Need some good news? Things may be better than they seem.

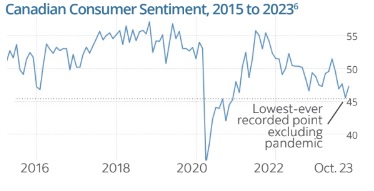

Understandably, consumer sentiment has lingered at low levels. We’ve been through a lot lately. We’ve persevered through a pandemic, only to face new challenges on the other side, many of which have come about quickly: a substantially higher cost of living, higher interest rates and ongoing global conflict, to name a few.

Yet, according to a recent article in the The Economist, our collective feeling does not accurately reflect actual economic data.1 Since the pandemic, there’s been a growing divergence in sentiment and economic performance.

Indeed, the significant strides we’ve achieved during this economic cycle shouldn’t be overlooked. In Q3, U.S. GDP was reported at 4.9 percent — the highest economic growth since 2014, after adjusting for the pandemic.2

While Canada has been challenged by sluggish growth, we shouldn’t forget this was the central banks’ intention in raising rates to curb inflation. Over the past two years, economic resilience has surpassed expectations, partly due to low unemployment rates. Canada’s fell to its lowest level on record in June/July 2022, at 4.9 percent, and continues to remain at relatively low levels.3 The latest data shows that Canadian household net worth increased for the third consecutive quarter, by 3.4 percent to reach $15,704 billion in Q1 2023.4 In Q2, U.S. households held the highest levels of net worth ever recorded.5 Households have never been wealthier. The year that has passed serves as a reminder that things can often unfold much differently than predicted. Despite the many challenges, both economies and households have remained comparatively resilient.

This isn’t to suggest there aren’t challenges ahead. However, reflecting on the positive economic outcomes over 2023, there may be a lesson. Don’t lose sight of the economic and wealth-building progress that can be achieved even during seemingly challenging times.