While many of us are unhappy about the high taxes we pay, one way to ease the burden is by fully using tax-advantaged accounts. Yet RRSP participation rates have declined over the past two decades, from 29.1 percent of taxpayers in 2000 to just 21.7 percent in 2022. The good news is that high-income earners are more likely to contribute. In 2023, 66 percent of taxpayers earning between $200,000 and $500,000 made RRSP contributions. But younger Canadians are falling short. The introduction of the Tax-Free Savings Account (TFSA) in 2009 may be part of the reason, but persistent misconceptions about the RRSP also play a role. Let’s address two common myths.

Myth 1: It’s better to invest in a TFSA than an RRSP.

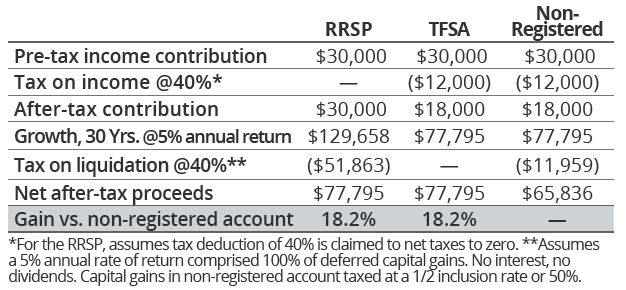

In fact, the RRSP generally yields a greater benefit if you expect a lower tax rate in retirement. In practice, many contribute to their RRSP during higher-income working years and withdraw when income is lower in retirement, leading to an advantage for the RRSP. Of course, there are situations when the TFSA is a better choice, such as if you have a higher tax rate at withdrawal or face recovery tax for income-tested benefits like Old Age Security.

Myth 2: RRSPs aren’t worth it because withdrawals are fully taxed, whereas in non-registered accounts, only income and gains are taxed.

A common complaint is that RRSP withdrawals are fully taxed at marginal rates, whereas non-registered accounts only tax income and gains, with favourable tax treatment for dividends and capital gains. While it’s true that RRSP withdrawals, usually from a Registered Retirement Income Fund (RRIF), are taxed as income, what’s often forgotten is the initial tax deduction at contribution. For example, a $30,000 RRSP contribution at a 40 percent marginal tax rate is equivalent to an after-tax contribution of $18,000. If your tax rate is the same at the time of contribution and withdrawal, you effectively receive a tax-free rate of return on your net after-tax RRSP contribution.

In many cases, even if your tax rate is higher at the time of withdrawal, you may still be better off compared to a non-registered account due to the effect of tax-free compounding over long time periods.

For the RRSP, this illustration assumes a tax deduction of 40 percent is claimed to net taxes to zero. It also assumes a 5 percent annual rate of return comprised entirely of deferred capital gains. No interest or dividends are assumed. Capital gains in the non-registered account are taxed at a 50 percent inclusion rate.

While the fair market value of the RRSP or RRIF at death is generally included in the terminal tax return and taxed at marginal rates, there may be ways to mitigate the potential tax liability. This includes a tax-deferred rollover to a spouse or financially dependent child or grandchild. Another way to manage the potential tax bill is to engage in a “meltdown strategy,” making withdrawals earlier when your tax rate is lower than you expect in the future or at the year of death.

2026 Reminders for Tax-Advantaged Accounts

- The deadline for RRSP contributions for the 2025 tax year is Monday, March 2, 2026. Contributions are limited to 18 percent of the previous year’s earned income, to a maximum of $32,490 for 2025.

- The 2026 TFSA dollar limit is $7,000, making the eligible lifetime contribution room $109,000, plus any unused contribution room carried forward from prior years, less any pension adjustments.