It has been said that “if you are what you do, when you don’t … you aren’t.” As you think ahead, have you contemplated a plan for what you will do in retirement?

Many of us plan by working hard, saving consistently and investing for the future to ensure a financially secure retirement. As stewards of your wealth, we take this role seriously by helping to support clients in this regard. However, there is often less focus given to planning for what we will do with our new-found time once we achieve retirement. And, with increasing longevity, consider that this may end up being a lengthy portion of life — for some of us, one that could last for decades.

A surprisingly high number of  retirees struggle with the transition. Some fail to recognize the extent to which their careers provided a sense of identity or self-worth. Upon retirement, the oft-overlooked benefits of the workplace are no longer there: daily routine, work interactions, social events, leadership status or a professional identity built up over time. As well, many find it difficult to adapt to new circumstances, such as changes in relationships with spouses or family members. After all, spending more time at home, and in a non-work capacity, can sometimes reshape the dynamics.

retirees struggle with the transition. Some fail to recognize the extent to which their careers provided a sense of identity or self-worth. Upon retirement, the oft-overlooked benefits of the workplace are no longer there: daily routine, work interactions, social events, leadership status or a professional identity built up over time. As well, many find it difficult to adapt to new circumstances, such as changes in relationships with spouses or family members. After all, spending more time at home, and in a non-work capacity, can sometimes reshape the dynamics.

Planning for the “What” in Retirement

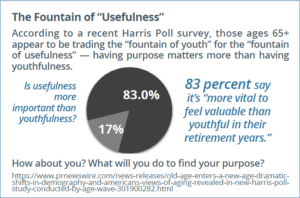

Without a doubt, growing older comes with a host of new challenges — changes to our health, confronting loss and letting things go, to name a few. Yet, it may also not be that bad — many of us are given the newly found freedom of time. And, studies continue to suggest that one of the keys to living well as we age may be found by finding purpose. Those who focus on retirement coaching often point to the Japanese concept of “ikigai” — loosely translated as a reason to live — suggesting that this focus can help to make retirement more fulfilling or meaningful.

Does finding purpose lead to better outcomes? Studies in Japan have shown that ikigai can positively impact health, happiness and productivity, helping individuals cope with stress and even promoting.

greater longevity. Those who considered themselves as having purpose were shown to have lower mortality rates and greater lifespans. Researchers who study longevity often point to the “Blue Zones” — five areas in the world where people live some of the longest lives. One of these zones is Okinawa, Japan, where it has been suggested that some of the keys to greater longevity are a strong dedication to community and a collective sense of purpose.

Closer to home, a 2021 study of around 13,000 participants over age 50 associated a stronger life purpose with healthier lifestyle behaviors, slower rates of progression to chronic illness and greater longevity. Other studies suggest a similar outcome: purposeful living may have positive health benefits and is, indeed, associated with decreased mortality.

Of course, the notion of finding “purpose” can mean different things to different people. However, with the luxury of time, retirement offers a unique opportunity for personal growth and exploration. This may include discovering new hobbies, pursuing higher education, continuing to work in a different capacity, volunteering for a worthy cause, becoming a mentor, building new relationships or engaging in more altruistic acts.

What Is It That You Will Do Once You Leave Work Behind?

As advisors, we are here to help you plan for your financial future to allow you to pursue whatever you choose. However, giving forethought to how you will spend this time is equally important. As one retirement coach reminds us: “You can retire from your career, but you can’t ever retire from life.”

1. https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-oneseniors-take-on-how-to-avoid-spinning-out-in-retirement/; 2. https://fortune.com/well/2023/07/28/

living-well-after-retirement-finding-purpose/; 3. https://www.marketwatch.com/story/why-thisjapanese-idea-can-lead-to-a-more-fulfilling-retirement-11672779167; https://www.weforum.org/

agenda/2017/08/is-this-japanese-concept-the-secret-to-a-long-life/; 4. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8814687/; 5. https://pubmed.ncbi.nlm.nih.gov/19539820/; 6. https://www.bbc.

com/travel/article/20201126-why-so-many-japanese-live-to-100; 7. https://journals.sagepub.com/doi/abs/10.1177/07334648211027691; 8.https://jamanetwork.com/journals/jamanetworkopen/

fullarticle/2734064; 9. https://www.cnbc.com/2022/06/15/67-year-old-who-unretired-at-62-shares-thebiggest-retirement-challenge-that-no-one-talks-about.html