A recent article in the popular press posed the question: “Do you know where your retirement money is?” It highlighted the substantial amount of unclaimed pension plans—Ontario alone has $3.6 billion in unclaimed pension funds, due to nearly 200,000 “missing” plan members.1

The article featured a woman who, in her 20s, contributed $8,000 to an RRSP while working as a contractor. Now, at age 60, she discovered old paperwork revealing her forgotten investment, which has since grown to more than $100,000 over 40 years.

This situation isn’t uncommon. Many people who contributed to pensions earlier in their careers may not remember, especially since retirement savings are not usually top-of-mind at that stage of life. Complicating matters, individuals can shift employers over the span of a career, move residences or change phone numbers, making it difficult to keep track of older pension plans, or for pension providers to locate their members.

It’s Never Too Late to Start Looking

If you think you may have unclaimed pension funds, contact your former employers and speak to the plan administrator to check your eligibility.

Here are some other places where you may have money hiding:

Bank Accounts — At last count, the Bank of Canada holds over $1.8B in unclaimed balances from dormant bank accounts, term deposits and GICs that have had no activity for 10 years or more.2 To check for unclaimed funds, see:

https://www.unclaimedproperties.bankofcanada.ca/

Canada Revenue Agency (CRA) Refunds — The latest report suggests the CRA holds 8.9 million uncashed cheques worth over $1.4 billion.3 To check for outstanding payments, log into your CRA “My Account.” For more information, please see:

https://www.canada.ca/en/revenue-agency/services/uncashed-cheque.html

Canada Savings Bonds (CSBs) — Though CSBs were discontinued in November 2017, most were issued as physical paper certificates. Before they were discontinued, a report found there were $420 million of matured—but non-redeemed—CSBs and Canada Premium Bonds, suggesting many may have been misplaced. If you’ve found an old certificate, you can take it to any financial institution to redeem it. For lost certificates, see:

https://www.unclaimedproperties.bankofcanada.ca/app/report-lost-bonds

Insurance Benefits — If you believe you are an entitled beneficiary or have unclaimed life insurance benefits, contact the insurance company directly. If you’re unsure of the provider, visit the OmbudService for Life & Health Insurance: https://olhi.ca/

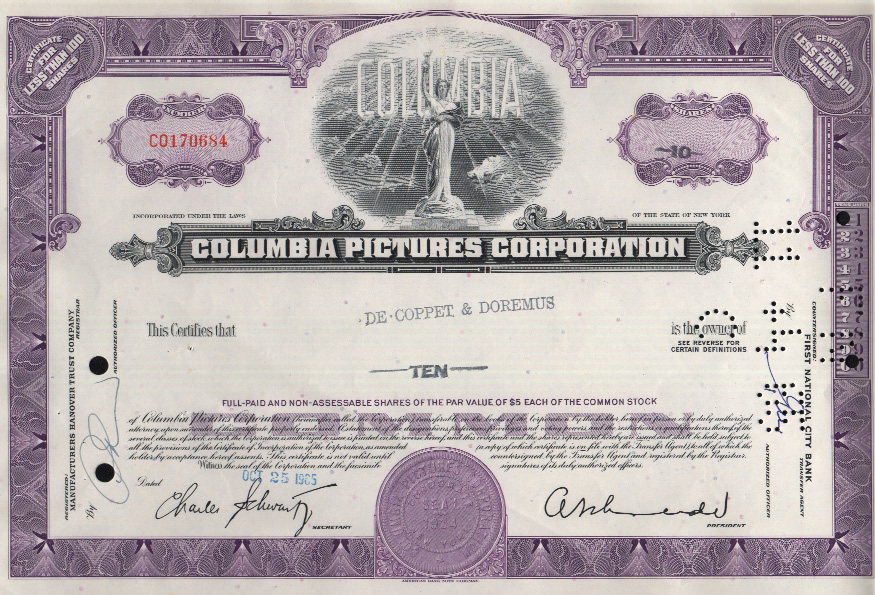

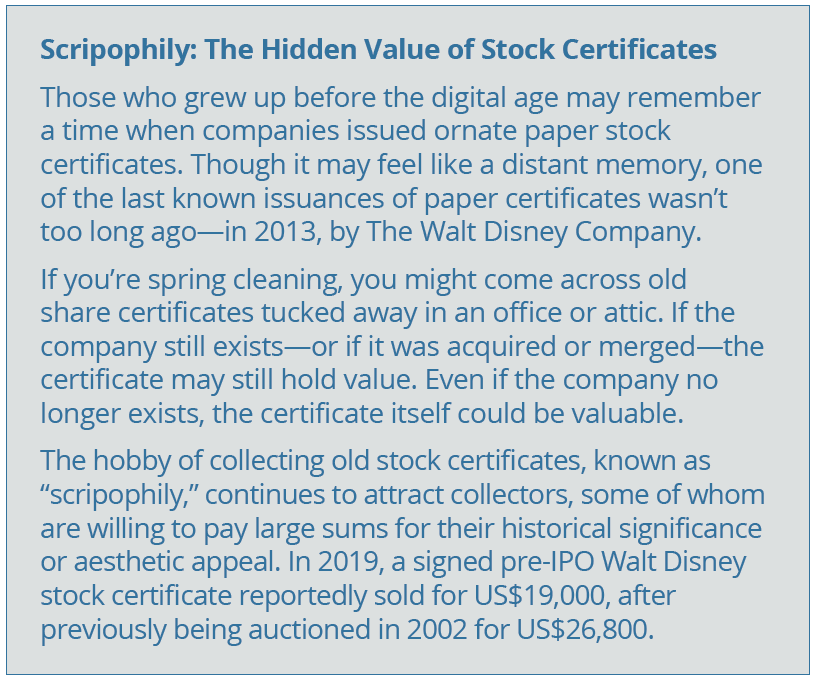

Old Stock Certificates — If you come across an old stock certificate, the Canadian Securities Administrators provides guidance on how to determine its value. Please see:

https://www.securities-administrators.ca/investor-tools/howto-determine-the-value-of-an-old-stock-certificate/.

Even if the company no longer exists, it may hold value for a collector (see inset below).

1. https://www.cbc.ca/radio/costofliving/forgotten-retirement-savings-1.7452815; 2. https://nationalpost.com/news/canada/how-to-know-if-you-own-any-of-the-1-8b-inunclaimed-

bank-accounts-in-canada; 3. https://www.canada.ca/en/revenue-agency/news/2022/08/approximately-14-billion-in-uncashed-cheques-is-sitting-in-the-canadarevenue-agencys-coffers.html

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Financial Inc. (Wellington-Altus) is the parent company to Wellington-Altus Private Wealth Inc. (WAPW), Wellington-Altus Private Counsel Inc. (WAPC), Wellington-Altus Insurance Inc. (WAII), Wellington-Altus Group Solutions Inc. (WAGS), and Wellington-Altus USA Inc. Wellington-Altus (WA) does not guarantee the accuracy or completeness of the information contained herein, nor does WA assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor..

©2024, Wellington-Altus Private Wealth Inc., Wellington-Altus Private Counsel Inc., Wellington-Altus Insurance Inc., Wellington-Altus Group Solutions Inc., and Wellington-Altus USA Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca