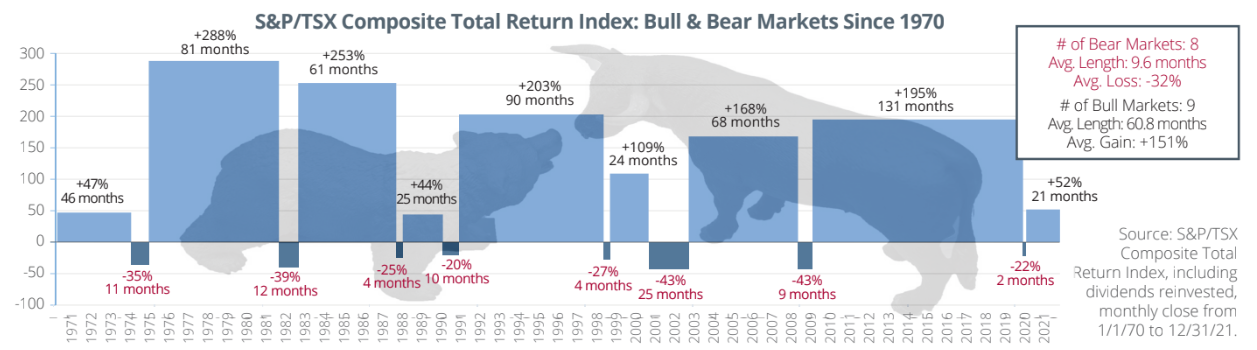

1. Bear markets are much shorter than bull markets.

2. Bear markets: often the good comes with the bad.

A recent analysis done on the S&P 500 Index showed that the biggest up and down days often occur during down market times.¹ Since 1928, there have been 350 trading days when the index was down three percent or worse. There have also been 290 days when it was up three percent or more in a single day. However, more than 90 percent of both volatile days have taken place during a correction of 10 percent or worse. More than 80 percent of those days have taken place during a bear market drawdown of 20 percent or worse.

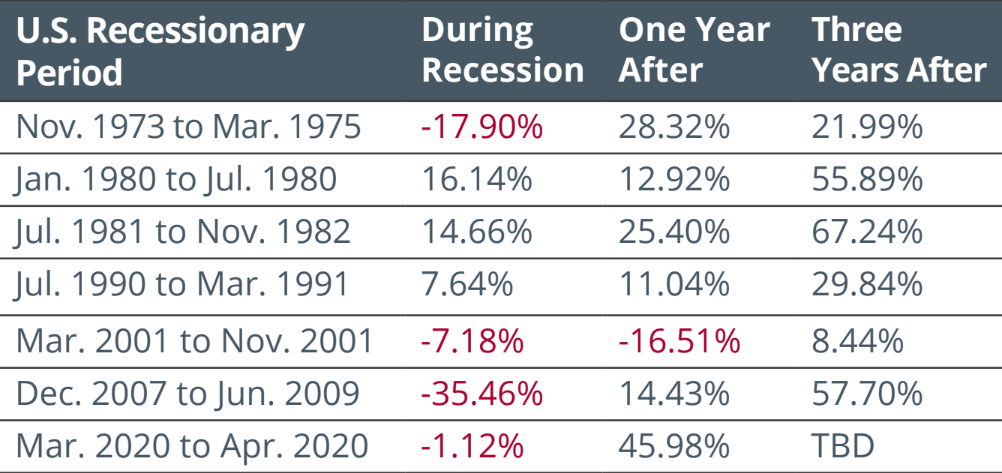

3. What comes after a bear market? It isn’t uncommon to see significant gains.

Here are the five worst bear markets for the S&P 500 Index since 1970 (chart), along with their ensuing one, three and five-year forward returns. Even though it takes a 100 percent gain to make up for a 50 percent loss, the gains were enough to produce overall double-digit returns.S&P 500 Index Returns After a Bear Market

Continue Looking Forward

While periods of market declines never feel good for investors, portfolios have been positioned with the expectation that the equity markets will experience both bull and bear market times — this is a normal part of the investing journey. Continue to look forward to better days ahead.The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. ©️ 2023, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION