Are You Overlooking the Tax-Free Opportunity?

There are few “gifts” that the government gives us, and the Tax-Free Savings Account (TFSA) is one of them. The opportunity to invest and grow funds on a tax-free basis over a lifetime should not be overlooked.

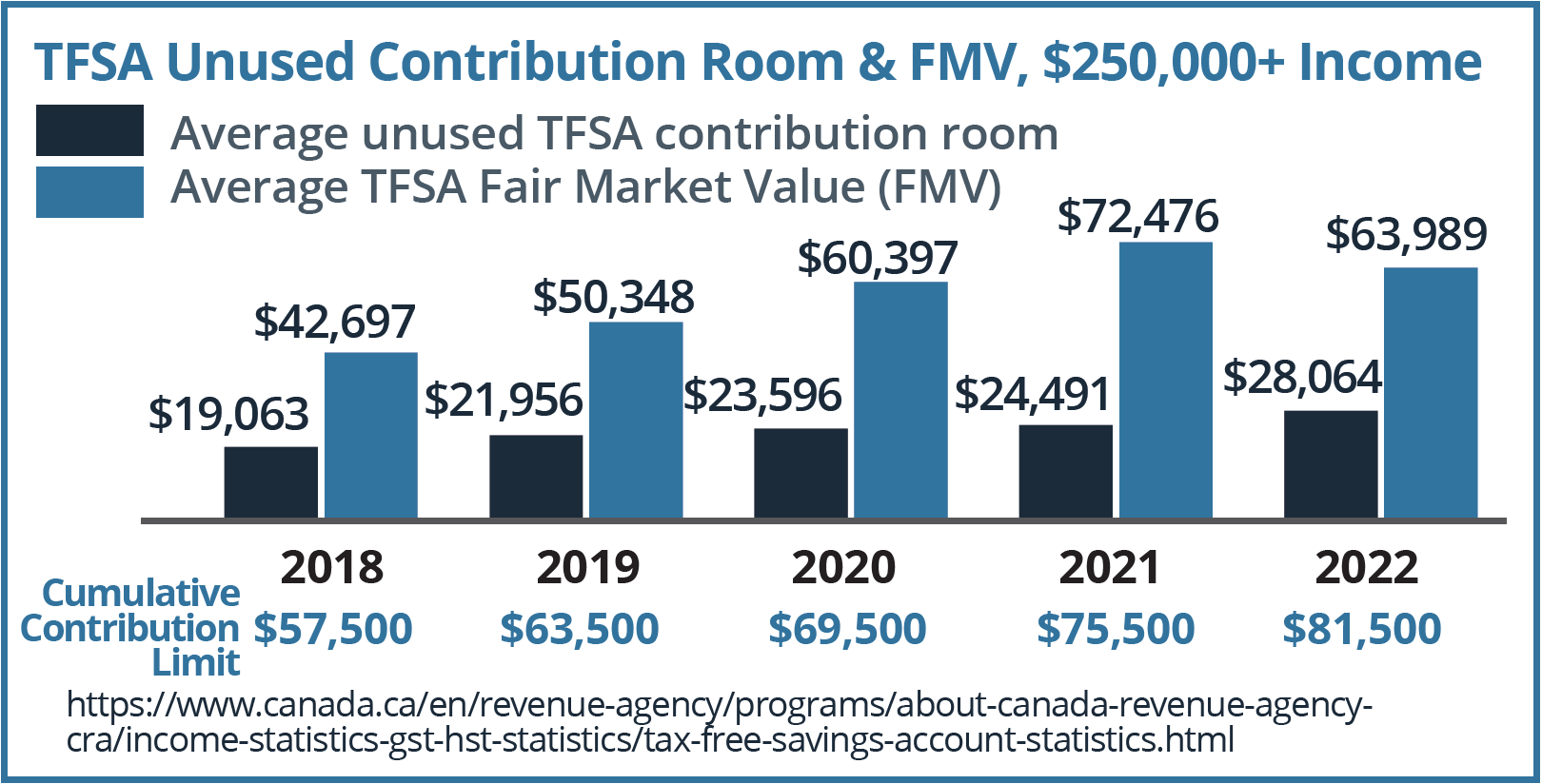

Yet, the latest statistics reveal that many high-net-worth (HNW) individuals are not taking full advantage. The 2024 TFSA statistics (for the 2022 tax year) were recently released and are surprising. For HNW taxpayers with incomes over $250,000, around 35 percent of average contribution room remains unused. While many of us gripe about higher taxes, we certainly aren’t doing a great job of maximizing tax-advantaged accounts. As well, the average fair market value (FMV) remains below the cumulative contribution limit. An investor who invested the full annual dollar amount since the TFSA’s inception could have over $145,000, assuming a rate of return of 5 percent each year.

What’s causing these shortfalls? Several factors might be at play. When the TFSA was introduced in 2009, it was often misunderstood as merely a ‘savings account,’ leading some investors to miss out on its growth potential. Others continue to view the TFSA as a short-term tool, withdrawing funds for immediate expenses rather than letting them grow. However, the opportunity cost is significant. Consider an investor who contributes the 2024 cumulative contribution limit of $95,000, plus $7,000 annually at a 5 percent rate of return over 25 years. This would accumulate to almost $650,000 in funds that could be withdrawn

and used completely tax free! Yet, this assumes that contributions and investment gains are left untouched in the TFSA, allowing for growth.

Another factor may be that some investors have taken a more risky approach with their TFSA investments. This may be harmful for two reasons. If an investment realizes a substantial loss, that contribution room is lost forever. And, there is no tax relief. Unlike a non-registered account, TFSA losses cannot be claimed on an income tax return.

How about you? Are you fully maximizing your TFSA? Don’t overlook the potential for significant future tax-free growth. Call for assistance.

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances.

Insurance products are provided through Wellington-Altus Insurance Inc.

© 2024, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION.

www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca