INSIDE

Getting the job done

There is a lot to digest when looking back at the last 11 months while heading into 2025. It’s hard to believe Craig and Martin have been in the markets for nearly a quarter of a century. This is more and more uncommon in today’s market environment that is dominated by young managers touting the huge gains made from high flyers like crypto coins and MicroStrategy, and artificial intelligence behemoth Nvidia that is now larger than some G7 countries. This has now worked its way through equity markets like the S&P 500 trading at valuation levels not seen since 2000—yes, Craig and Martin remember that far back.

All we’re saying is don’t forget that this time is never different—historically, when valuations have reached such levels, forward returns have not been that enticing. Be humble, do your own thing, and always be looking at the downside risks when deploying capital. But that’s just what us old-timers believe. Boring isn’t sexy, it won’t let you brag to your friend, but it does get the job done.

The power of asymmetric investing in portfolio management

While bull markets make many forget about the power of risk management, linear extrapolation of recent returns can be especially dangerous to investors. Adding in asymmetric investment strategies takes skill because too much downside protection can result in not enough upside capture—something we learned back in 2017. Therefore, we somewhat shifted our approach and are now targeting return profiles offering a 55 to 65 per cent downside protection with at least 70 to 75 per cent upside participation during rallies.

Who is in charge—your inner analyst or the big picture thinker?

Aiming for clarity minimizes mistakes but it doesn’t mean they won’t happen, we’re human after all. However, the more we exercise our right brain, the better we can get at minimizing the damage when getting it wrong by quickly identifying any errors made and pivoting back toward the right direction. With practice, suddenly what others do and say have less of an emotional impact on our decision-making process. We can then map out the risks and rewards with less fear of the uncertainty of what lies ahead.

December 2024: IS IT THAT EASY?

“Charlie Munger was right about it not being easy. I’m convinced that everything that’s important in investing is counterintuitive, and everything that’s obvious is wrong.” – Howard Marks, co-founder Oaktree Capital Management Inc.

Welcome to this month’s Market Strategy. In this edition we share our latest views on the market along with how we’re positioned strategically. As this year ends, we are witnessing things that we have only rarely seen in our investment careers going back 25 years, with the current levels of market euphoria reminding us of what we saw in 1999 and 2007.

This includes Wall Street veteran -and well-known bear, David Rosenberg, offering an apology for his stock-market pessimism, BlackRock Inc. writing a piece saying that the world economy has exited the “boom and bust cycle,” and some market strategists calling for the S&P 500 to be as high as 15,000 in the next four years. It has reached the point that we’re now seeing pictures of Benjamin Graham’s book The Intelligent Investor being thrown in the garbage on social media, and a cryptocurrency named Fart Coin with a market cap of over US$550 million.

In response to this, someone recently posted on Martin’s X feed an interesting take on why being older and going through a few market cycles can actually work against you during such times: “If my memory serves, Gerald Tsai who was a PM at Fidelity in the 60s had a comment about needing to hire young PMs in bull markets cause the older vets were too timid to go all in and stay invested throughout. Few individual investors even remember 2008/2009 anymore I find.”

For those targeting today’s higher growth and highly speculative strategies, this is probably a fair comment. However, while everyone is cheerleading the strong returns from bitcoin recently, we still have a very hard time seeing how the average investor or portfolio manager could stomach their clients experiencing three major drawdowns, -78 per cent, -82 per cent and -55 per cent, over the past 12 years. With the last large correction being only three years ago, maybe market participants are even that much younger than we think?

The same kind of rationale can be applied when looking at the S&P 500. We are now humble enough to admit that, though there are some major differences this go around compared with other bull market runs, it took me a while to catch on. I found that so many portfolio managers of my vintage didn’t understand the power of massive liquidity from the U.S. Federal Reserve post-2008 and then again post-2020. This is understandable, as we had never seen this level of money printing before in our careers, while for newer investors this is all they have ever known.

Quantitative Easing has clearly transformed the U.S. economy into a global powerhouse. Big tech companies have been able to take this near-zero cost of capital and grow their earnings at such an impressive level. A lot of this growth has resulted in the stealing of market share from other developed countries.

For example, back in 2006, the U.S. represented less than 45 per cent of the share of G7 GDP, and has since grown it to nearly 60 per cent. Interestingly, as a per cent of the total economy, it’s flat over the same period with China taking it away from Japan and Europe.

When looking at valuations and how much of this is factored in, the U.S. accounted for 40 to 45 per cent of the global stock market capitalization back in 2006 but has now grown to approximately 65 per cent. So essentially, no change in GDP as a percentage of the global economy but a material change in its market capitalization as a share of the total.

This begs the question: How much of this is dependent on the U.S. being able to take down China, its biggest competitor, who coincidentally is struggling post-COVID-19 to regain its footing? Many think this will be the case with president-elect Donald Trump implementing tariffs against them.

We think this does ignore a lot of other risks, though, including a Federal Reserve, which may not be able to continue to ease at the same pace and magnitude due to resurging inflation and the monstrous size of the U.S. deficit. Some of this is being reflected in the strong U.S. dollar that we think will continue to rise against other countries who are struggling economically.

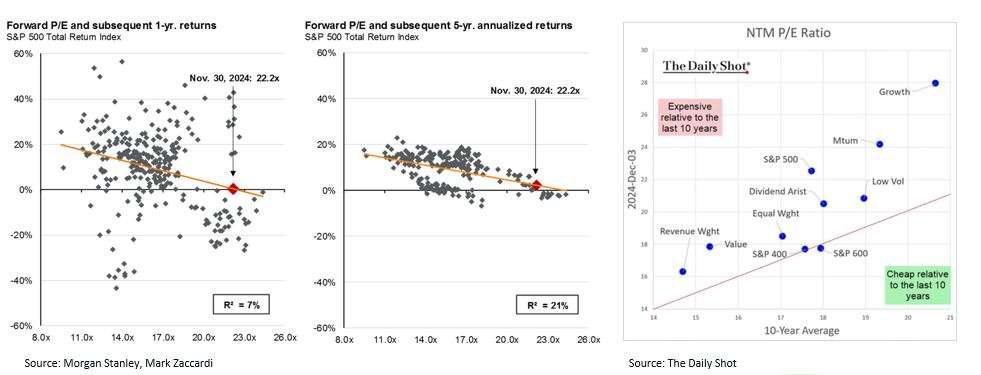

The bottom line is that two back-to-back strong years in the markets doesn’t necessarily imply a correction is around the corner but at the same time valuations are becoming very stretched. This is when it can be especially helpful to look at price/earnings (P/E) multiples and what the historic forward return has been when trading at these levels in the past.

On a one-year forward basis it isn’t statistically relevant, but when extending out to a five-year basis, forward returns tend to be much lower. Intuitively, this makes sense, as stocks will cycle just like economies despite what some will tell you.

Therefore, in times like these it’s important to introduce some skill in overseeing your portfolio instead of relying on luck as a long-term strategy, or worse, chasing returns. But that’s just what us old timers believe. Boring isn’t sexy, it won’t let you brag to your friend, but it does get the job done.

Thanks for reading, and please feel free to reach out to any of our team members should you have any comments, questions about markets, your portfolio, or just wanting to catch up.

All the best over the holidays, wishing you a Very Merry Christmas and keep investing wisely!

![]()

Skill vs. luck: the power of goals-based, risk-managed investing

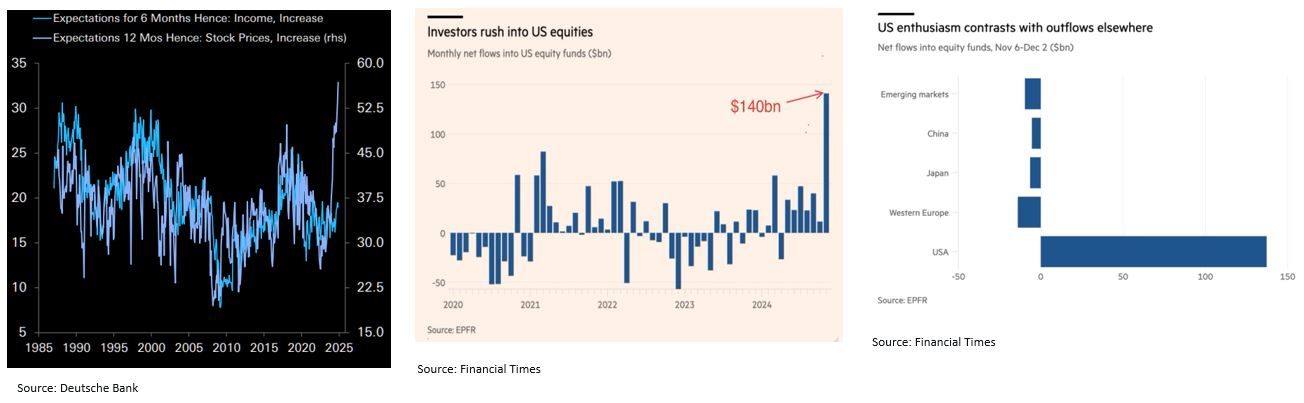

While there is no shortage of advisors touting their excellent returns thanks to strong markets last year, this is changing the overall perception of risk, with things like put option prices on the S&P 500 trading at incredibly inexpensive levels, and the equity risk premium being negative meaning investors are now paying to onboard risk instead of the other way around. As a result, investors have been piling into U.S. equities at levels never seen before all in fear of missing out.

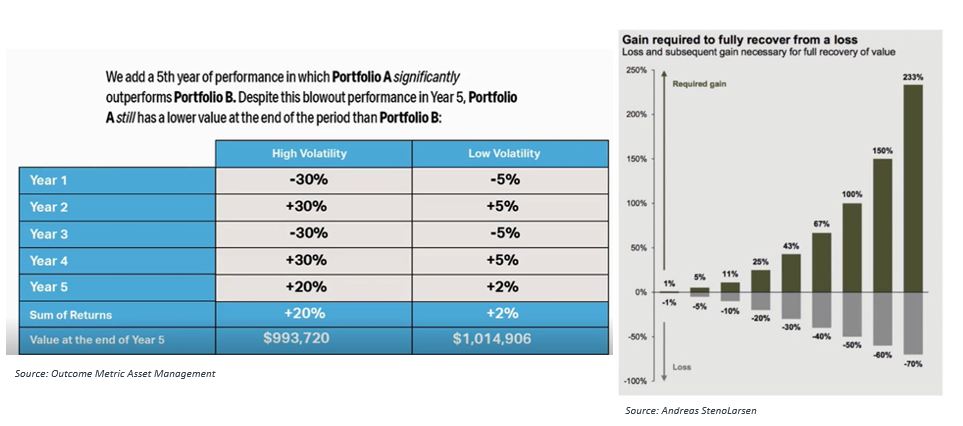

We talked about the importance of separating out skill from luck in last month’s edition. It takes real skill in managing risk alongside return and touting performance numbers delivered during a bull market does little to demonstrate that. Our friends over at Outcome Metric Asset Management provided an excellent overview of the importance of understanding this. They show two portfolios with dramatically different return profiles and yet the one with a significantly higher sum of returns generated a lower portfolio value.

You will notice that the high volatility portfolio on the left has a sum of returns of 20 per cent and yet a lower total value at the end of five years when compared to the low volatility one on the right with only a 2 per cent summed return. This is because when you lose money you have to generate a higher return to make it back. So, with a loss of 30 per cent, you need a gain of about 43 per cent to get back to even, a loss of 40 per cent needs a gain of about 67 per cent to be made whole and if you lose half your money you need to double what you have left to get back to where you started.

You will notice that the high volatility portfolio on the left has a sum of returns of 20 per cent and yet a lower total value at the end of five years when compared to the low volatility one on the right with only a 2 per cent summed return. This is because when you lose money you have to generate a higher return to make it back. So, with a loss of 30 per cent, you need a gain of about 43 per cent to get back to even, a loss of 40 per cent needs a gain of about 67 per cent to be made whole and if you lose half your money you need to double what you have left to get back to where you started.

This is why we’re huge fans of goals-based investing as it isn’t about beating everyone else or whatever is the top performing index but rather designing a portfolio to meet targeted desired value while minimizing the ups and downs along the way.

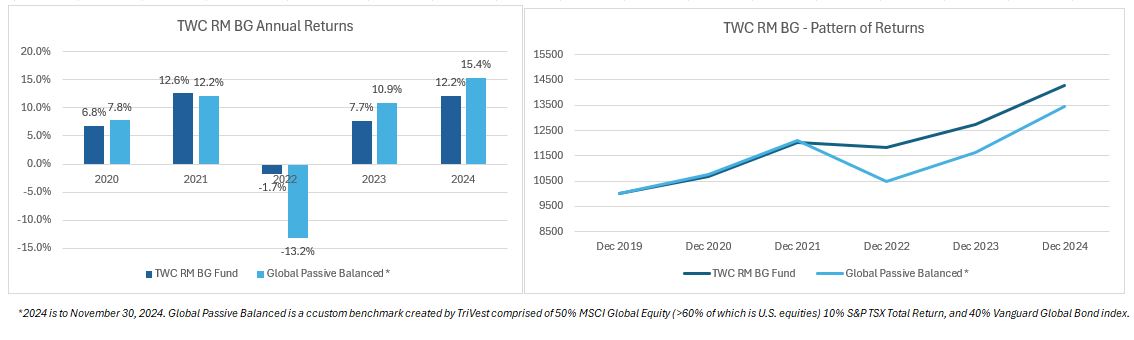

Let’s take a deeper look at how this approach has helped our clients via our TWC Risk-Managed Balanced Growth Fund over the past five years. We go back at least this number of years because its important to factor in years where markets didn’t go up and corrected such as in 2022. When you sum the returns the Global Passive Balanced benchmark grew a total of 33.1 per cent compared to our fund that added up to only to 37.6 per cent. When starting with $10,000 our fund grew to $14,285 versus $13,436 for the Global Passive Balanced.

The good thing is that most reporting software should pick this up when showing annualized performance on a time-weighted basis (removing impact of timing from inflows and outflows) and money-weighted basis (reflects the size and timing of deposits). In the case of our TWC fund, it grew at an annualized rate of 7.3 per cent on a time-weighted basis and 8.1 per cent on a money-weighted basis over the past three years compared to the Global Passive Balanced benchmark that grew at a 5.6 average per cent per year.

Therefore, you can see the true power of managing risk. This just so happens to be an excellent fit to the type of clients we service, focusing on what famous investor Howard Marks calls investment strategies that deliver “regular solid returns rather than erratic highs and lows.” Fortunately, this means not having to rely on the hot air rising from Fart Coins, or views that economies and markets will go up forever.

The Master and his Emissary: a new way of looking at investing and the world

As humans, our minds are designed to present options to us in binary terms. This is because dualistic thinking provides us with a sense of certainty. The more complex something is, the less certainty we have, which causes anxiety about what lies ahead. We often end up overwhelmed by all the choices we must make and so we seek out comfort by narrowing it down into categories like right or wrong, black or white.

In his book Full-Spectrum Thinking, author and futurist Bob Johansen says the problem with this is that, while simplified categories may lead us toward attaining the certainty we so desire, it moves us away from clarity and understanding.

Neuroscientist and psychiatrist Iain McGilchrist takes this further by detailing the biology of our brains and the roles our left- and right-side hemispheres play in critical thinking. His book The Master and His Emissary: The Divided Brain and the Making of the Western World, is a masterpiece. It is a 600-page read but a Cole’s Notes version can be found in his paper called “Can the divided brain tell us anything about the ultimate nature of reality?”

The problem is that our left analytical side likes to think it is in charge because it is so good at analyzing various data inputs independent of one another. As a result, it isn’t uncommon for it to overrule critical thinking by narrowing down potential outcomes into binary ones simply because it is unable to do what the right brain is made for: tying all the data together into a big picture that may, in actuality, be some shade of grey.

“So the left hemisphere needs certainty and needs to be right. The right hemisphere makes it possible to hold several ambiguous possibilities in suspension together without premature closure on one outcome. These are not different ways of thinking about the world: they are different ways of being in the world. And their difference is not symmetrical, but fundamentally asymmetrical,” McGilchrist writes.

However, society wants us to choose a side. Social media platforms such as X are specifically designed to take advantage of our left-brained dominance by bombarding us with the dualistic information that we so desire. Worse yet, we allow it to form a part of our identity and so, when questioned, we defend it at all costs, unwilling to listen to the other side because our right-brained hemisphere is cut off and no longer in charge.

For example, it isn’t a secret that we have been quite critical about the damage being done to the Canadian economy by the existing Trudeau government. However, this should not imply that we are supportive of those leaders or governments with economic policies on the other end of the political spectrum.

We have also been supportive of oil and natural gas development, but that doesn’t imply we are a disbeliever in global climate change and the importance of renewables, even from an investment standpoint. Not surprisingly, we have had people on both sides unable to fathom how Martin could be investing in oil and gas while he was living in an eco-community and a near net-zero home.

Such thinking can get a person into a lot of trouble when it comes to investing. This is because we can get sucked into making binary “I’m right and you are wrong” decisions, such as in today’s environment of either being all-in on the high-flyers like Nvidia Corp., bitcoin or MicroStrategy Inc. or choosing to be on the sidelines listening to the few remaining doom-and-gloomers calling for a large market correction.

We find it helps during such situations to ask, “If someone else was in my body and seeing what I’m seeing, would they be interpreting it the same way or differently, and if so, why?” There is so much power in putting yourself in the other person’s shoes and trying to see things from all sides.

Aiming for clarity minimizes mistakes but it doesn’t mean they won’t happen, as we’re human, after all. However, the more we exercise our right brain, the better we can get at minimizing the damage when getting it wrong by quickly identifying any errors we have made and pivoting back toward the right direction.

With practice, suddenly what others do and say have less of an emotional impact on our decision-making process. We can then map out the risks and rewards with less fear of the uncertainty of what lies ahead.

Research, media, and reads of the month

BNN Bloomberg: Market outlook for 2025. Martin Pelletier, portfolio manager at Wellington-Altus Private Counsel, shares his projections for the markets in 2025. Watch Here

BNN Bloomberg: Why investors are paying to take on risks in the equity market. Portfolio manager Martin Pelletier explains the bond market’s bearish moment and investors are paying to take on risks in stocks. Watch Here

Financial Post: We need the U.S. more than they need us. Martin Pelletier: While Trump’s threatened 25% tariff on Canadian imports isn’t a given outcome, we need to get our house in order. Read Here

Asymmetric investing. For those scared of the markets but want to put money to work, we just did this note on blue chip Canadian stocks over the next 3.5 years. 100 per cent principal protected. See Here

An interesting summary on macro and debt-to-GDP. With real interest rates near true growth potential, even modest deficits will lead to an increase in debt-to-GDP ratio. Watch Here

The new normal roundabout. The reason the economy remains slightly abnormal: financial markets are *extremely* abnormal. Watch Here

Crazy ideas. Former US Treasury Secretary Larry Summers says a national bitcoin reserve idea is “crazy.” Watch Here

Senator Rubio’s 58-page report on China. It was surprisingly well done—current, thorough, and balanced. It was complementary of China’s progress across many fronts, and frankly was not particularly combative—more focused on what the U.S. needs to do to be competitive (focus and subsidies). Read Here

U.S. electricity demand forecast to surge 16 per cent. Over the next five years revised estimates to feed data centers dwarf previous numbers. Utilities to need 128 gigawatts of new power, researcher says. Read Here U.S. construction spending on data centers accelerates: See Here

The S&P 500 is now trading at 25x 2024 earnings estimates. The funny thing is that the S&P 500 2024 and 2025 earnings estimates are now lower than in October 2022. See Here The S&P 500 price-to-book (P/B) ratio rose to 5.3x, the highest level since the 2000 Dot-Com Bubble Burst. As a reminder, book value is a company’s total assets minus its total liabilities. P/B ratio has DOUBLED since 2020. See Here Further analyst expectations for equity returns in ’25 have surged more than any time in the past in their recent outlooks, penciling out stocks at 6700 by year-end 2025. See Here

Fewer than 32 per cent of S&P 500 companies have outperformed the S&P this year, one of the lowest readings over the last 50 years. In fact, the performance from 2023-24 is almost identical to that of 1998-1999. See Here

Nomura’s list of 6 potential gray swan events is pretty sobering: 1. Nvidia crash 2. Carry implosion 3. US 10YY > 6% 4. U.S. growth shock 5. Geopolitics gets out of hand 6. China stimulus falls short. Watch Here

‘We’re in a recession,’ says former Bank of Canada governor Stephen Poloz. Canadian consumer has suffered a 30% increase in the cost of living. Read Here

On the Positive

“The most important thing in life is not to have the most but to need the least.” – Unknown

Albert Einstein wrote, “Everybody is a genius. But if you judge a fish by its ability to climb a tree, it will live its whole life believing that it is stupid.” The question I have for you at this point of our journey together is, “What is your genius?” – “The Rhythm of Life: Living Every Day with Passion and Purpose” by Matthew Kelly contained a chapter titled “Everybody is a Genius”

Handwriting leads to widespread brain connectivity – typing does not. These findings are from a study in which recorded brain electrical activity in 36 university students as they were handwriting visually presented words using a digital pen and typewriting the words on a keyboard. Read Here

Jeff Bezos and the wisdom of the owner operator mindset. Being an owner operator and measuring the wealth made for others not yourself. Watch Here

Very wise words. This will be an excellent use of one minute of your time. Watch Here

That smile. Leonardo’s Self Portrait and the Mona Lisa are of the exact same face using the same proportions and ratios. Watch Here

Nothing. Ever wonder what nothing looks like? Watch Here

The Heart of the Pacific Ocean. This is the side of Earth you never see. See Here

Quite amazing! 900 Tesla owners do a synchronized Light Show in Finland. Watch Here

Just two dudes in 2003. Not realizing they just made one of the best songs ever. Watch Here

Marty’s backcountry adventures. Where he snow is deep, and the mountains steep. Watch Here

Thanks for visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook . Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

All trademarks are the property of their respective owners.

© 2024, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca