Plan – Build – Evolve

But always evidence-based, data-driven, and focused on you.

STEP 1

Create Your Plan

At Mahrt Investment Group, we place great emphasis on collaboration, working closely with our clients to gain a deep understanding of their personal, family, and business goals. Our meticulous planning process involves aligning these aspirations with tailored strategies, uncovering untapped potential, and driving towards the best possible outcomes.

This comprehensive plan not only provides a sense of comfort and security but also serves as a guiding framework for our investment decisions. With your goals at the forefront, we navigate the investment landscape to effectively grow and safeguard your wealth.

The wealth planning process typically involves the following steps:

1

Define your Goals

Define your Goals

and establish timelines.

6

Monitoring & Review

Monitoring & Review

2

Gather your Data

Gather your Data

5

Implement your Plan

Implement your Plan

3

Analyze your Data

Analyze your Data

4

Develop your Plan

Develop your Plan

- Hover over each step for detailed information

STEP 2

Build Your Portfolio

In our Plan-Build-Evolve framework, the wealth planning process plays a pivotal role in building your investment portfolio. It achieves this by addressing two key factors:

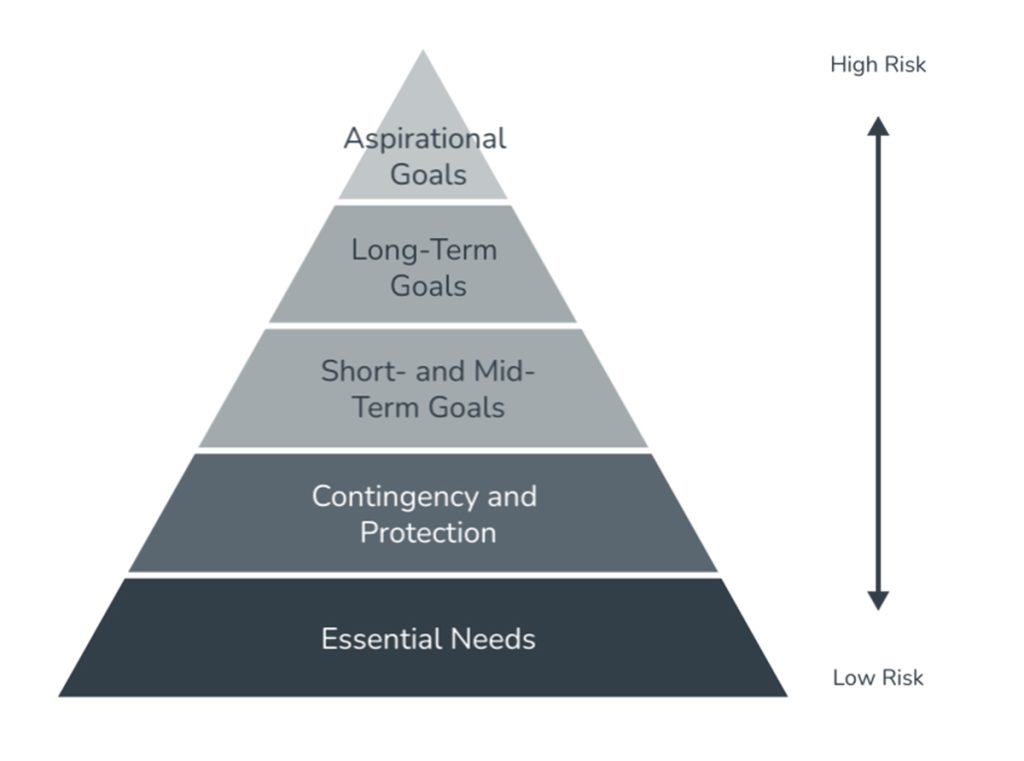

1 | Identifying Your Goals: Our wealth planning process delves deep into understanding the goals you aspire to achieve. By gaining clarity on your objectives, we create a strong foundation for constructing an investment portfolio that is tailored to your unique aspirations.

2 | Assessing Your Risk Tolerance: We recognize the importance of your risk tolerance in investment decision-making. Through our wealth planning process, we gain insights into your risk preferences, enabling us to align your portfolio with an appropriate level of risk that suits your comfort and long-term objectives.

At Mahrt Investment Group, we utilize modern portfolio theory as the cornerstone of our portfolio construction approach. This approach blends a goals-based methodology with mean-variance optimization techniques. By combining these elements, we strive to provide you with an investment portfolio that delivers optimal risk-adjusted returns while being explicitly tailored to your specific goals.

Goals-based

Approach

A goals-based methodology places your unique objectives at the forefront of your portfolio. We believe that your financial journey should be centered around what matters most to you – your goals and aspirations.

With our goals-based methodology, you can expect a tailored investment strategy that takes into account your unique time horizon, risk tolerance, and liquidity needs. We emphasize regular communication and monitoring to ensure that your portfolio remains aligned with your evolving goals and priorities.

Mean-Variance

Optimization

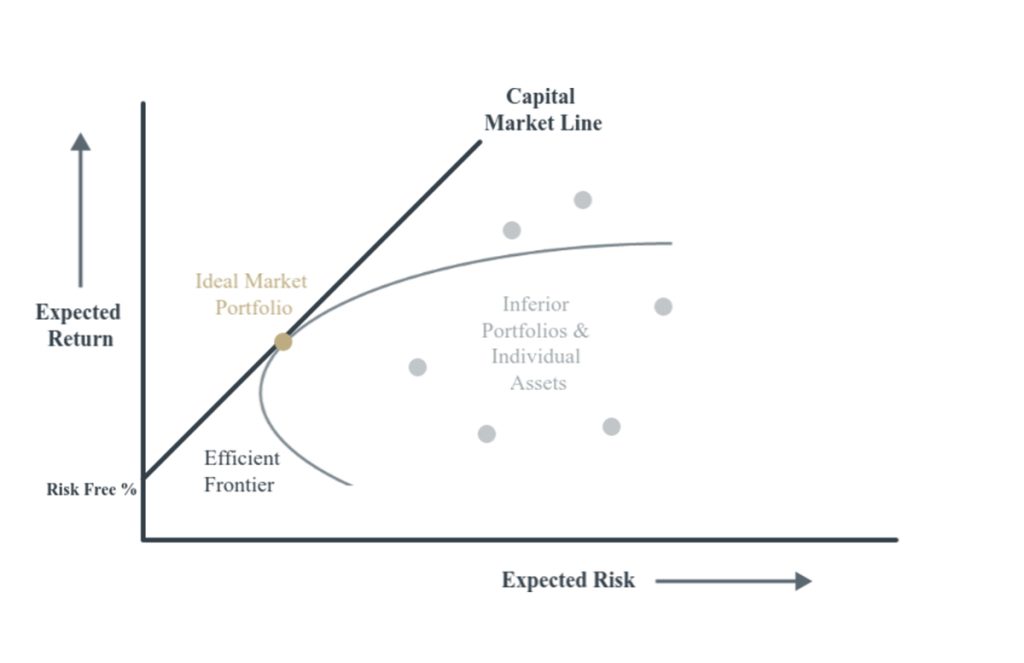

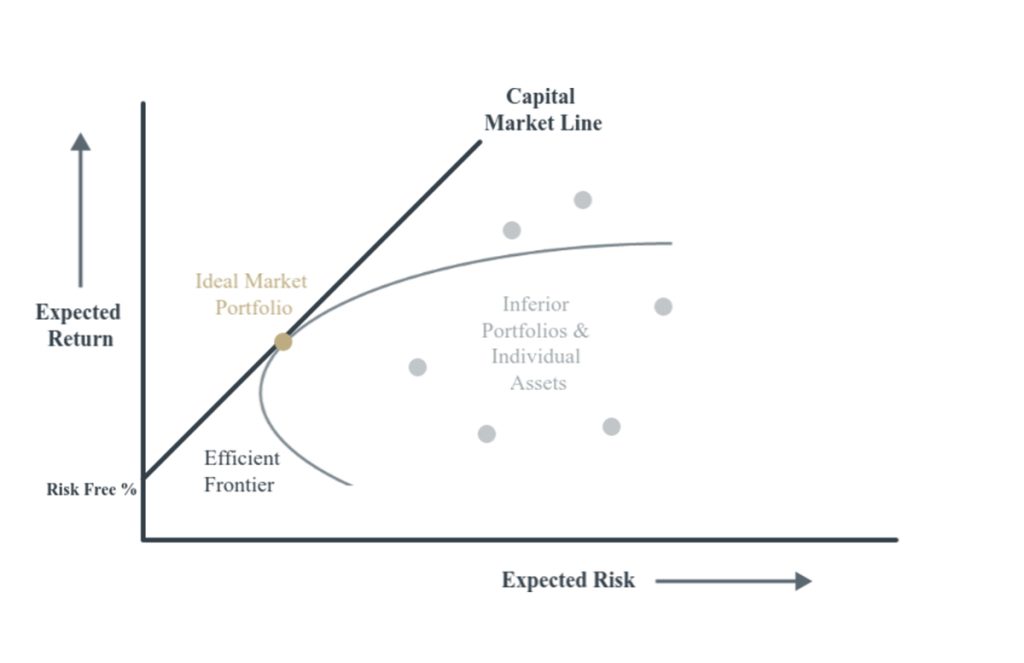

Mean-variance optimization is a technique used to construct investment portfolios with the aim of achieving the maximum return for each level of risk. We utilize this strategy as a starting point to develop our overall asset allocation but maintain flexibility and discipline by establishing upper and lower limits to the allocation percentage of each asset class. This allows us to identify potential opportunities for outperformance by selectively overweighting asset classes or sectors based on market conditions.

The MVO methodology relies on two key components: “mean” refers to the expected returns of different asset classes or investments, while “variance” measures the dispersion of these returns, reflecting their volatility or risk. By analyzing historical data and market trends, we identify the potential risk and return characteristics of various assets to determine the ideal asset allocation that maximizes returns for a given level of risk or minimizes risk for a desired level of returns. The ideal market portfolio is the portfolio which offers the highest return for a given level of risk.

The synergy between goals-based methodology and mean-variance optimization arises from their complementary nature. The goals-based methodology guides the investment strategy by setting the direction and purpose, ensuring that the portfolio is aligned with your specific objectives. Mean-variance optimization, on the other hand, provides a data-driven approach to asset allocation, enhancing diversification and risk management within the framework of your goals.

By integrating these two elements, we create portfolios that are not only well-structured and optimized but also purposeful and aligned with your aspirations.

STEP 3

Evolve Your Goals

Your life will evolve – so should your goals. We recognize that your wealth plan and portfolio construction are not one-time events but an ongoing process of adaptation and growth.

As you achieve success and experience new milestones, your goals may evolve, becoming more ambitious and complex. Our strategies are designed to support you through every stage of your financial journey. We understand the importance of staying agile and responsive to your changing needs.