Resolve to Review Your Will

If you are looking for a financial resolution to start the year, why not make estate planning a priority?

Every so often we hear stories about the consequences of not having a valid will. To die without one, known as dying “intestate,” can have significant and perhaps unintended effects as assets will be distributed according to the rules set out by your province of residence. This can result in additional costs to the estate, such as a large tax bill that could have been reduced if better planned for. It can also lead to conflicts between loved ones who are left behind to sort out matters without direction. In addition, other tax-planning or succession plans may be compromised as a result. This would be unfortunate, as a valid will is comparatively inexpensive to put in place. Even if you do have a valid will in place, consider the importance of it reflecting your current circumstances, which points to the need for periodic reviews.

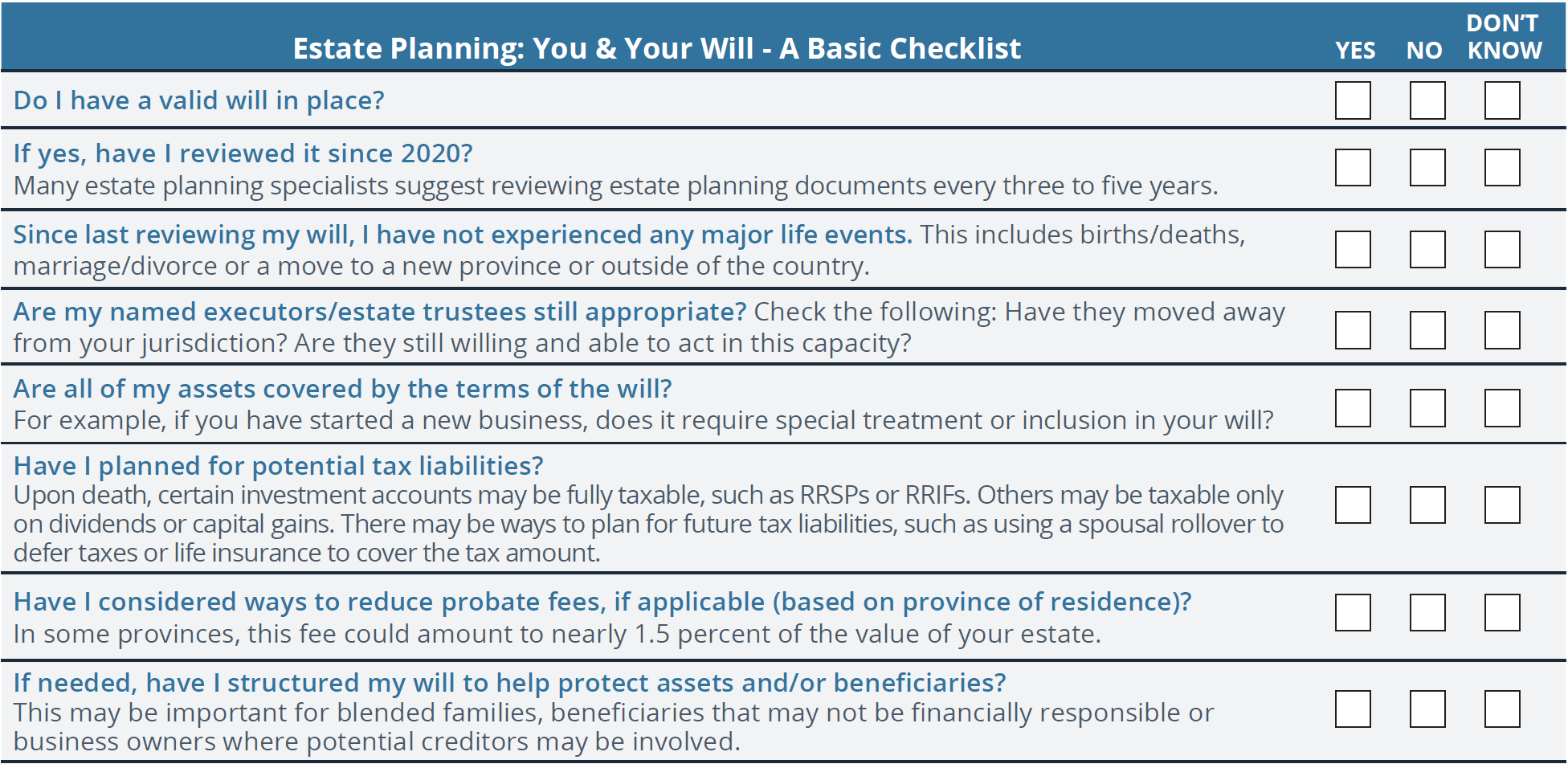

As we begin another year, take a look at the checklist below to see if any adjustments are needed to your final instructions. This isn’t meant to be a comprehensive list, but is intended to act as a starting point to determine whether a review might be useful. If you answer “no” or “don’t know” to any of the questions, perhaps a review is in order. it’s time well spent to take steps to ensure the validity of your will for the sake of your beneficiaries. It may also be a good time to review beneficiary designations for accounts or assets that do not pass through a will, which may include registered accounts (not applicable in QC) or insurance.

Why not resolve to make your estate plan a priority for 2025? If you need assistance, please call.