Though the pandemic may now feel like a distant memory, it did bring about some positive changes. One notable outcome was that many clients began to take a closer look at their estate planning .In doing so, some discovered that they were concerned beneficiaries might not be able to responsibly manage their inheritance. As a result, I’ve/we’ve been assisting some clients in exploring various options as they refine their estate plans. Here are three potential strategies:

1. Set up a testamentary trust — A testamentary trust takes effect upon your death and is managed by a trustee to pay out portions of the inheritance over time, based on a predetermined payment schedule and timeline. It can specify terms to encourage certain types of behaviour, such as tying income to employment — e.g., “monthly income will increase if the beneficiary maintains a job for x years.” Or, it can put constraints on inheritance payments — e.g., “capital won’t be distributed until the beneficiary completes their education.” Note that there are legal limits to these types of restrictions depending on your particular situation, so please consult a qualified trust and estate lawyer. However, a testamentary trust may be a good option for heirs who lack financial maturity, are living with a disability or are otherwise financially vulnerable, as it helps support the longevity of wealth over time and can encourage responsible behaviours.

Disadvantages — Generally, with some exceptions (such as qualified disability trusts or graduated rate estates), income taxed within a trust will be subject to the highest marginal income tax rate. There are also associated costs, including the initial set up, trust administration fees and other management fees. The trustee, or the person who is appointed to manage the trust, will also face ongoing administrative responsibilities, including bookkeeping and tax returns. As an alternative, you might consider hiring a professional trustee to manage it and reduce any potential burden, though this would add to the overall cost.

2. Direct a portion of the inheritance to a life annuity — A life annuity is an insurance product that is designed to pay a guaranteed income for life to the beneficiary, similar to how a pension plan benefits a retiree. The beneficiary will receive a monthly income over their lifetime, providing financial stability.

Disadvantages — Allocating funds to an annuity will not allow for income flexibility or the potential for higher investment returns, as capital is committed to paying for the annuity and the annuity will pay a set amount over the beneficiary’s lifetime. It also restricts future legacy planning — once the beneficiary passes away, payments will cease and there will be no money available for the beneficiary’s heirs. Unlike a testamentary trust, the life annuity doesn’t allow for potentially influencing the behaviour of the beneficiary.

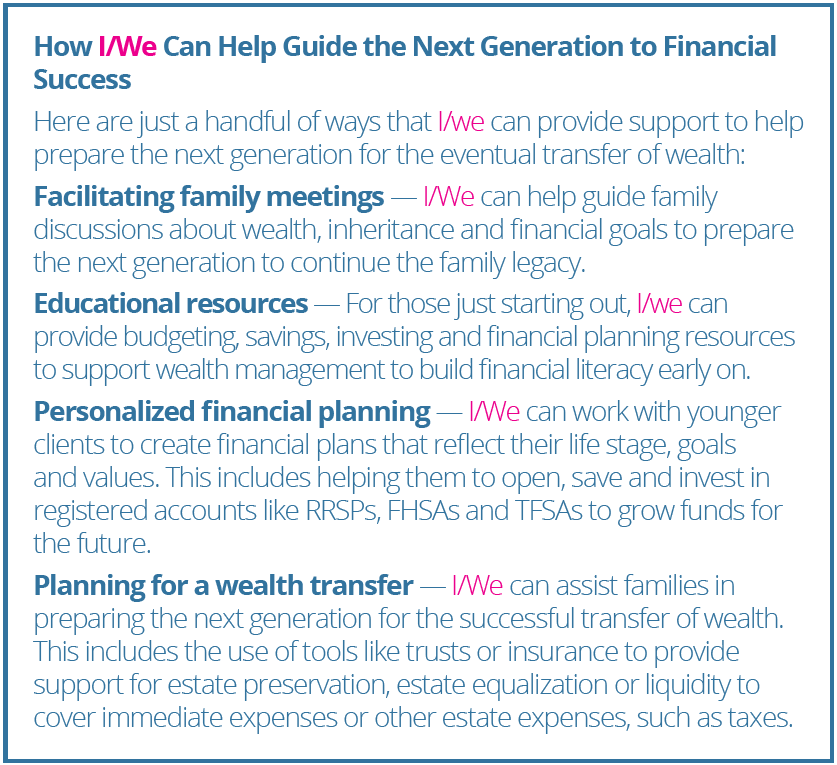

3. Introduce your beneficiary to me/us, your trusted advisor(s)

— I am/We are here to build a relationship with your beneficiaries which may be worth while if there is a need to foster financial literacy or build responsibility. By getting to know me/us early, your beneficiaries may better learn and understand your own financial values. I/We can also facilitate family meetings, to discuss the intentions behind your estate plan or help to direct financial planning, estate distribution and the responsibilities that come with inheritance.

Disadvantages — While establishing this relationship can be highly beneficial, it does not provide the same structured control as a trust or annuity. The success of the beneficiary depends heavily on their willingness to engage and learn. Additionally, there is no guarantee that the beneficiaries will adhere to the financial guidance provided.

These are just a few considerations that may help set up beneficiaries for longer-term success. Each comes with its own set of advantages and drawbacks, so it’s important to determine the best fit for your unique situation. For a deeper discussion, please call.

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances.

Insurance products are provided through Wellington-Altus Insurance Inc.

© 2024, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION.

www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca