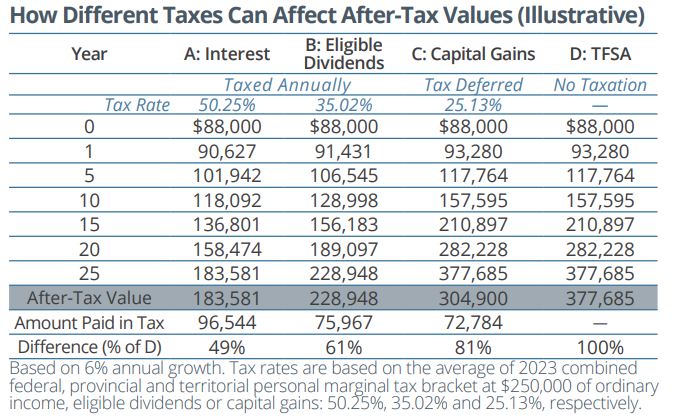

- Fully maximize tax-efficient accounts. Don’t overlook the benefits of tax-free and tax-deferred growth through TFSAs and RRSPs.

- Optimize asset location. Different types of income may be taxed differently based on the type of account the income is generated from. By consolidating assets, a comprehensive view can help to better optimize asset location across all accounts while maintaining a balanced allocation.

- Consider tax-efficient investing alternatives. Some types of investments have tax-advantaged attributes. Mutual funds, REITs, limited partnerships and others may provide return of capital (ROC) distributions that are not a taxable receipt. With increased interest in Guaranteed Investment Certificates (GICs), some investors have considered high-quality bonds trading at a discount, which have both an income and more favourably taxed capital gains component.

- Explore other tools. There may be other tools that can help defer tax, such as an individual pension plan (IPP) that allows business owners/ executives tax-deferred contributions to build retirement income. Those looking to pass a company to the next generation may use an estate freeze to lock in the tax liability at death based on today’s business value.

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. ©️ 2023, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION