At a Glance: Perspectives on the Big Tech Bull Market

After a summer of considerable market enthusiasm surrounding artificial intelligence (AI), it’s worth taking a step back.

Why does AI seem to be advancing so quickly? While it may feel like a recent phenomenon, its roots stretch back to the 1950s when Alan Turing proposed his now-famous “Turing Test” for machine intelligence. What’s different today is the pace of progress, driven by exponential increases in computing power, vast datasets and advances in machine learning algorithms. To put it into perspective, in the late 1980s, annual data creation was measured in terabytes (TB). In 2025, global data generation is expected to exceed 180 zettabytes (ZB)—one ZB is a billion times larger than one TB. At the end of the 1980s, one terabyte of storage cost more than $20 million; today, it is well under $100—a mind-blowing decline in just four decades.1

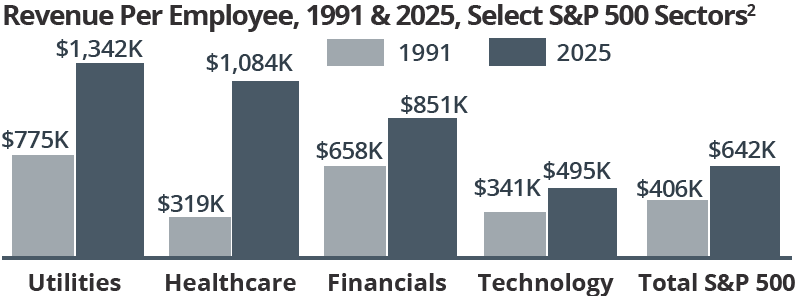

Few doubt that AI will be an economic driver in the years ahead. Technology has long supported productivity gains. Consider how revenue per employee has dramatically increased since 1991 (chart, top), fuelled by computers, the internet, mobile devices, software and the innovation they’ve enabled. However, key questions remain: Will AI live up to its transformative promise, reshaping the world like the steam engine or lightbulb? And, beyond the excitement, who will emerge as the winners?

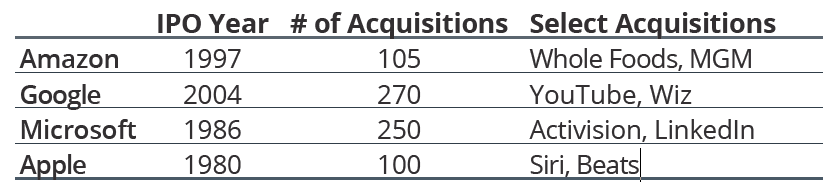

Concerns persist about the concentration of big tech in the S&P 500, but the reality is more nuanced. Today’s largest tech firms differ from the internet darlings of the late 1990s. The “Magnificent Seven” are cash-generating, innovative and diversified, having acquired over 800 companies and expanding across industries. In many ways, they function as modern tech conglomerates—still growing organically, but supported by multiple engines of innovation.

Ultimately, history reminds us that the successful adoption of any new technology doesn’t guarantee financial success for all early adopters. Thoughtful analysis and evaluation, alongside a diversified approach to balance exposure and keep portfolios resilient as conditions shift, can help investors capture innovation’s upside.

Select Large Technology Company Acquisitions2

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Financial Inc. (Wellington-Altus) is the parent company to Wellington-Altus Private Wealth Inc. (WAPW), Wellington-Altus Private Counsel Inc. (WAPC), Wellington-Altus Insurance Inc. (WAII), Wellington-Altus Group Solutions Inc. (WAGS), and Wellington-Altus USA Inc. Wellington-Altus (WA) does not guarantee the accuracy or completeness of the information contained herein, nor does WA assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor..

©2024, Wellington-Altus Private Wealth Inc., Wellington-Altus Private Counsel Inc., Wellington-Altus Insurance Inc., Wellington-Altus Group Solutions Inc., and Wellington-Altus USA Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca