Which generation is more likely to fall for online scams? The answer may surprise you. Despite growing up immersed in digital technology since birth, younger generations—often called “digital natives”—are statistically more likely to fall victim to online fraud.1 This is referred to as the paradox of the digital natives: early exposure to digital technologies does not equate to digital literacy. Given the growing sophistication of online scams, it may be an ideal time to revisit some basic digital safety principles—whether for younger family members, or for older adults who may be more vulnerable and in need of support. Here are a handful of universal tips that may act as talking points to help protect against fraud:

Pause before you (re)act. Scammers often rely on urgency or emotional pressure—though sophisticated scams may involve building trust over time. Slowing down can protect you from making mistakes.

• Be skeptical of messages that pressure you to act immediately— especially those involving money or personal information.

• “Take Five, Tell Two:” If you’re unsure, pause for five minutes and speak to two trusted people.

Let technology work for you. Leverage built-in tools and settings to screen out threats. Given our significant daily use of smartphones, here are a handful of ideas relating to mobile phones:

• Let unknown calls go to voicemail. Legitimate callers will leave a message.

• Silence calls from unknown numbers to avoid answering by accident. For the iPhone, go to Settings > Apps > Phone. Scroll down to “Calls.” Tap “Silence Unknown Callers.”

• Use your carrier’s screening tools. For example, Rogers offers “Call Control,” which requires callers to enter a randomly generated number before the call connects. This helps block automated robocalls.

• Set up a filter on phones to sort unknown texts into a separate folder to avoid accidental replies and reduce clutter.

• Never reply to unknown calls or messages—doing so confirms your number is active.

Limit what you share. The less information you put out there, the harder it is for scammers to target you.

• Never share personal or financial information unless you’re certain of the recipient’s identity and the communication channel is secure.

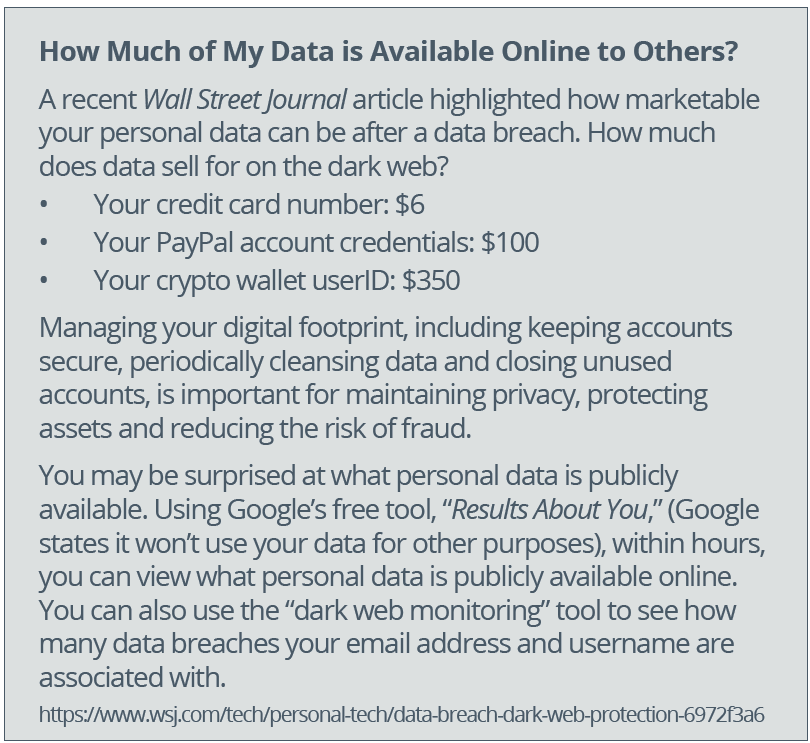

• Reduce your digital footprint. Delete unused online accounts to reduce access in case of a data breach.

• Avoid posting personal details on social media like birthdays, addresses, travel plans or even family-member names.

• Set online privacy settings to the highest level.

• Be cautious with online forms or surveys—verify the source first. Use good payment practices. Be thoughtful about how and where you send money.

• Use payment methods with fraud protection, such as PayPal, when sending funds to unfamiliar recipients. Avoid wire transfers, gift cards or Interact e-transfers for unfamiliar transactions.

• Use separate email addresses or usernames for less-secure transactions to protect your identity online.

Add a layer of personal security. Proactive steps can make it harder to impersonate you or your loved ones.

• Create a family code word to verify the identity of anyone claiming to be a loved one in distress. If a caller can’t provide the code word, hang up.

• Consider using a dedicated email address exclusively for financial and banking transactions.

• For added privacy, some use “alternate” (burner) birthdates or slight name variations when registering for non-financial services— to conceal private data and limit exposure of personal information.

Stay informed. Fraud tactics continue to become more sophisticated

and evolve rapidly.

• Follow trusted resources such as the Canadian Anti-Fraud Centre to stay updated. See: https://antifraudcentre-centreantifraude.ca/

• If you suspect a scam, report it—you could help protect others. https://antifraudcentre-centreantifraude.ca/report-signalez-eng.htm

1. https://www.news24.com/life/lifestyle-trends/which-generation-is-more-likely-to-fallfor-

online-scams-the-paradox-of-thedigital-natives-20250312#; https://www.wsj.com/

tech/cybersecurity/young-adult-phishing-scams-social-media-use-bcf7b6ca?; https://www.

ey.com/en_us/newsroom/2022/10/gen-z-and-millennials-less-serious-about-cybersecurityon-

work-issued-devices-than-personal-according-to-new-ey-consulting-survey

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Financial Inc. (Wellington-Altus) is the parent company to Wellington-Altus Private Wealth Inc. (WAPW), Wellington-Altus Private Counsel Inc. (WAPC), Wellington-Altus Insurance Inc. (WAII), Wellington-Altus Group Solutions Inc. (WAGS), and Wellington-Altus USA Inc. Wellington-Altus (WA) does not guarantee the accuracy or completeness of the information contained herein, nor does WA assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor..

©2024, Wellington-Altus Private Wealth Inc., Wellington-Altus Private Counsel Inc., Wellington-Altus Insurance Inc., Wellington-Altus Group Solutions Inc., and Wellington-Altus USA Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca