To Defer or Not to Defer: Realizing Capital Gains

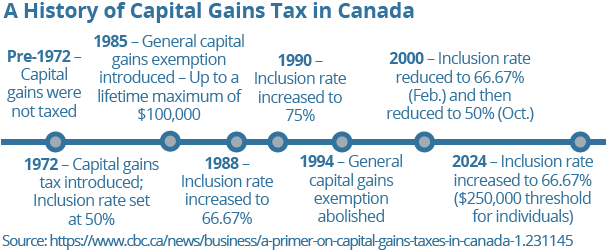

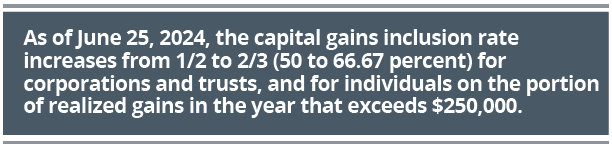

The proposed* increases to the capital gains inclusion rate have prompted some investors to ask the tax-planning question: To defer, or not to defer? Tax deferral is commonly viewed as a way for investors to create greater future returns, since funds that might otherwise go to paying tax can remain invested for longer-term growth. Yet, with increases to the capital gains inclusion rate, individuals may be evaluating the possibility of deferred taxation at higher rates against accelerated taxation at a lower rate.

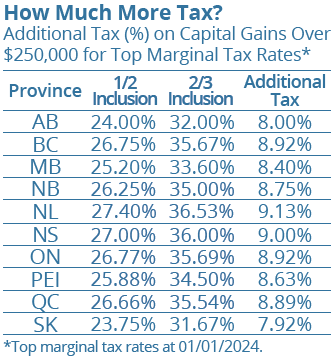

As one scenario, for a realized gain of $100,000 at a marginal Tax rate of 48 percent, an investor would save $8,000 in tax by realizing a gain at the 1/2 inclusion rate, rather than realizing the gain at the 2/3 inclusion rate. However, this comes at the cost of “pre-paying” $24,000 in capital gains taxes. If this amount was instead invested in a portfolio returning 5 percent per year, it would take 9 years of tax-deferred growth at the higher 2/3 inclusion rate to beat the $8,000 in tax savings. Here are some considerations for individual investors:

Spread gains over multiple years — Where possible, consider realizing gains over multiple years to make use of the lower inclusion rate (under $250,000) compared to a larger realized gain in a single year.

Harvest gains — Deliberately selling and rebuying stocks to trigger a capital gain may be a way to reset book value over time. This strategy is often considered for years when an investor is in a lower tax bracket, but may be used to capitalize on the lower inclusion rate each year. The decision may depend on a variety of factors such as time horizon, current/future tax rates and potential growth rate of investments.

Donate securities — Assuming the new rules apply to the deemed disposition of assets at death, if you are considering donations to support a legacy, the use of publicly-listed securities may be beneficial.

Any accrued capital gain is excluded from taxable income and a donation receipt equal to the value of the donated securities will be received. Note: For large donations other than in the year of death, the Alternative Minimum Tax may apply.

Business owners — Evaluate whether certain assets should be held in the corporation or owned personally. For corporations, there is no $250,000 threshold and 2/3 of realized gains are taxable.

Plan Ahead: For many, the increased inclusion rate will mean higher future tax liabilities. Planning ahead is important. The use of insurance or other planning techniques may help to cover a higher tax bill, such as on the transfer of a family property or on death. For business owners, the use of corporate-owned insurance or an individual pension plan may support a business’ tax strategy. Forward planning can also help access available exemptions, such as the lifetime capital gains exemption. As tax

planning remains an important part of wealth planning, seek advice.

*Please note: Legislation has not been enacted at the time of writing.

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

Insurance products are provided through Wellington-Altus Insurance Inc.

© 2024, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION.

www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca