The Mechanics Behind the Cascading Life Insurance Strategy

When it comes to preserving family wealth, many affluent Canadians face a familiar challenge: How do I pass assets along to future generations in a tax-efficient way? In the past ,I’ve/we’ve discussed various ways to support an intergenerational wealth transfer, such as the use of a testamentary trust, a life annuity and introducing me/us, your advisor(s) to your beneficiaries to provide support. Yet, these tactics may not focus solely on tax efficiency.

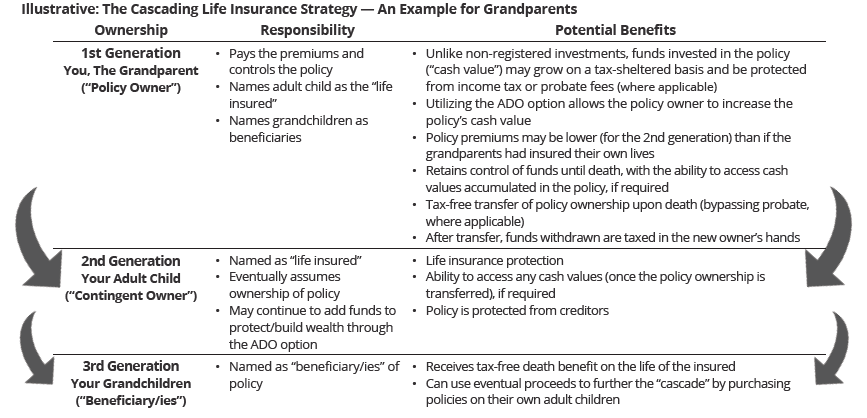

For high-net-worth investors, cascading life insurance can offer a tax-efficient way to transfer family wealth across multiple generations. In general, the strategy involves a whole life insurance policy structured so that a future generation ultimately receives the death benefit.

Cascading life insurance is designed to shift both ownership and benefits, so they “cascade” between generations. It can be used in various family situations—not just for parents/grandparents. Aunts, uncles and other relatives who want to support non-child heirs may also find this insurance strategy appealing.

To understand how this works in practice, consider the example of grandparents purchasing cascading life insurance. They buy a whole life policy that insures the life of their child, naming a grandchild as the beneficiary. The grandparents can transfer their wealth by using the Additional Deposit Option (ADO), allowing them to increase the policy’s cash value. Upon the grandparents’ death, ownership of the policy transfers to the adult child on a tax-free basis. When the adult child passes, the grandchild receives the death benefit tax free. While this is just one approach, it illustrates the core principle: transferring wealth in a controlled, tax-efficient way across multiple generations. The chart below illustrates the potential benefits for each generation.

As with any insurance strategy, there are potential risks. Ongoing premium payments are required, and failure to pay may result in the coverage lapsing. Withdrawals from the whole life policy’s cash value may have tax implications. Once the policy is transferred, the original owner loses control, allowing the new owner to make changes that may differ from the original intent.

For high-net-worth (HNW) families looking to safeguard wealth and create a multi-generational legacy, cascading life insurance may be worth considering. For a deeper discussion, please contact the office.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Financial Inc. (Wellington-Altus) is the parent company to Wellington-Altus Private Wealth Inc. (WAPW), Wellington-Altus Private Counsel Inc. (WAPC), Wellington-Altus Insurance Inc. (WAII), Wellington-Altus Group Solutions Inc. (WAGS), and Wellington-Altus USA Inc. Wellington-Altus (WA) does not guarantee the accuracy or completeness of the information contained herein, nor does WA assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor..

©2024, Wellington-Altus Private Wealth Inc., Wellington-Altus Private Counsel Inc., Wellington-Altus Insurance Inc., Wellington-Altus Group Solutions Inc., and Wellington-Altus USA Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca