Mortgage Debt & the Great Renewal

It has been termed ‘the great renewal’: A significant number of Canadian mortgages are coming up for renewal. By one account, around 2.2 million mortgages, or 45 percent of all outstanding mortgages, are set to face higher interest rates this year and next.1

Even though the Bank of Canada cut interest rates in 2024 as inflation continues to ease, a return to the low rates of pre-pandemic times is unlikely. We may have entered a new era of comparatively higher-for-longer rates, a scenario that younger generations have never before experienced. For many years, historically low interest rates made it easier to assume debt, particularly in the form of mortgages.

If you or your family members hold a mortgage, it may be worthwhile to consider how these increased rates could impact your financial situation.

Mortgage Debt with Higher Interest Rates

Higher mortgage rates increase the cost of holding a mortgage. Those who hold mortgages with fixed interest rates will not be affected until the term of their mortgage ends and they need to renew their mortgage. However, many who hold variable-rate mortgages, comprising around one-third of all Canadian mortgages, have already been confronted with rising payments or longer amortization periods when the Bank of Canada raised interest rates in 2022 and 20232.

Consider that a three percent increase in interest rates raises the monthly payments on a 25-year, $160,000 mortgage by over $265 per month. For some, this may not seem significant, but over the life of the mortgage, this equates to $80,000 in additional interest costs!

By increasing borrowing costs, higher rates make it more difficult for some homebuyers to qualify for a mortgage and reduce the size of the mortgage that others can obtain.

Are There Ways to Pay Down a Mortgage More Quickly?

Given the potential increased cost of holding a mortgage due to higher rates, it may be worthwhile to consider paying a mortgage down more quickly. Here are a few ideas. As always, consult your mortgage provider’s rules prior to making payments to ensure that penalties do not apply.

1. First, buy within your means — Before making any purchase, it is important to consider whether you can comfortably afford the mortgage. This includes planning ahead to build in contingencies, such as the possibility of a temporary loss of income due to job loss. Mortgage payments should also be manageable alongside other living expenses. Higher inflation has increased the costs for many household expenditures, such as food and gas. Future potential costs, like those associated with having children, including childcare or postsecondary education, should also be planned for.

2. Make regular payments — This may seem obvious, but many people skip payments. Making regular payments is especially important at the beginning of the mortgage when the principal amount is high and the mortgage’s interest is a large component. Missed payments can result in additional fees and interest charges, and may negatively impact your credit score.

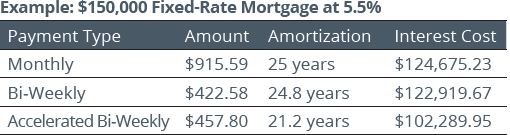

3. Set up “accelerated” weekly/bi-weekly payments — Accelerated payments allow for extra payments to be made against the principal as part of the regular payment stream — equivalent to an extra monthly payment per year. This will not only save on interest costs, but also reduce the mortgage’s amortization period — the time it takes to pay down the mortgage.

4. Overpay payments — Consider rounding up payments if you get a raise at work or have extra spending money on hand. It may be surprising how additional dollars added to a weekly payment can impact a mortgage over the long run.

5. Don’t forget the annual lump sum option — Many mortgages allow for paying an additional annual lump sum. Extra funds, such as a work bonus, inheritance or a tax refund from a Registered Retirement Savings Plan (RRSP) contribution can be used to make a one-off payment.

1. https://www.theglobeandmail.com/business/article-online-lender-nesto-aimsto-grab-market-share-as-wave-of-homeowners/#;

2. Estimate in 2023; https://financialpost.com/news/canadians-love-affair-variable-rate-mortgages-over

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances.

Insurance products are provided through Wellington-Altus Insurance Inc.

© 2024, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION.

www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca