Investing After Periods of Strong Market Returns

“The strongest of all warriors are these two: Time and Patience.”

— Leo Tolstoy

Following the notable gains in both Canadian and U.S. equity markets in 2024, some investors may feel hesitant about the prospect of continuing to put money to work. Here are a few myths, debunked, about investing after periods of strong market performance:

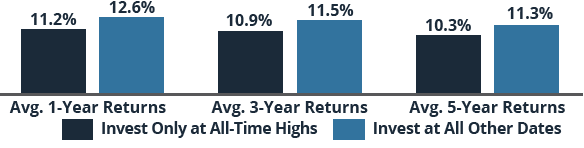

Myth: Investing at all-time highs means substantially lower returns. While investing benefits from the practice of buying low and selling high, sometimes perceived highs still allow for growth .Consider the situation to start 2024 — many were asking if U.S. markets had peaked. Yet, investing only at market highs may not be as unfavorable as many believe. Since 1950, the returns from investing in the S&P 500 only at all-time highs wouldn’t be far from the average index when investing at all other dates for one-, three- and five-year periods.

Invest at All-Time Highs vs. Other Times, S&P 500, 1950 to 20241

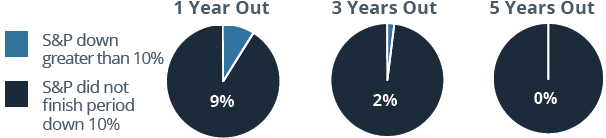

Myth: Market corrections often follow market highs. In reality, corrections are not common after markets reach all-time highs. The chart (top) shows just how often the S&P 500 has finished down more than 10 percent (often defined as a market correction) over various periods, following any of the over 1,250+ all-time highs since1 950.

Myth: High U.S. market concentration will lead to a prolonged bear market. While strong performance driven by the tech sector has led some market pundits to warn of a

How Frequent Are Market Corrections After All-Time Highs?1

potential “lost decade” for U.S. stocks, historical analysis suggests otherwise. An interesting study of over 200 years of U.S. stock market history concluded that significant increases in market concentration did not typically lead to dramatic bear markets; instead, bull markets often continued following periods of rising concentration associated with the onset of a bull market. Certain sectors, reflecting the prevailing innovation at the time, such as technology today, were responsible for high concentration and this dominance often persisted for extended periods — in many cases multiple decades.2 Another analysis of the S&P 500 over 90 years shows that rolling 10-year returns below 3 percent are rare, largely occurring in the worst economic periods in history: the Great Depression, the stagflation of the 1970s and the Great Financial Crisis.3

This isn’t to suggest that recent rapid gains are expected to continue at a similar pace. Indeed, we may find ourselves in a period where strategic security selection is even more important — and this is where our work as advisors shines through. These perspectives are intended to provide a more balanced view of market concentration and high valuations. Enjoy the gains we’ve recently seen, but don’t overlook the importance of time and patience in building wealth for the future.

1. https://www.rbcgam.com/en/ca/learn-plan/investment-basics/investing-at-all-time-highs/

detail; 2. https://globalfinancialdata.com/200-years-of-market-concentration;

3. https://awealthofcommonsense.com/2024/10/3-stock-market-returns-for-the-next-decade/