Given the rise in interest rates since the start of 2022, there has understandably been greater interest in low-risk, fixed-income investments like Guaranteed Investment Certificates (GICs). While investors can take advantage of rates not seen in decades, it is important to consider the tax implications. When a GIC is held in a non-registered account, any income earned will be fully taxable at the investor’s marginal rate — compared to capital gains and dividend income, which generally receive more favorable tax treatment. As such, are there tax-efficient alternatives?

Due to rapid rate increases and unprecedented bond market volatility, many quality bonds are trading at discounts to their par values. These bonds may be suitable alternatives to GICs from a risk perspective, but may offer greater after-tax return potential.

A Short Primer: GICs vs. Bonds

GICs pay a guaranteed return, expressed as an interest rate paid on the amount invested, which is taxable as interest income in a non- registered account. Since they aren’t tradeable assets, they don’t vary in price. At maturity, the original investment is returned to the investor. Bonds, on the other hand, generally pay a coupon, or annual interest rate (sometimes paid semi-annually), which is taxable as interest income. The coupon rate is expressed as a percentage of the bond’s “face value” — the amount paid to the bondholder at maturity. Over the life of the bond, a bond’s price can vary as interest rates change.

If interest rates were to rise, any comparable bonds would now offer a higher coupon amount. As such, the bond that was issued at the lower interest rate, which pays a lower coupon, will need to fall in price so that its coupon and eventual face value paid at maturity will be equivalent to the new bond. When a bond is sold for less than its face value, it is termed a “discounted bond.” Conversely, if interest rates fall, the bond’s price will rise. If it is sold for more than its face value, it would be sold at a “premium” (or above par).

Discounted Bonds: A Tax Advantage

What makes a discounted bond attractive from a tax perspective? Since the bond was purchased at a discount from its face value, part of the total return from the bond comes from capital gains. The coupon amount would still be taxed as interest income; however, the capital gain would be subject to a lower tax rate. This makes the discounted bond more tax-efficient than a comparable GIC with returns fully taxable as interest income.

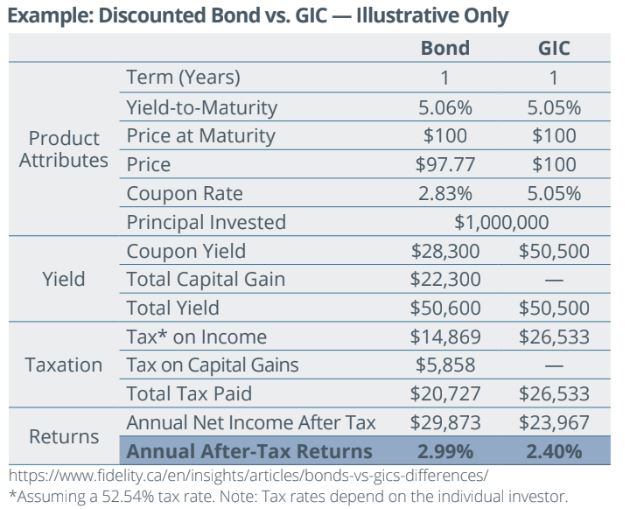

To illustrate the tax efficiency of a discounted bond compared to a GIC, the chart compares a bond offered by a $14 billion Canadian packaged foods company with a yield to maturity of 5.06 percent to a GIC that pays interest at 5.05 percent. Based on a tax rate of 52.54 percent, the after-tax return for the bond is 2.99 percent, whereas the GIC’s return is only 2.40 percent once taxes are considered. In fact, on an initial $1 million investment, the net after-tax income is $5,906 more for the bond than for the GIC.

What accounts for such a difference? Since capital gains are treated more favorably, as a result, the blended tax rate is only 41 percent for the bond, compared to 53 percent for the GIC.

In some cases, even if a GIC has a higher pre-tax expected return than a discounted bond, the after-tax returns of the discounted bond may be notably higher. In addition to the tax advantage, many quality bonds are more liquid than GICs. As well, in a situation where future interest rates decline, there may be an opportunity for investors to realize gains before the bond reaches maturity. Since many quality bonds currently trade at a discount, investors may be able to find appropriate portfolio additions that meet their risk tolerance, while offering higher after-tax returns than GICs. To learn more, please feel free to call the office.