The RESP: Would You Turn Down “Free Money”?

There are many reasons to consider a Registered Education Savings Plan (RESP) to save for a child’s future education: tax-deferred growth within the plan, earnings taxed at the child’s tax rate when eventually withdrawn and, of course, the Canada Education Savings Grant (CESG). The CESG consists of funds paid into the plan by the federal government as a 20 percent matching grant, to an annual maximum of $500 ($1,000 if there’s unused grant room from a previous year )and a lifetime maximum of $7,200 per beneficiary. There are no annual limits on RESP contributions, however the lifetime limit is $50,000.

Conventional wisdom suggests we should take advantage of the CESG — after all, it’s essentially ‘free’ money. But is this always the best decision? One way to maximize the CESG involves contributing $2,500 per year over 15 years to receive the full $7,200 in grants. However, will this achieve the greatest outcome for the RESP?

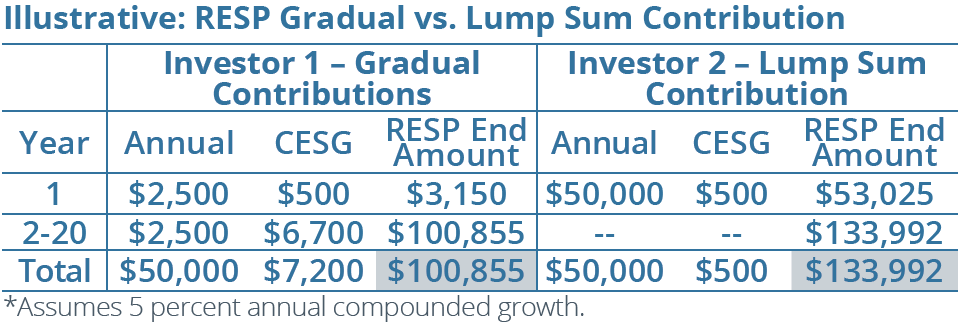

To answer this question, let’s compare Investor 1, who gradually contributes and maximizes the CESG, and Investor 2, who contributes a lump sum amount and doesn’t maximize the CESG. The outcome may be surprising. Both investors are assumed to earn an annual rate of return of 5 percent. Investor 1 contributes $2,500 each year starting in, the first year of the child’s life until year 20, to a maximum contribution of $50,000, and receives the full $7,200 CESG grant. After 20 years,

the RESP produces $43,655 of growth, resulting in a value of $100,855. Investor 2 contributes a lump sum of $50,000 — the full RESP limit — in the first year of the child’s life, so the RESP receives only $500 of CESGs. Yet, the RESP grows to $133,992 over the same period. This shows the profound impact of compounding over time. Front loading the initial contribution yields a larger outcome, even without receiving the full CESG, all else being equal. Despite lower total contributions (funds paid into the plan plus CESGs) for Investor 2, or $6,700 less in CESGs, the outcome is $33,137 greater.

the RESP produces $43,655 of growth, resulting in a value of $100,855. Investor 2 contributes a lump sum of $50,000 — the full RESP limit — in the first year of the child’s life, so the RESP receives only $500 of CESGs. Yet, the RESP grows to $133,992 over the same period. This shows the profound impact of compounding over time. Front loading the initial contribution yields a larger outcome, even without receiving the full CESG, all else being equal. Despite lower total contributions (funds paid into the plan plus CESGs) for Investor 2, or $6,700 less in CESGs, the outcome is $33,137 greater.

A Lesson for the RESP — And, Investing in General

Of course, not many investors have $50,000 of discretionary funds at the start of a child’s life. As such, maximizing the CESG where possible is a prudent strategy. Yet, this example illustrates why, as advisors, we often remind investors not to overlook the impact that compounding can have over time on any investment — not just the RESP. One takeaway? The sooner you start, the more time funds have to grow and, when it comes to growth, the larger the initial investment, the better!

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances.

Insurance products are provided through Wellington-Altus Insurance Inc.

© 2024, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION.

www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca