Budget 2025: “Generational Capital Investments to Build Canada Strong”

Canada’s 2025 federal budget, delivered on November 4th instead of the usual spring release, marks a shift toward what Prime Minister Carney calls a “generational” investment in the country’s future. Framed as a plan to rebuild national capacity and competitiveness, the budget commits $450 billion in new spending—primarily on infrastructure, productivity and defense—while projecting a $78.3 billion deficit for 2025–26. This falls to $57.9 billion by 2028–29, but adds around $322 billion to Canada’s debt over that period (2025 to 2030). Total spending cuts are projected to be $60 billion over five years. Public debt charges are expected to rise by $22.7 billion during the same period, meaning that by 2030, Canada will be spending an estimated $1.46 billion per week on interest payments alone.1

Carney also introduced a new method of reporting that separates operating expenses from capital investment spending, pledging to balance the operating budget within three years. Opinions are divided: critics call it an accounting manoeuvre to obscure underlying deficits, while supporters see it as a way to distinguish between spending that “sustains” from that which “builds” national capacity.2

No changes were made to federal personal or corporate tax rates. The budget confirms the previously announced “middleclass tax cut,” reducing the lowest personal income tax rate (on income up to $57,375, for 2025) from 15 percent to 14.5 percent in 2025, and 14 percent in 2026.

Here are some of the more notable proposed income tax measures that may affect investors:

- Top-Up Tax Credit — A new non-refundable credit to effectively maintain the 15 percent rate for non-refundable tax credits claimed on amounts in excess of the first income tax bracket threshold. This prevents taxpayers—such as those claiming large one-time expenses (e.g., tuition)—from facing higher tax liability under the lowest bracket rate. This would apply for the 2025 to 2030 taxation years.

- Personal Support Workers (PSWs) Tax Credit — A temporary five-year refundable tax credit (2026 to 2030 tax years) for eligible PSWs working in approved health care facilities equal to 5 percent of eligible earnings, up to $1,100 annually. This excludes BC, NWT and NL, where bilateral agreements exist.

- Trusts & the 21-Year Rule — Broadens the anti-avoidance provisions for certain transactions involving trusts that aim to sidestep the 21-year deemed disposition rules.

- Bare Trust Reporting Deferral — Defers the bare trust reporting requirements by one year, applying to taxation years ending on or after December 31, 2026.

- Lifetime Capital Gains Exemption — Confirms the increase to the limit to $1.25 million (and indexed, starting in 2026), announced under Budget 2024.

- Canadian Entrepreneurs’ Incentive: Cancelled — Appears this incentive, originally proposed under Budget 2024, will not proceed.

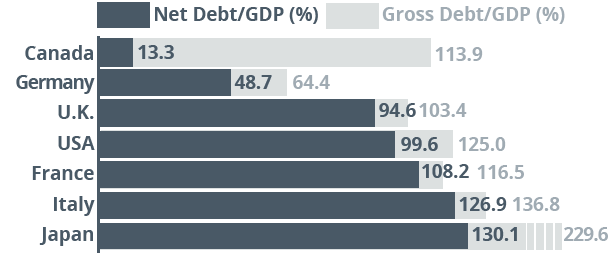

G7: General Government Net & Gross Debt-to-GDP Ratio, 2025

Budget 2025 boasted Canada as having “the lowest net-debt-to-GDP ratio in the G7.” On the surface, that sounds reassuring—but Canada’s gross debt tells a different story. The difference comes down to which government assets are counted. Net debt subtracts holdings like cash reserves, foreign exchange funds and other public assets. In Canada, it also nets out the Canada and Quebec Pension Plans (CPP, QPP), among the most fully funded in the world, with assets exceeding $700 billion—though assets belong to contributors, not the government.

- Luxury Tax Changes — Proposes to eliminate the luxury tax on aircraft and boats after November 4, 2025, while retaining the tax on automobiles.

- Underused Housing Tax Repealed — Proposes to eliminate this tax effective as of the 2025 calendar year.

- Qualified Investments for Registered Plans: Small Business Investments — Starting 2027, proposes that investments in specified small business corporations, venture capital corporations and specified cooperative corporations will be extended to RDSPs, aligning with other registered plans. However, investments in shares of eligible corporations and interests in small business investment limited partnerships and small business investment trusts will no longer be qualified investments.

- Home Accessibility Tax Credit — Before Budget 2025, it was possible to claim a tax credit for the same expense incurred under the medical expense tax credit and the home accessibility tax credit. From 2026, expenses claimed under the medical expense tax credit can no longer be claimed under the home accessibility tax credit.

For more information, please see: https://budget.canada.ca/2025/report-rapport/intro-en.html

Note: At the time of writing, these proposals have not been enacted into law.

1. https://financialpost.com/news/good-bad-and-ugly-canada-budget-2025

2. https://financialpost.com/personal-finance/carney-trick-us-accountingsleight-of-hand

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPW assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor. Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions prospective investors may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and prospective investors should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. The information contained herein may include the opinions of representatives of third-party companies or organizations and may not necessarily reflect that of Wellington-Altus (WA) or its representatives. All third-party products and services referred to or advertised are sold by the company or organization named. While WA may have referral arrangements with some third-party companies or organizations, WA does not specifically endorse any of these products or services and is not liable for any claims, losses or damages however arising out of any purchase or use of third-party products or services. All insurance products and services are offered by life licensed advisors of Wellington-Altus Insurance Inc. or other insurance companies separate from WAPW.

© 2026, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca

If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca