“Chances are you will be the happiest you have been

since you were a teenager.”

According to an article in the popular press, this is what many of us can anticipate in retirement.1 If you’re retired, perhaps you concur. If retirement is still on the horizon, the promise of retirement bliss is something to look forward to. Notably, it appears that this contentment isn’t primarily driven by financial factors. Once financial obligations are met, additional income doesn’t have a substantial impact on life satisfaction. Instead, the most significant contributors are family and social connections, along with good health.

However, there’s a counterbalance: Baby boomers are expected to enjoy historically long lifespans, but with fewer children available to provide support compared to previous generations. For some, this may pose challenges when saving for retirement. On the other hand, many retirees today are finding themselves confronted with the unanticipated financial needs of adult children who experience job loss, divorce or health issues. With a growing cost of living, buying a home and getting an education, for some, tapping the bank of mom and dad (or grandpa and grandma!) never seems to end.2

Not surprisingly, many retirees may also face a high cost of long-term care. As we work with clients, we incorporate these costs into financial plans recognizing that major lifestyle adjustments may be necessary if they aren’t adequately planned for. Another unanticipated financial shock that is never planned for is divorce. Consider that the number of divorced Canadians over age 65 grew by nearly 80 percent from 2010 to 2020.3

The good news is that we may overestimate how much we think we need in retirement. While recent surveys suggest that many Canadians think they need $1.7 million in savings,4 we may not accurately be factoring in how we will eventually draw down our retirement savings. A U.S. study shows that retirees generally exhibit very slow decumulation of assets. In fact, after two decades of retirement, retirees with half a million or more just before retirement had drawn down less than 12 percent of funds. Quite interestingly, one-third of all retirees had actually increased their assets over the first two decades of retirement.5

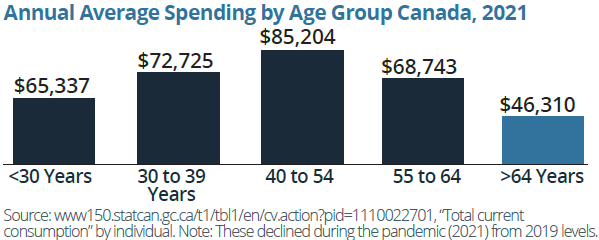

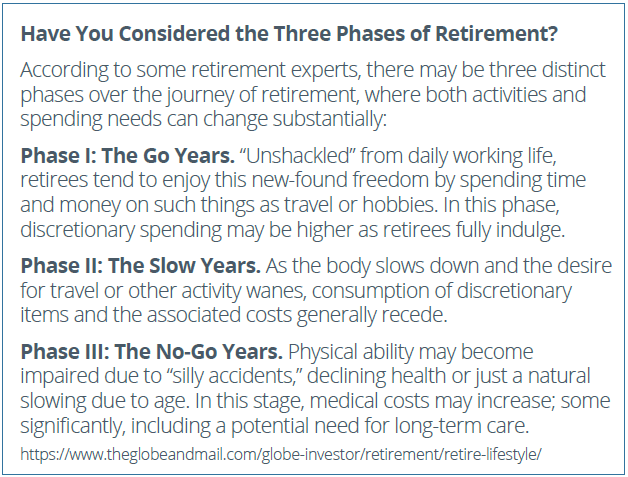

Closer to home, the latest data may support this finding: A recent report by Statistics Canada suggests that retirees have been able to maintain more of their pre-retirement family incomes in retirement6. Consider also that our spending peaks well before retirement and declines as we get older. When we are younger, we may assume our spending habits continue at similar levels, but in most cases, they decrease. Even over the course of retirement, spending needs can substantially change based on the types of activity and level of health (see inset box).

One of our roles is to help you prepare for retirement and beyond, factoring these and other considerations into your wealth plan. Whatever your plans, having financial wherewithal is key. This is why we often stress the importance of giving your wealth plan the attention it deserves. Contribute steadily, stay invested and have confidence that your assets are working hard to support your future. By having a wealth plan in place, you have a retirement advantage that many Canadians don’t have. Continue to look forward — an exciting time awaits.

1. https://theglobeandmail.com/investing/personal-finance/retirement/article-happy-health-retirementcanada/;

2. https://theglobeandmail.com/globe-investor/retirement/ask-a-retiree-for-good-retirementadvice/article29557330/;

3. https://theglobeandmail.com/investing/personal-finance/retirement/articlegetting-divorced-in-retirement-heres-how-to-protect-your-assets/;

4. https://www.advisor.ca/practice/planning-and-advice/canadians-now-expect-to-need-1-7m-in-order-to-retire-finds-survey/;

5. https://aspeninstitute.org/wp-content/uploads/2019/04/ebri_ib_447_assetpreservation-3apr18.pdf;

6. https://www.statcan.gc.ca/o1/en/plus/3693-golden-years-retirement-have-become-more-golden

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

Insurance products are provided through Wellington-Altus Insurance Inc.

© 2024, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION.

www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca