Three Perspectives on Our Higher Cost of Living

With higher inflation, the increasing cost of living has been top of mind for many Canadians. While there has been good news on the inflation front given continuing signs of easing, here are three perspectives on our rising cost pressures.

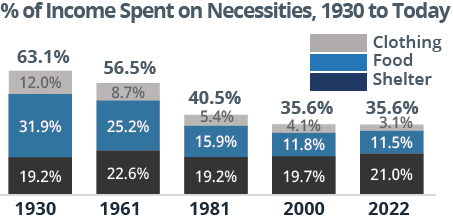

1. Today, less of our paycheques go to necessities.

Despite a substantial rise in grocery costs, it may be surprising that the proportion of income spent on necessities has declined substantially over time. In 1961, Canadians spent 33.9 percent of family income on food and clothing; today, this has declined to just 14.6 percent. This is largely because incomes have grown faster.

Despite a substantial rise in grocery costs, it may be surprising that the proportion of income spent on necessities has declined substantially over time. In 1961, Canadians spent 33.9 percent of family income on food and clothing; today, this has declined to just 14.6 percent. This is largely because incomes have grown faster.

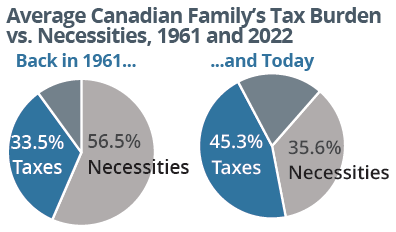

2. Which expenditure has grown the most? Taxes.

According to the Canadian Consumer Tax Index, the average Canadian family spends 45.3 percent of income on total taxes, compared to 35.6 percent on necessities. Since 1961, there has been a 2,778 percent rise in the taxes we pay, outpacing increases in the Consumer Price Index (that measures changes in prices), which has increased by 863 percent.

According to the Canadian Consumer Tax Index, the average Canadian family spends 45.3 percent of income on total taxes, compared to 35.6 percent on necessities. Since 1961, there has been a 2,778 percent rise in the taxes we pay, outpacing increases in the Consumer Price Index (that measures changes in prices), which has increased by 863 percent.

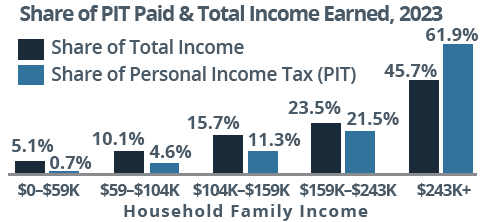

3. Higher-income taxpayers shoulder the heaviest tax burden.

When comparing the share of taxes paid to the share of income, the highest income earners pay the most tax. The top 20 percent of income earners (with family income over $243,000) pay 61.9 percent of personal income taxes (PIT) yet represent 45.7 percent of total income. Every other income group pays a smaller share of PIT.

When comparing the share of taxes paid to the share of income, the highest income earners pay the most tax. The top 20 percent of income earners (with family income over $243,000) pay 61.9 percent of personal income taxes (PIT) yet represent 45.7 percent of total income. Every other income group pays a smaller share of PIT.

1.&2.https://www.fraserinstitute.org/studies/taxes-versus-necessities-of-life-canadianconsumer-tax-index-2023-edition;

3.https://www.fraserinstitute.org/studies/measuringprogressivity-in-canadas-tax-system-2023

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

Insurance products are provided through Wellington-Altus Insurance Inc.

© 2024, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION.

www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca