To a Trillion & Beyond…

Warren Buffett, known as the “Oracle of Omaha,” is one of the most iconic investors of our time, and, arguably, the most successful investor alive today. At 94 years old, he ranks as the sixth richest person in the world on Forbes’ 2024 Billionaires List, with an estimated net worth of over $133 billion.1 For years, reports have circulated that Buffett has been winding down his career and making succession plans for Berkshire Hathaway, the company he has turned into a powerhouse.

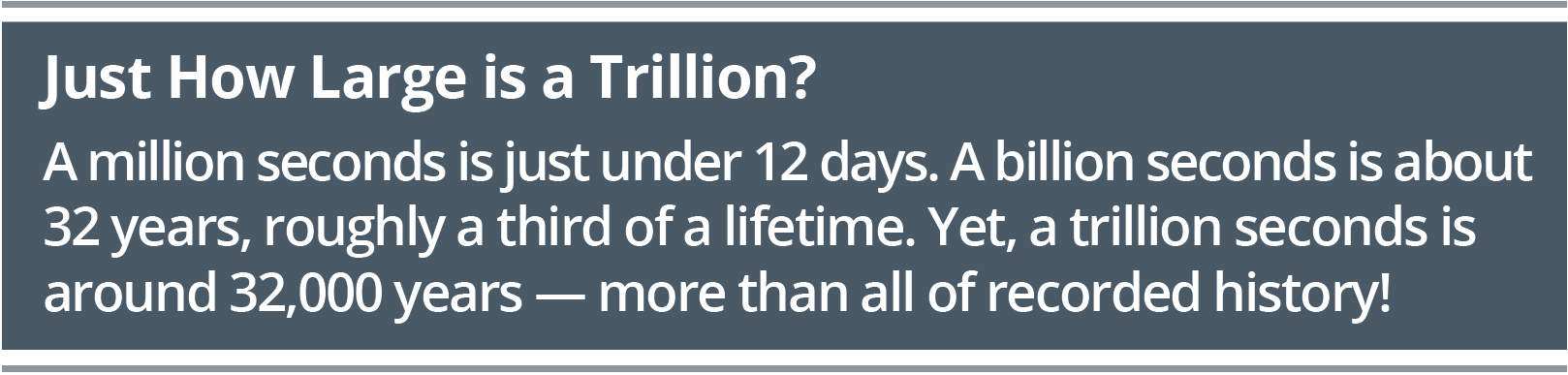

With the market’s run in 2024, Berkshire became the eighth U.S. company to reach a trillion-dollar market capitalization value2. For companies achieving this milestone, success didn’t happen overnight — building substantial wealth takes time. Buffett’s accomplishment is the result of nearly six decades in the making. When he took control of the company in 1965, Berkshire Hathaway was valued at around $2 million.3 At the end of that year, the company’s net working capital was

about $19 per share. By the time of its Initial Public Offering(I PO) in 1980, Berkshire’s stock (BRK-A) was valued at $290. Today, it trades for around $700,000 per share.4 This extraordinary growth has been the result of time, compounding and perseverance, with profits reinvested into new investments, allowing the company’s value to substantially grow.

It’s a perspective worth remembering as we begin a new year: meaningful growth is often measured over decades, not over months or even years.

What Has Made the Oracle of Omaha Such a Success?

There are valuable investing lessons we can learn from Warren Buffett’s journey that may help guide our own financial decisions:

He started early. Buffett is a prime example of how time can be an investor’s ally. He bought his first stock at age 11 and continued building wealth from a young age.

He worked hard and saved. By the time he was 16, Buffett had accumulated the equivalent of $53,000. He worked hard and saved money by delivering the Washington Post, selling used golf balls and stamps and even polishing cars. At the same time, he was constantly thinking about investing ideas and generating returns on his savings.

He experienced failure but persevered. Buffett has faced his fair share of setbacks, including being rejected by Harvard Business School, despite being confident in his acceptance. He has also experienced unsuccessful investments. Ironically, Buffett once suggested that the “dumbest stock” he ever bought was Berkshire Hathaway, which at the time of purchase was a struggling textile mill.5 It would take almost 20 years for Buffett to restructure Berkshire into a multinational conglomerate holding company.

He experienced failure but persevered. Buffett has faced his fair share of setbacks, including being rejected by Harvard Business School, despite being confident in his acceptance. He has also experienced unsuccessful investments. Ironically, Buffett once suggested that the “dumbest stock” he ever bought was Berkshire Hathaway, which at the time of purchase was a struggling textile mill.5 It would take almost 20 years for Buffett to restructure Berkshire into a multinational conglomerate holding company.

He invests time in learning. Both Buffett and his former long-time business partner, Charlie Munger (who passed away at the end of 2023), credit their success to spending 80 percent of their working days reading, thinking and continuously expanding their knowledge base.

He is an example of how building wealth takes time. Despite being one of the world’s richest, consider that more than 99 percent of Warren Buffett’s fortune was accumulated after his 50th birthday. On Buffett’s 50th birthday in 1980, a share of Berkshire Hathaway (BRK-A) closed at $380. Its growth to a value of around $700,000 represents a staggering 184,000 percent increase over 44 years, or compounded annual growth rate of nearly 19 percent. As we reflect on the strong equity market gains in 2024, Buffett’s journey serves as a reminder: while good results can be achieved over a few years, truly significant outcomes often require the patience and perspective of decades.

How Does Buffett Measure Success in Life?

Despite his immense wealth, Warren Buffett has committed to living a modest lifestyle. He still lives in the same home he purchased in 1958 for $31,500 in Omaha, Nebraska. When his daughter once asked him for a $41,000 loan to remodel her kitchen, he reportedly suggested she go to the bank instead. In 2024, Buffett announced that he plans to donate his fortune to a charitable trust managed by his three children after his death.

What does Buffett believe defines success?

“Basically, when you get to my age, you’ll really measure your success

in life by how many of the people you want to have love you acutally do

love you.”

Indeed, these are fine words of wisdom from a legendary investor.

1. https://www.forbes.com/billionaires/;

2. https://www.visualcapitalist.com/berkshirehathaway-1-trillion-club-how-long/;

3. https://www.berkshirehathaway.com/letters/1985.html;

4. On 11/11/24, BRK-A traded at $700,224;

5. https://www.cnbc.com/2017/12/15/warrenbuffetts-failures-15-investing-mistakes-he-regrets.html; All other information sourced from: “22

Fascinating Facts About Warren Buffett’s Success”, Time Magazine, 11/03/15.