It’s been a wild ride this year – and we’re only halfway through.

If April’s market movements felt unsettling, you weren’t mistaken. While volatility is a natural part of equity markets, the magnitude of April’s decline was unusual. A two-day drop of more than 10 percent in the S&P 500, seen over April 3 and 4, is rare and has occurred only four times since 1980: on Black Monday in 1987, twice during the 2008 Global Financial Crisis (GFC) and in the early days of the 2020 pandemic.

It’s worth repeating: while it might feel tempting to exit the markets during turbulent periods, doing so can come at a cost. One reason is that some of the best-performing days often follow the worst. Exiting the markets after a decline may mean missing out on these gains, which can then make re-entering even more difficult. We saw this play out in the spring when April’s sharp drop was followed by a swift recovery in May.

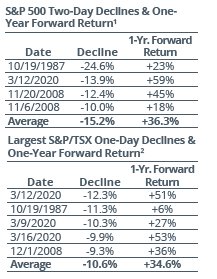

While markets don’t always rebound immediately, time has a powerful way of smoothing even the sharpest declines. In the year following the worst two-day drops, the S&P 500 posted an average gain of 36.3 percent. Similarly, after the largest one-day declines in the S&P/TSX, the average one-year forward return was +34.6 percent.

One of the benefits of navigating through challenging markets like the GFC and the pandemic is that we have accumulated invaluable experience. Time and again, we are reminded that you can’t keep the markets—or the economy— down for long. Even the darkest nights eventually give way to dawn—and patience remains one of an investor’s great virtues.

- BMO Capital Markets, U.S. Strategy Report, April 6, 2025. 2. BMO Capital Markets, Canadian Strategy Report, April 6, 2025. Calculations based on BMO Capital Markets Investment Strategy Group calculations, Factset, Compustat, IBES.