“Never bet against America.”

– Warren Buffett

Ray Kurzweil, computer scientist and futurist, once said, “The past is over; the present is fleeting; we live in the future.” This sentiment echoes through our current moment as we stand on the threshold of an era defined by technological advancement, navigating a myriad of complex challenges and opportunities.

As Mark Twain is said to have pointed out, “History doesn’t repeat itself, but it often rhymes.” In today’s world, where social media engagement often fosters sensationalism, echoes of the past can be heard. Some argue that the COVID-19 shutdown and subsequent reopening marked the most pivotal economic event in recent history. My perspective differs. While the pandemic’s gravity is undeniable, assuming it will have lasting structural implications seems imprudent. As we venture into 2024, investors should prepare for 150 basis points (bps) of rate cuts, a return to the pre-pandemic deflationary structural forces—such as significant debt levels—fluctuating globalization, demographic influences, and accelerating digitization.

The investment landscape is set to shift significantly. The next two years will usher in a new phase. Central banks will focus on supporting economic growth, reshaping market expectations. We expect the effects of extreme fiscal policy to wane. Inflation fears will give way to concerns about economic growth and deflation, triggering interest rate reductions.

Investors need to allocate capital to sectors and industries likely to outperform in this environment. A technology wave not seen since the mid 1990s—with the start of the internet and the mass adoption of the personal computer—is about to transform our global economy. Unlike the 1990s, however, innovation can be found in every sector. Companies that embrace digitization, irrespective of industry and geography, will be the ones that gain market share in the coming slow growth environment.

While many continue to put forth the thesis that we are witnessing the end of the American Empire, I disagree. The unique American spirit—its readiness to embrace change, risk, and reinvention—is deeply rooted in the historical narrative known as the American Jeremiad. This discourse of decline and renewal, which emerged in early American Puritan society, has spurred a call to action. It has instilled in the American spirit a readiness to self-criticize, adapt, evolve, and strive for a better future.

This spirit is embodied in the audacious companies listed on the NASDAQ-100 Index, guiding the nation’s technological and economic evolution. As we enter an era of exponential technological growth, we find compelling reasons for preferring the U.S. over Canada, and the NASDAQ-100 over the S&P/TSX Composite Index. Simply put, productivity growth in the U.S. is significantly stronger than in Canada. We align ourselves not just with a market or an economy, but with a profound narrative of progress, a relentless drive for self-improvement, and a strong belief in the power of innovation to shape the future. As Warren Buffet says, “Never bet against America.”

A Look Back at 2023

The U.S. economy is heading into a transitional phase, where the sugar high of fiscal policy wears off, and an episode of secular stagnation takes centre stage. Nonetheless, my prediction for the U.S. stands and will indicate the continued resilience and strength of its economy from the private sector. Furthermore, core inflation has seen a significant decline. The normalization of labour markets has continued, as have the significant disinflationary forces in the pipeline for 2024. As we move forward, the outlook remains promising, with limited recession risk in the U.S. The same cannot be said for Canada.

In 2024, based on the earlier call for a soft landing and the Federal Reserve’s pause in hikes, interest rates are positioned to potentially return to pre-pandemic levels or even preGlobal Financial Crisis (GFC) levels. Currently, no one really knows. This transition period will most likely follow a volatile path over the next two years, presenting investors with the potential for better forward returns on fixed-income assets. Moreover, the U.S. growth story remains robust on a relative basis, with innovation leading the way. As a result, the U.S. dollar is expected to remain strong, providing stability and advantages for U.S. markets.

Considering my earlier predictions from 2022 and current outlook for the year ahead, it becomes evident that the U.S. economy and investment landscape are well-positioned for success. Therefore, investors should look to capitalize on the presented opportunities. While the global market outlook for 2024 is complex, my baseline forecast is that returns in credit, equities, and commodities will outperform cash. This suggests a consideration for a balanced portfolio asset mix, with an emphasis on the favourable outlook in U.S. markets, secular growth, and duration.

What Awaits After the Sugar High is Over?

Through 2024 and into 2025, economic growth is expected to be below trend, with disinflation gaining momentum. Central Banks will cut interest rates to support economic growth. The dangerous cocktail of excessive government debt and high interest rates points to a period of austerity. Investors should prepare for another episode of secular stagnation and deflation. Declining interest rates support allocations to bonds, while slowing economic growth suggests favouring growth over value.

After the sugar high of extreme fiscal policy wears off, we will face a technology wave similar to the 1920s and the 1990s. In this era, digitization and demographics will shape social and investment norms, forcing every company to embrace technology. It’s essential that investors approach the future with curiosity, adaptability, and a willingness to ride the upcoming wave of transformation.

Demographics is Destiny

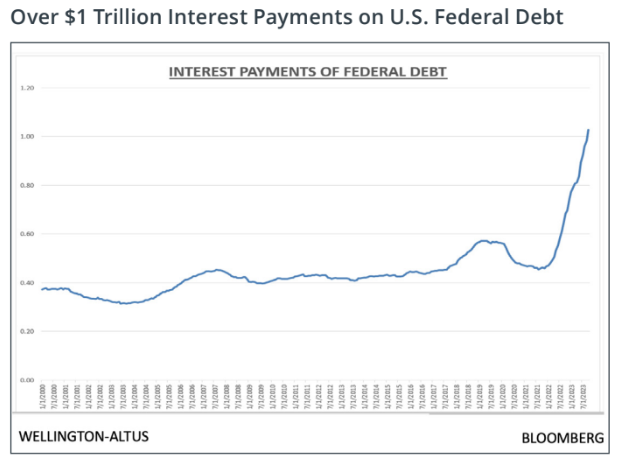

However, there is a risk to our forecast, which lies in unchecked fiscal policy. Interest payments on U.S. government debt are on track to surpass $1 trillion annually, and there is a lack of acknowledgment among younger generations that permanent inflation is a direct consequence of fiscal policy. If deficits continue to grow and government spending resembles that of wartime, it will lead to higher inflation and interest rates. The current concerns of housing affordability and the cost of living have become paramount. In my opinion, based on these factors, millennials are likely to follow in the footsteps of baby boomers and prioritize

fiscal responsibility going forward.

The End of the Fed “Put”

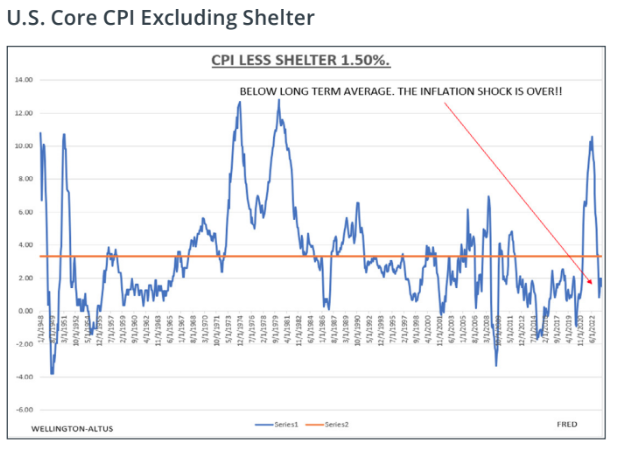

As we emerge from the COVID-19 pandemic, we’re left to wonder what lies ahead for interest rates. If one removes shelter—a lagging variable—the Bank of Canada’s real overnight rate now surpasses three per cent, and inflation is declining, threatening to tighten financial conditions in an already fragile economy. Applying the same lens to the U.S. Consumer Price Index (CPI) calculation, inflation is already close to the Federal Reserve’s two per cent target. Moreover, according to the U.S. Bureau of Labor Statistics, 70 per cent of the total increase in Core CPI on a year-over-year basis is attributed to the shelter component. The challenge for the Federal Reserve is to maintain price stability and full employment, necessitating rate cuts into 2025. Contradicting the narrative of “higher for longer,” significant interest rate reductions are expected to begin in 2024, indicating a return to a bond bull market. While the end of the “Fed put” attracts views for pundits on Fintwit, the fact remains that central bankers are committed to achieving price stability and a robust jobs market.

Risk is Perverse

American financier Michael Milken observed in the 1970s that promising companies were undervalued while aging businesses received favourable ratings. The fear of the unknown was also apparent in the 1990s when the internet emerged. Despite technology’s transformative impact, many dismissed it as a scam. This bias against innovative companies prevails today, shaping our perception even though technology has grown exponentially. In an evolving world, we need to understand subconscious biases can distort our risk perception. As Ray Kurzweil suggests, “The past is over; the present is fleeting; we live in the future,” and yet too many investors get comfort from investing in the past.

Challenging these biases is critical, as well as understanding that innovative companies aren’t necessarily riskier but often offer the potential for significant growth opportunities. To navigate investment complexities, investors need to focus on markets and sectors that embrace innovation and show growth potential. For instance, favouring the U.S. over Canada suggests recognizing the U.S. market’s robust technologically innovative ecosystem, entrepreneurial spirit, and capital access. This preference acknowledges the potential for exponential growth and American companies’ adaptability, along with a diversified economy. The number of companies evolving are such that one can build a diversified portfolio encompassing all aspects of the digital global economy.

What Should Investors Do?

The U.S., represented by the NASDAQ-100, offers an innovative, dynamic environment conducive to harnessing exponential technological growth, outshining the more conservative Canadian market and the TSX. By opting for the U.S. and NASDAQ-100, investors align themselves with a powerful ethos of progress, relentless self-improvement, and bold innovation. While there are innovative and evolving firms in Canada, investors favouring home companies should focus on stock selection.

Summary of 2024 Forecast

2. Below trend economic growth, rapidly declining inflation, interest rate cuts, and a stop to quantitative tightening.

3. Long duration assets will outperform. Cash as an asset class will underperform.

4. Investor fears will shift from inflation to growth and deflation as we head back to secular stagnation.

5. Forecast 150 bps of rate cuts with a bull market for bonds, banks and home builders.

6. By the end of 2024, the S&P 500 Index will hit the target of 5400.

8. Uranium bull market will continue, along with a run in gold as the Federal Reserve cuts interest rates.

9. Oil trades between US$70 and US$90.

10. Bitcoin bull run will last until late in the third quarter of 2025.

In conclusion, my 2024 forecast signals significant shifts in the economic landscape. As we navigate these changes, investors should remember that subconscious biases often skew risk perceptions. By challenging these biases, we can recognize and capitalize on the potential of innovative companies. Furthermore, demographics will continue to play a significant role in shaping social and investment norms.

In the face of unprecedented challenges, the resilience and adaptability of economies and markets will be tested. However, with careful analysis and innovative thinking, we can navigate these uncharted waters with confidence. As we look ahead to 2024 and beyond, one thing remains certain— given the impressive economic progress in the U.S. since the Second World War, a simple conclusion emerges— “Never bet against America.”

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable.

The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

©️ 2023, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSIO