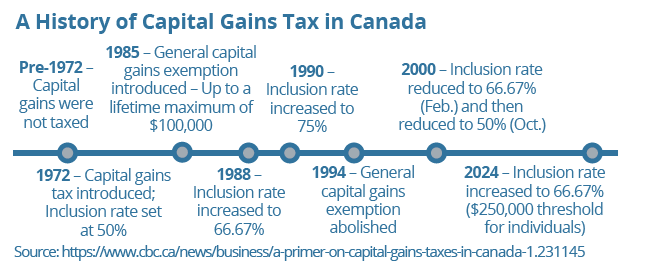

The proposed* increases to the capital gains inclusion rate have prompted some investors to ask the tax-planning question: To defer, or not to defer? Tax deferral is commonly viewed as a way for investors to create greater future returns, since funds that might otherwise go to paying tax can remain invested for longer-term growth. Yet, with increases to the capital gains inclusion rate, individuals may be evaluating the possibility of deferred taxation at higher rates against accelerated taxation at a lower rate.

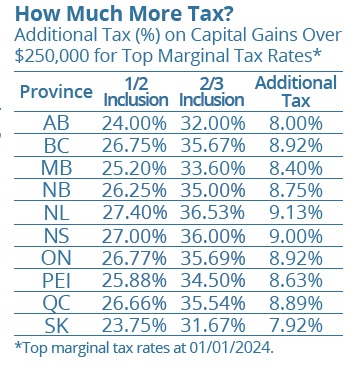

As of June 25, 2024, the capital gains inclusion rate increases from 1/2 to 2/3 (50.00 to 66.67 percent) for corporations and trusts, and for individuals on the portion of realized gains in the year that exceeds $250,000.

As one scenario, for a realized gain of $100,000 at a marginal tax rate of 48 percent, an investor would save $8,000 in tax by realizing a gain at the 1/2 inclusion rate, rather than realizing the game at the 2/3 inclusion rate. However, this comes at the cost of “pre-paying” $24,000 in capital gains taxes. If this amount was instead invested in a portfolio returning 5 percent per year, it would take 9 years of tax-deferred growth at the higher 2/3 inclusion rate to beat the $8,000 in tax savings.

Here are some considerations for individual investors:

Spread gains over multiple years – Where possible, consider realizing gains over multiple years to make use of the lower inclusion rate (under $250,000) compared to a larger realized gain in a single year.

Harvest gains – Deliberately selling and rebuying stocks to trigger a capital gain may be a way to reset book value over time. This strategy is often considered for years when an investor is in a lower tax bracket, but may be used to capitalize on the lower inclusion rate each year. The decision may depend on a variety of factors such as time horizon, current/future tax rates and potential growth rate of investments.

Donate securities – Assuming the new rules apply to the deemed disposition of assets at death, if you are considering donations to support a legacy, the use of publicly listed securities may be beneficial.

Any accrued capital gain is excluded from taxable income and a donation receipt equal to the value of the donated securities will be received. Note: For large donations other than in the year of death, the Alternative Minimum Tax may apply.

Business owners – Evaluate whether certain assets should be held in the corporation or owned personally. For corporations, there is no $240,000 threshold and 2/3 of realized gains are taxable.

Plan ahead – For many, the increased inclusion rate will mean higher future tax liabilities. Planning ahead is important. The use of insurance or other planning techniques may help to cover a higher tax bill, such as on the transfer of a family property or on death. For business owners, the use of corporate-owned insurance or an individual pension plan may support a business’ tax strategy. Forward planning can also help access available exemptions, such as the lifetime capital gains exemption. As tax planning remains an important part of wealth planning, seek advice.

* Please note: Legislation has not been enacted at the time of writing.