizing our expected long term return.

If you have any questions about your portfolio, financial planning or investments please be in touch. If you’d like to add a friend or family to this email list, please let me know. Click to book a meeting: https://calendly.com/bwk-wapw

Thank you.

Yours,

Ben

Ben W. Kizemchuk

Portfolio Manager & Investment Advisor

Wellington-Altus Private Wealth

Office: 416.369.3024

Email: bwk@wellington-altus.ca

Book a meeting

Ben Kizemchuk offers full-service wealth management for high-net-worth Canadians including families, business owners, and successful professionals. Ben and his team provide investment advice, financial planning, tax minimization strategies, and retirement planning.

Performance reporting disclaimer: Performance results reflect the returns of each representative model portfolio. Returns are calculated using each model portfolio’s monthly performance, including changes in securities values, and accrued income (i.e., dividend and interest), against its market value at the closing of the last business day of the previous month. Performance results are expressed in the stated strategy’s base currency and are calculated on a net of fees basis. Individual account performance may materially differ from the representative performance history set out in this document, due to factors such as an account’s size, the length of time the strategy has been held, the timing and amount of deposits and withdrawals, the timing and amount of dividends and other income, and fees and other costs. Investors should seek professional financial advice regarding the appropriateness of investing in any investment strategy or security and no financial decisions should be made solely on the basis of the information provided in this document. This is not an official statement from WAPW. Please refer to your official WAPW statement for your specific performance numbers.

Recent Posts

July 2025 Update

If you’d like to add friends or family to this email list, please sign up

June 2025 Update

If you’d like to add friends or family to this email list, please sign up

May 2025 Update

If you’d like to add friends or family to this email list, please sign up

April 2025 Update

If you’d like to add friends or family to this email list, please sign up

March 2025 Update

If you’d like to add friends or family to this email list, please sign up

The opinions contained herein are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Wellington-Altus Private Wealth. Assumptions, opinions and information constitute the author’s judgement as of the date this material and subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. All third party products and services referred to or advertised in this presentation are sold by the company or organization named. While these products or services may serve as valuable aids to the independent investor, WAPW does not specifically endorse any of these products or services. The third party products and services referred to, or advertised in this presentation, are available as a convenience to its customers only, and WAPW is not liable for any claims, losses or damages however arising out of any purchase or use of third party products or services. All insurance products and services are offered by life licensed advisors of Wellington-Altus. Wellington-Altus Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. All trademarks are the property of their respective owners.